Synthetix has slowed down in 2022 in its DeFi pursuits, just like many crypto networks have during the bear market. Regardless, the network remains committed to its long-term pursuits and this was evident in its latest endeavor.

Read Synthetix (SNX) Price Prediction 2023-2024

Messari’s recent update takes a look at what Synthetix has been up to. According to the update, the latest development involves the rollout of the new Synthetix V3 governance module.

The new module will reportedly make it easier for the network to make governance decisions with fewer people. This is in response to previous voting challenges that Synthetix experienced in the past.

SNX price overview and analysis

We witnessed SNX drop in during the November crash which resulted in a retest of its June lows. It has since then demonstrated some more upside since the start of the month.

It traded at $1.89, at the time of writing, which means the subsequent upside has so far been limited, but will we see an end-of-year rally?

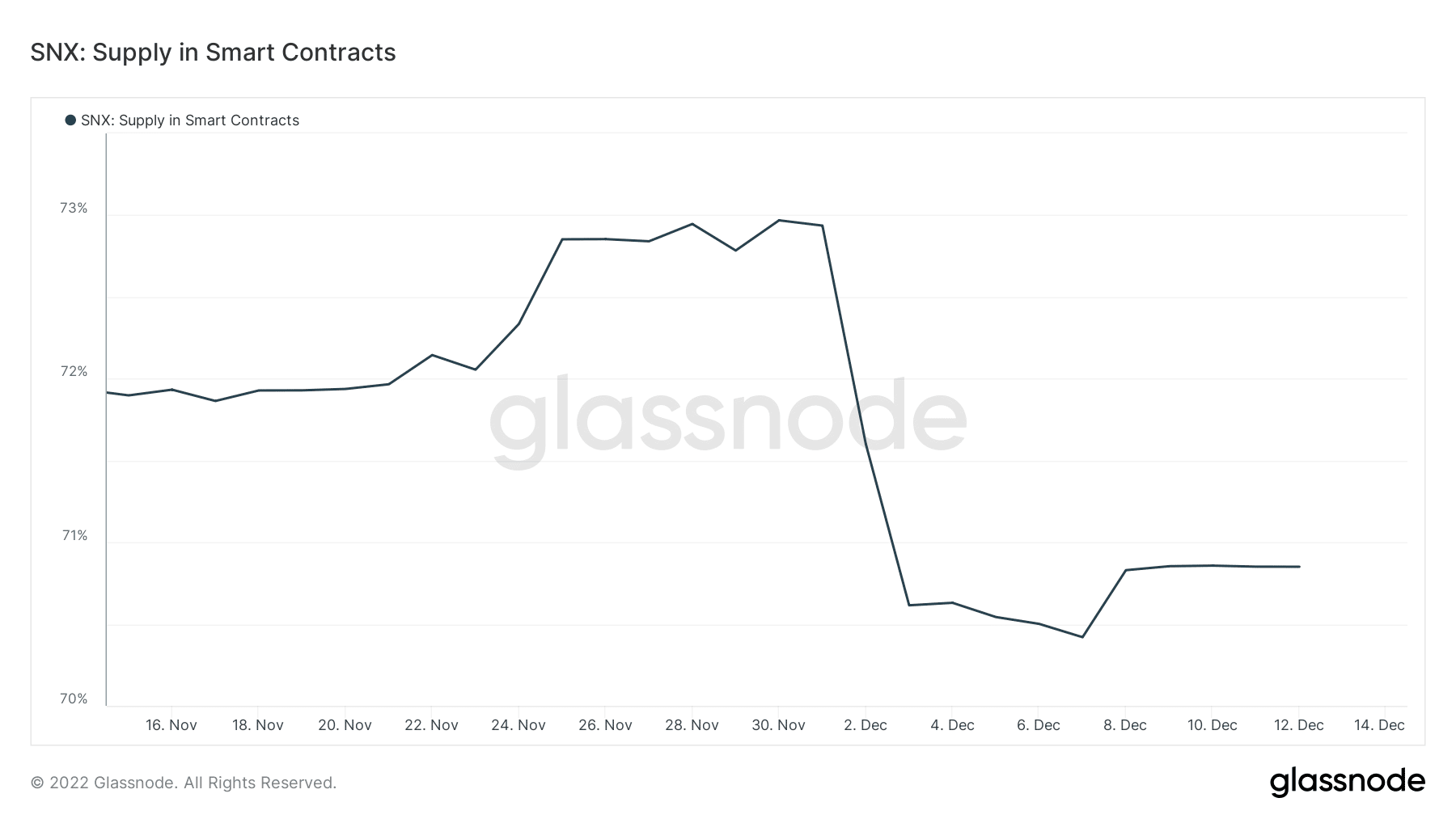

Organic demand for SNX may help explain why it has not managed to achieve much upside so far. The supply of SNX locked-in smart contracts experienced a substantial drop at the start of the month.

Source: GlassnodeSy

The fact that the supply in smart contracts is yet to recover speaks volumes about Synthetix’s current situation. It underscores the lack of adequate demand, a scenario that may likely result in low investor confidence.

Despite this, the network is seeing a recovery in some areas. For example, velocity was up in the last few days, which indicated that the demand was improving.

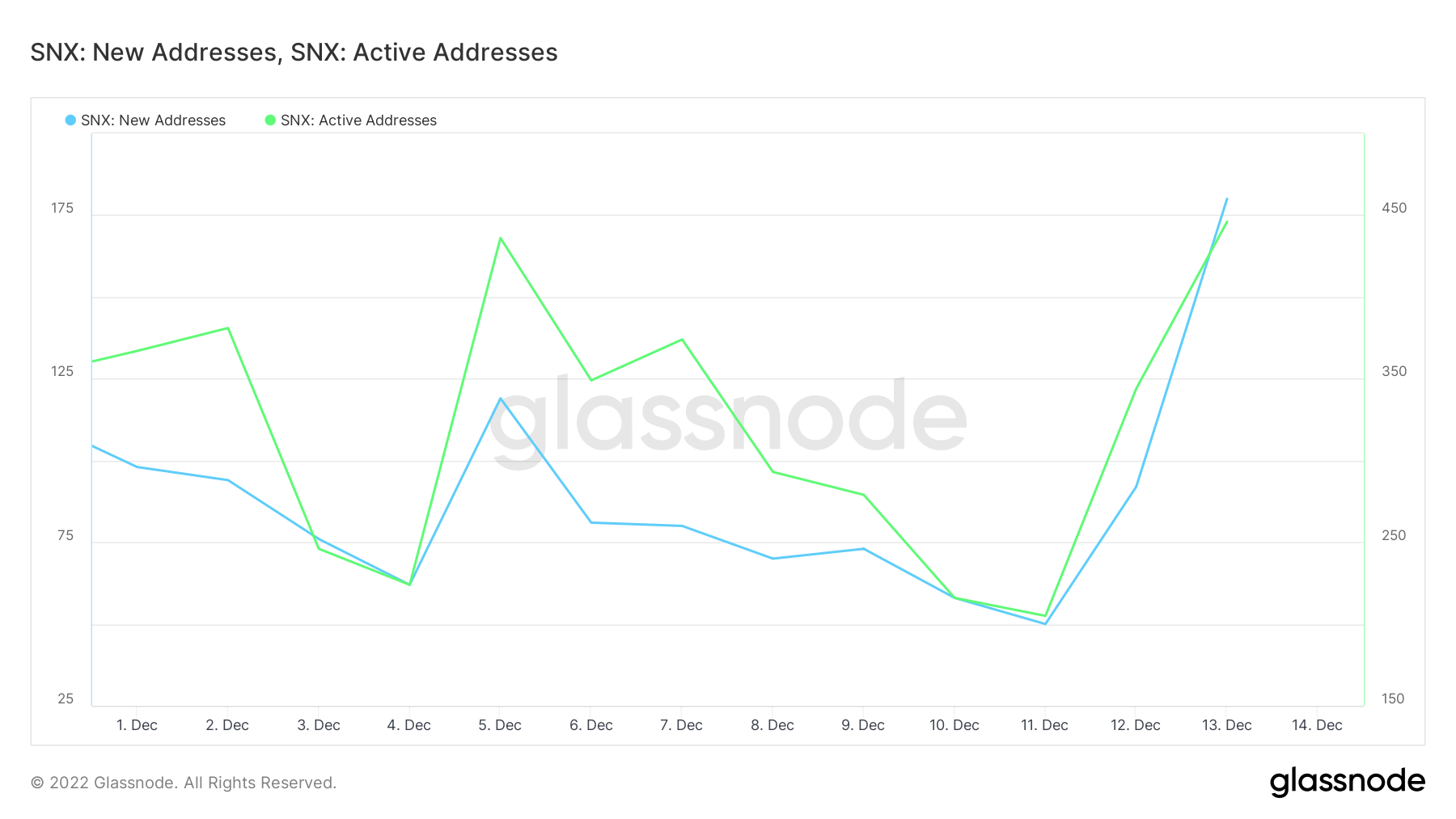

Source: Glassnode

This upsurge in velocity reflects the increase in the number of active addresses and new addresses during the same period.

And the increase in address activity confirms that demand is gradually recovering. Hence, these observations may provide insights into what to expect, especially if the market continues recovering.

Source: Glassnode

In conclusion, we can expect SNX to achieve more recovery if the overall market conditions recover. And, the governance update should help provide more efficiency in the long run.