Bitcoin (BTC) and the cryptocurrency market could not have asked for a better outcome from the Federal Open Market Committee (FOMC) meeting that ended on December 14.

After recording a gain that brought it to a level it had not seen since the beginning of the month, BTC responded unfavorably to the data from the FOMC. How big of an effect did the news have on BTC, and what can we anticipate in the coming days?

A dive into the report

The Consumer Price Index (CPI) was issued on 13 December, preceding the FOMC report by Chair Jerome Powell. Inflation in the United States slowed to 0.1% from 0.4% in October, a positive development for the Federal Reserve’s efforts to rein in skyrocketing prices.

Bitcoin (BTC) prices rose after the report was released because investors believed the Federal Reserve would be encouraged to slow the pace of interest rate hikes if inflationary pressures on consumers were lessened.

However, Bitcoin’s (BTC) market behavior following the release of the FOMC report suggested that the news had dampened investors’ enthusiasm. U.S. interest rates were increased by 50 basis points (Bps) on 14 December.

It is also worth noting that it has been 15 years since the federal fund’s target range was this high. The Federal Reserve Board Chair Jerome Powell has suggested that the final interest rate (terminal rate) will be greater than 5%.

Price drops, but the trend remains bullish

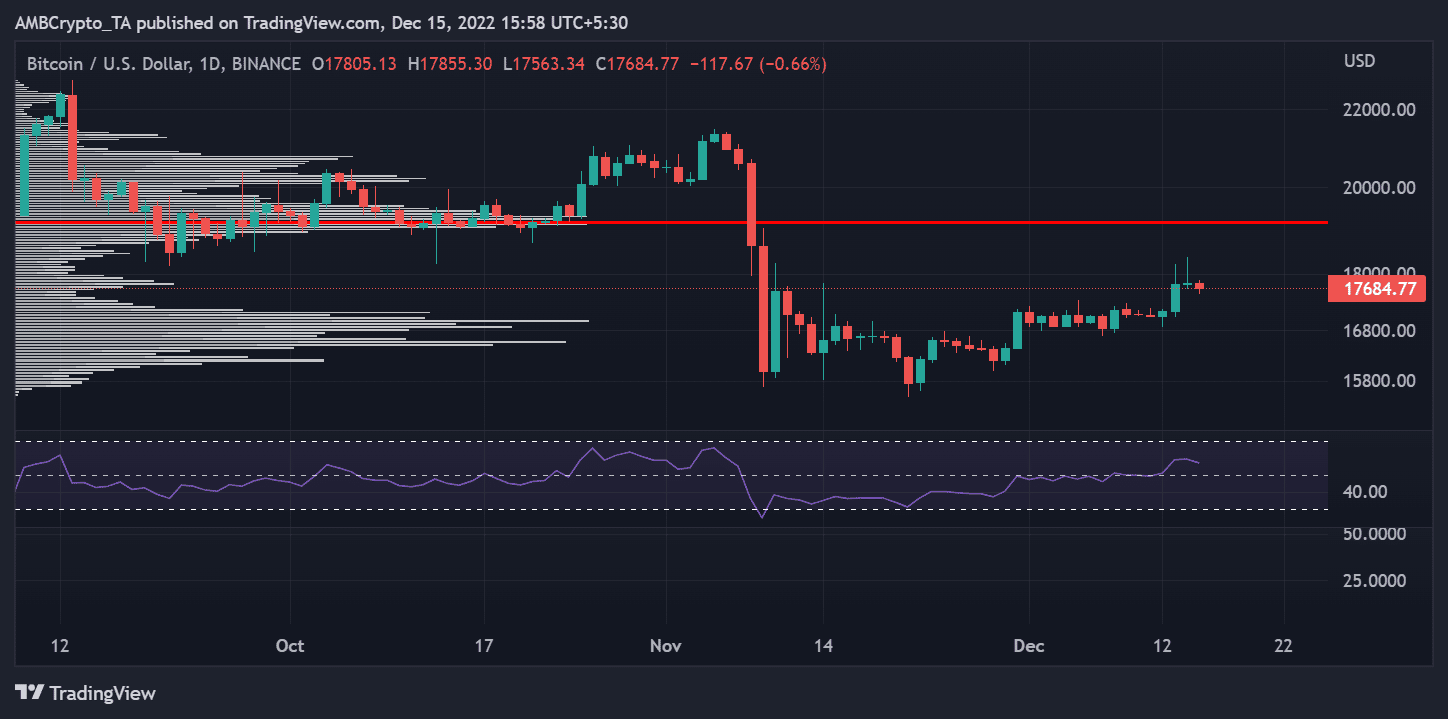

When looking at the daily timeframe for the BTC chart, it was clear that the asset did not respond well to the news. According to the graph, Bitcoin’s price peaked around the $18,000 area on 13 and 14 December before crashing to roughly $17,600 at the time of writing.

The Visible Range Volume Profile analysis showed that the price could still go higher despite the apparent decline.

Source: TradingView

As Bitcoin approaches $17,600, it enters a low-volume node region, which may indicate imminent price volatility. A significant price agreement generally accompanied by less rapid price fluctuation is represented by a high-volume node.

When compared to high-volume nodes, low-volume nodes denote less bustling hubs. To reach the next area of agreement, prices often move swiftly through these zones. The Relative Strength Index (RSI) indicator revealed that Bitcoin was still quite bullish despite the apparent, albeit modest, price downturn.

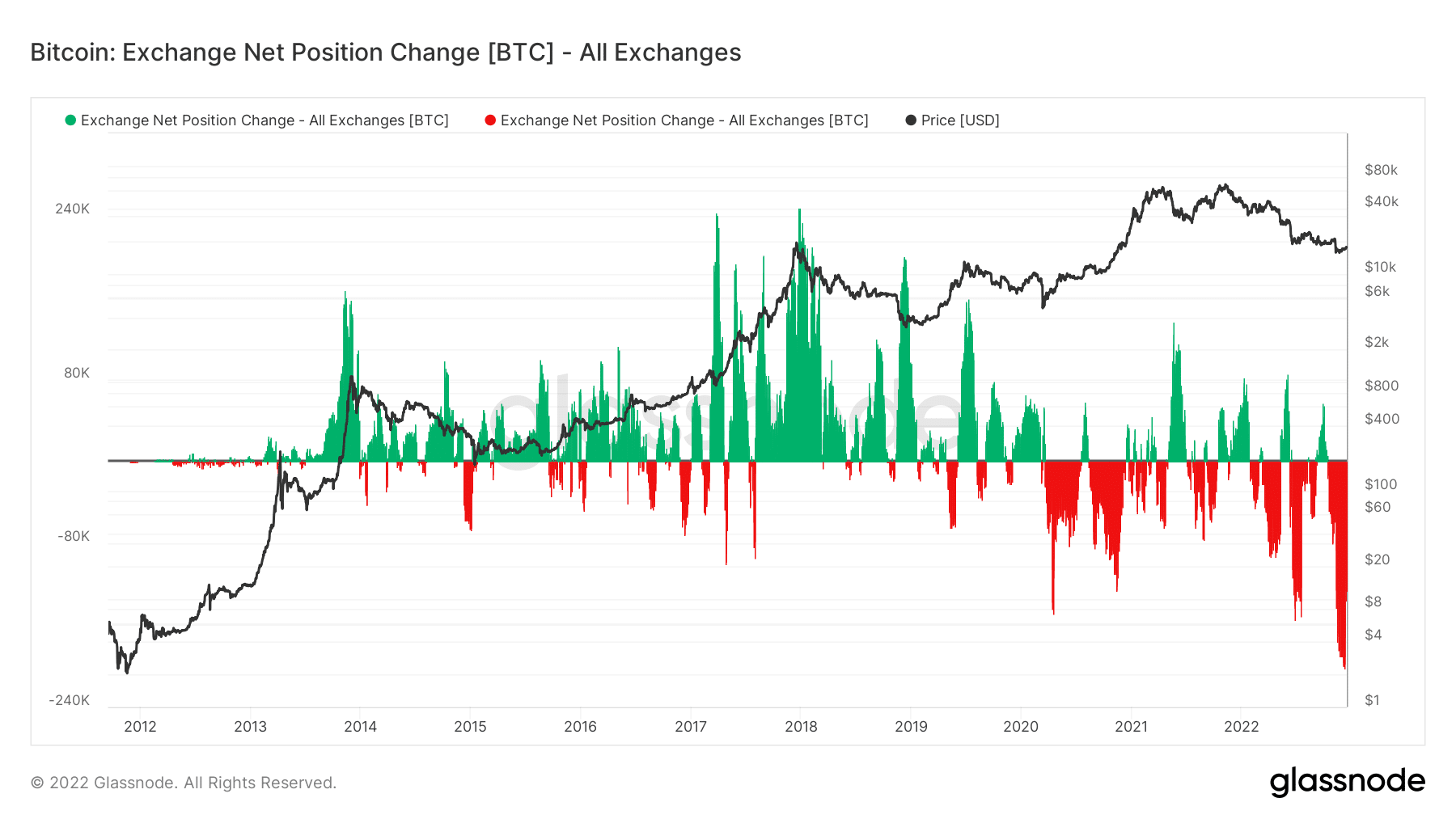

BTC outflow dominates

The Exchange Net Position Change metric may explain why Bitcoin remained bullish despite its apparent price decline. Glassnode’s data showed that the overall percentage of BTC leaving exchanges had increased.

If the value of this indicator is positive, it indicates that there are now more deposits being made to exchanges than withdrawals being made.

Source: Glassnode

As investors typically deposit their BTC in preparation for selling, this trend can be bearish. When the indicator’s value drops below zero, however, it indicates that more coins are being removed from exchange wallets than deposited, which could translate to a bullish trend.

It’s important to remember that the current market conditions represent a period of historically low prices while examining BTC’s price action. Historically, December and January are the most bearish for assets.