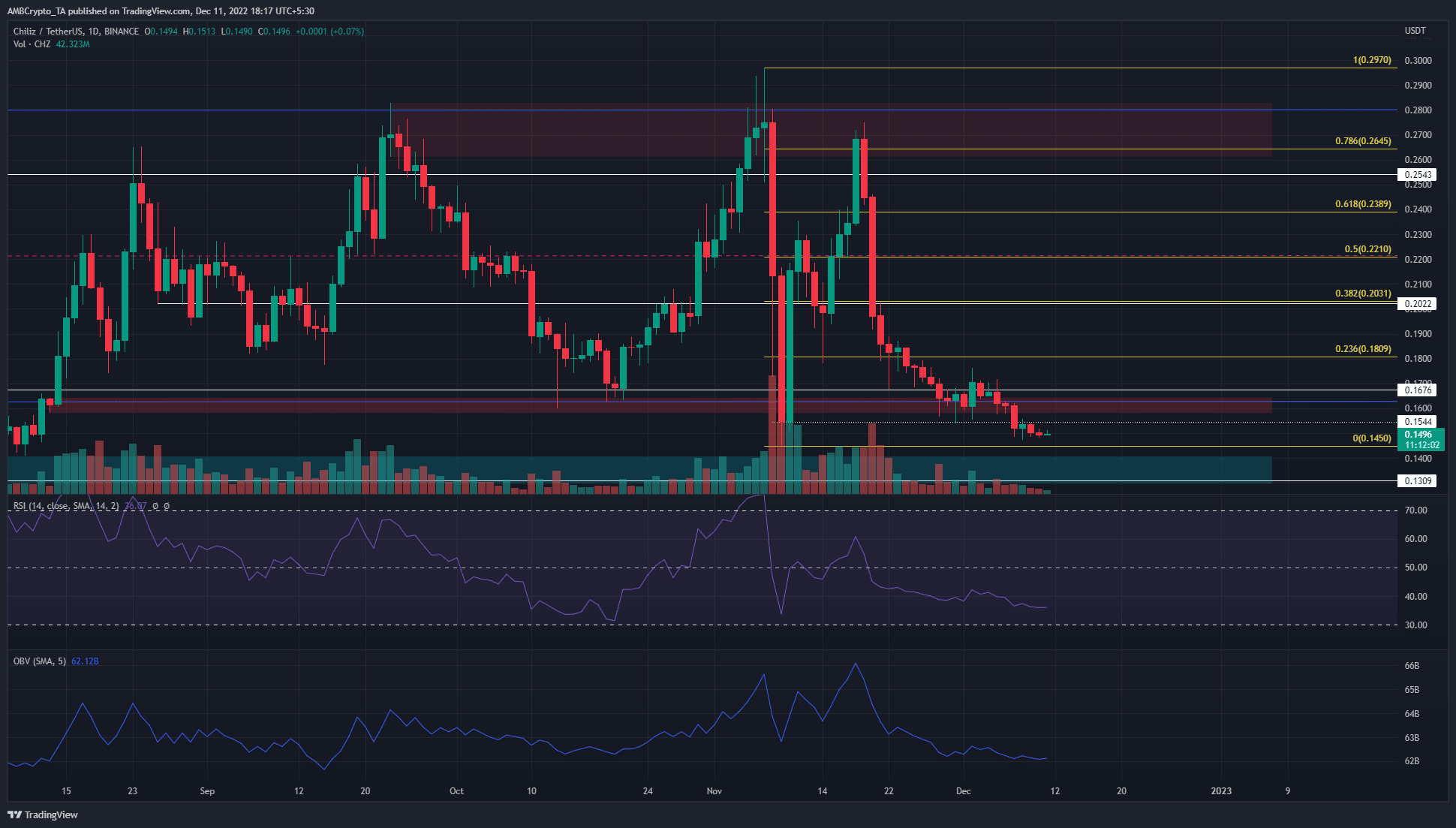

Chiliz traded within a range since late September. It extended from $0.28 to $0.162. The past month saw a large wave of selling and CHZ has shed 45% since November 18. Earlier in December, a whale unloaded CHZ worth $102 million.

Read Chiliz’s [CHZ] Price Prediction 2023-2024

The loss of the lows of the three-month range was also significant. It reinforced the fact that the bulls will have their work cut out in the coming weeks. Bitcoin’s trend did not favor the buyers either, and these risky market conditions meant that capital preservation was important.

Source: CHZ/USDT on TradingView

On 10 November, the Chiliz bulls took to heart as the token bounced from the range lows to near the range highs. Despite the heavily panicked market, CHZ registered gains of 73% within ten days from 9 November to 18 November.

These gains shed their weight just as quickly. The lows of the range had confluence with a bullish order block formed on 13 August. However, CHZ was only able to manage a tiny bounce from the range lows. Thereafter, the order block was broken and flipped to a bearish breaker.

The $0.154 level had been important over the past month. In late November, it served as support but was flipped to resistance in December. The lower timeframe momentum was also bearish, which meant a drop toward $0.13 can occur.

The $0.13-$0.141 area was a bullish order block from early August, and had confluence with a longer-term horizontal level. Therefore, a bounce in prices could materialize in this region.

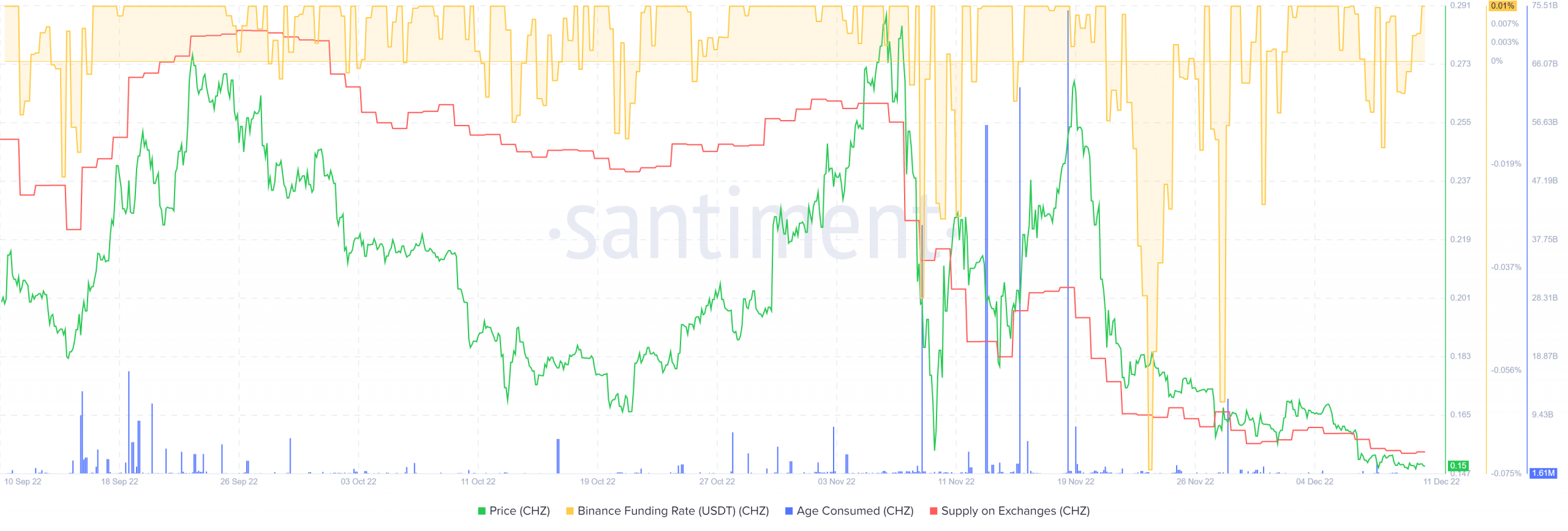

The funding rate steps into positive territory and exchange CHZ supply is in a downtrend

Source: Santiment

On Binance, the funding rate ticked back into the positive territory. This suggested that futures traders were positioned bullishly, although this could be a reflection of the lower timeframe sentiment. The longer-term structure and trend was bearish.

Meanwhile, the supply on exchanges metric declined since early November. This coincided with the local top for Chiliz. The supply metric showed that CHZ token was moved out of exchanges and into longer-term storage. The age consumed metric also saw large peaks which coincided with local tops in the price.

In summary, a move into the $0.13-$0.14 area could offer a scalping opportunity. But, until $0.155 and $0.162 are flipped to support, buyers would need to remain cautious.