In the history of cryptocurrencies, 2022 ranks high as one of the most challenging years so far. The year has been marked by significant losses causing several cryptocurrencies to record all-time lows.

The king coin, Bitcoin [BTC], was not spared as the liquidity crunch in the market, aggravated by the sudden fallout of cryptocurrency exchange FTX, caused it to trade briefly at a two-year low.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

In a new report, leading on-chain analytics platform Glassnode assessed the current state of BTC’s on-chain performance. The report also offered insights into what might come in the next trading year.

BTC on the chain

Following the widespread FUD that caused BTC’s price to plummet to a two-year low in November, the leading coin has seen some relief since the beginning of December. Currently exchanging hands at $17,144.23, “the Bitcoin market has turned very quiet coming into December,” Glassnode stated.

Glassnode assessed BTC’s annualized realized volatility metric and spotted it at its lowest volatility since October 2020. This was of significance as high values in an asset’s realized volatility indicate a phase of high risk in that market.

Per Glassnode, the market is relatively stable as,

“Short-term realized volatility for BTC is currently at multi-year lows of 22% (1-week), and 28% (2-weeks).”

Source: Glassnode

FTX’s fallout severely impacted BTC’s futures market. With investors still wary of further losses, Glassnode found that BTC futures volume was at a multi-year low.

With the BTC Futures market logging a daily trading volume of $9.5 billion, Glassnode opined that this

“indicated massive impact of tightening liquidity, widespread deleveraging, and the impairment of many lending and trading desks in the space.”

Another impact of FTX’s implosion on BTC’s Futures market was a significant decline in BTC Leverage Ratio. An assessment of BTC Futures Open Interest Leverage Ratio revealed that it was pegged at 2.46% as of 12 December. Prior to FTX’s fallout, this was at 3.46%.

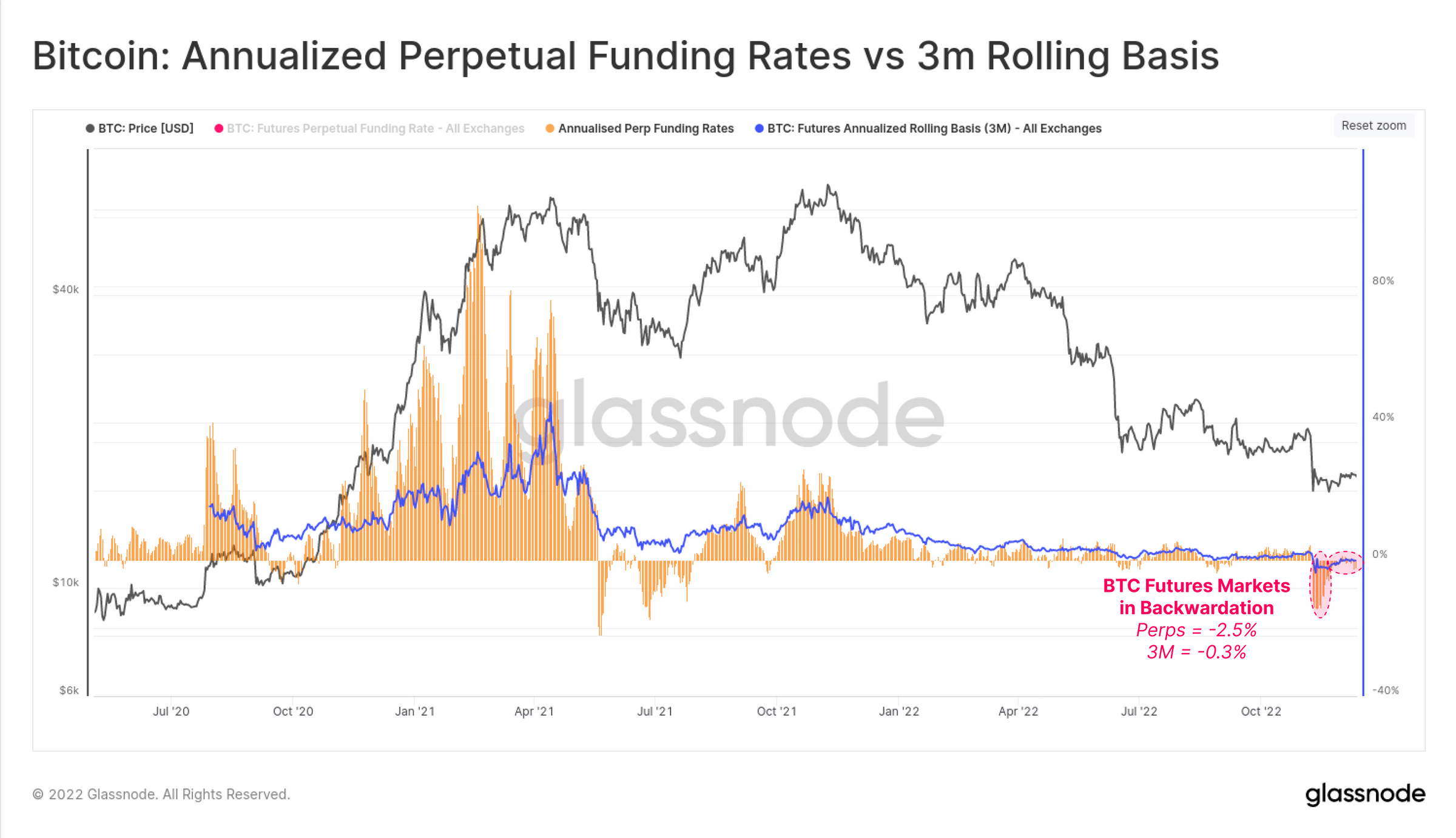

Still on the BTC Futures market, Glassnode found further that the futures and perpetual swaps traded at an annualized basis of -0.3%. This, according to the on-chain platform, represented “a state of backwardation.”

“Sustained periods of backwardation are uncommon, with the only similar period being the consolidation between May and July 2021. This suggests the market is relatively ‘hedged’ for further downside risk and/or heavier with short speculators,” Glassnode reported.

Source: Glassnode

Wading through the pain

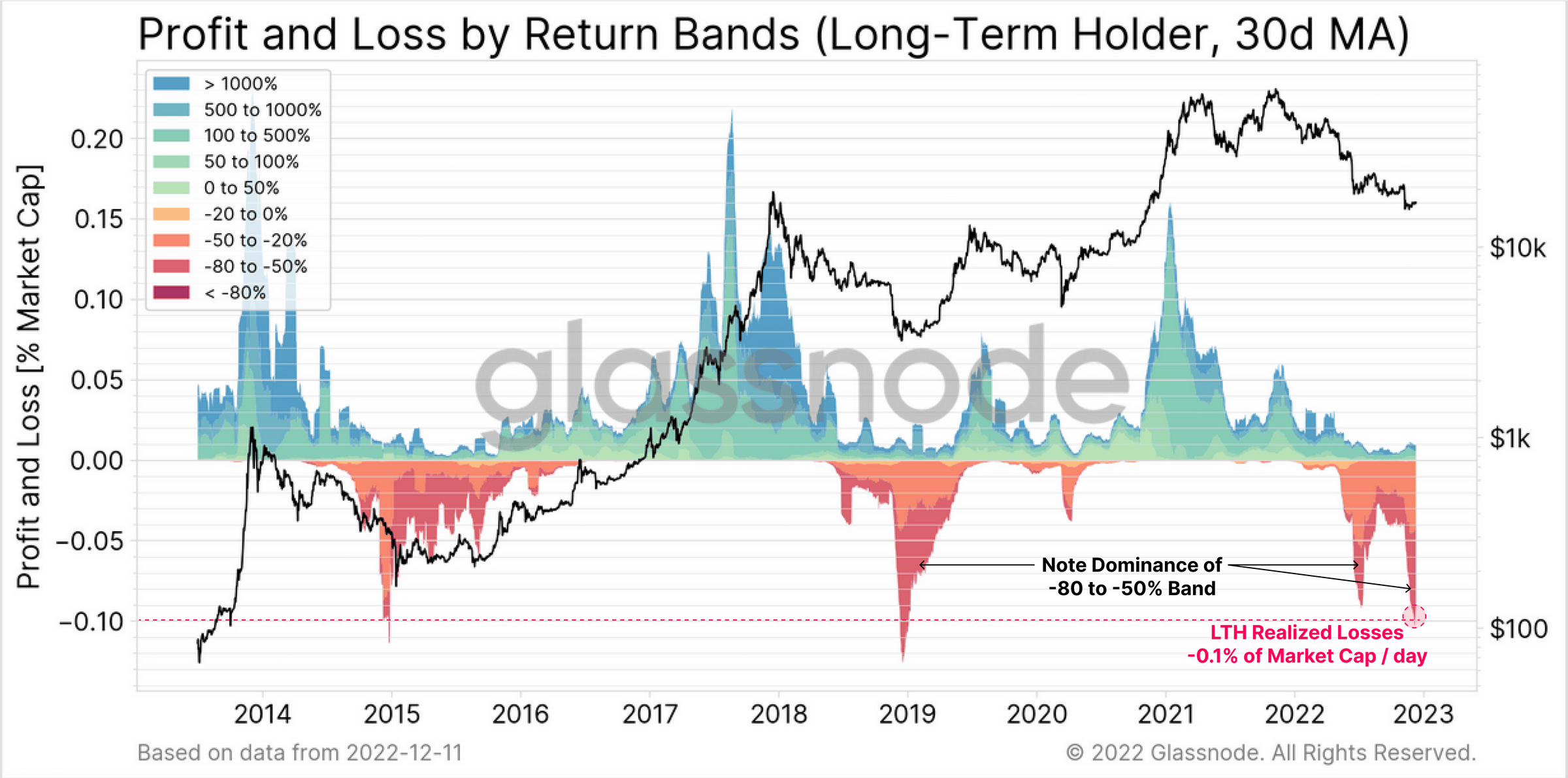

Since the commencement of the current bear cycle in November 2021, the BTC market has managed a $213 billion in realized losses from the $455 billion in yearly profits taken by BTC investors due to the excess liquidity in the market between 2020 and 2021.

BTC long-term holders (LTHs) have recorded the most losses, Glassnode found. In June, this cohort of investors was responsible for 50% to 80% of all losses incurred. Exacerbated by FTX’s collapse, LTH losses peaked at -0.10% of the BTC’s market capitalization daily in November.

Source: Glassnode

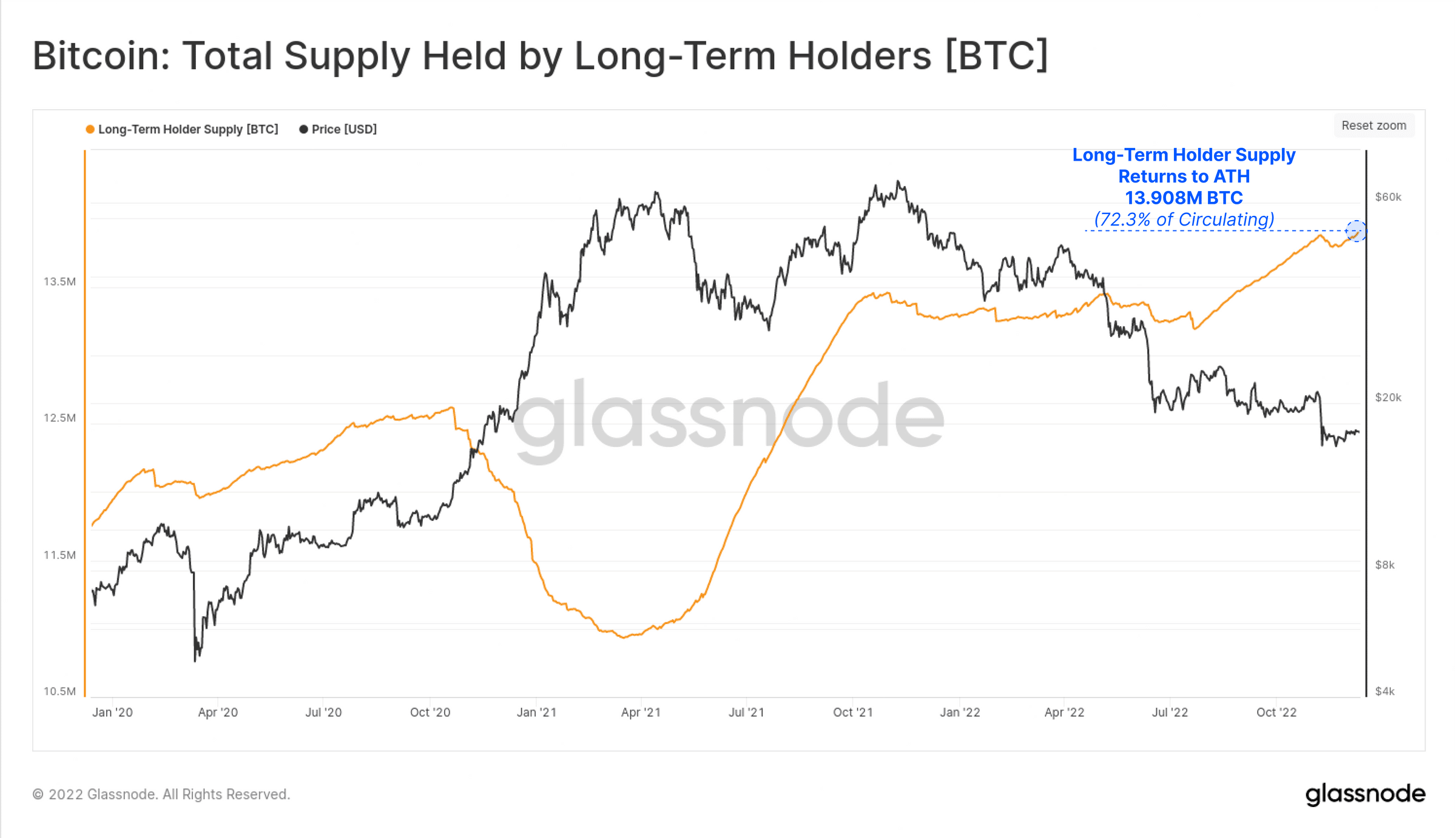

Interestingly, these investors remained resilient even in the face of a huge hole in their investments. Per the report, LTH intensified BTC accumulation after the FTX debacle to reclaim the all-time high of 13.90 BTC.

Source: Glassnode