Thanks to a huge coin distribution by its largest externally operated address (EOA) in the past few days, Chiliz’s [CHZ] value dropped by 10% in the last seven days, data from CoinMarketCap showed.

Read Chiliz’s [CHZ] Price Prediction for 2023-2024

On-chain analytics firm Lookonchain found that the whale with CHZ holdings worth $102 million began selling their coins on 4 December. The whale initiated the transfer of 21 million coins to nine different addresses before onward transfers to cryptocurrency exchanges such as Binance, OKX, ByBit, and Kucoin.

On 8 December, the whale initiated another transfer transaction of 20 million CHZ to these same nine externally operated addresses before depositing them to Binance and OKX.

Still holding 679 million CHZ tokens at press time (7.64% of total supply), the address was ranked as the number one EOA holder of CHZ.

Source: Watchers

CHZ suffers

As of this writing, CHZ traded at $0.1504. Its price was down by 2% in the last 24 hours. Likewise, trading volume declined by 26% within the same period.

Observed on a daily chart, selling momentum rallied as more CHZ holders dumped the coin in the past few days. In fact, while other tokens saw growing accumulation as the market attempted to recover following FTX’s unexpected demise, CHZ failed to see similar growth.

Since 7 November, selling momentum surged significantly. Key momentum indicators fell below their respective neutral spots when the FTX debacle began and continued downwards.

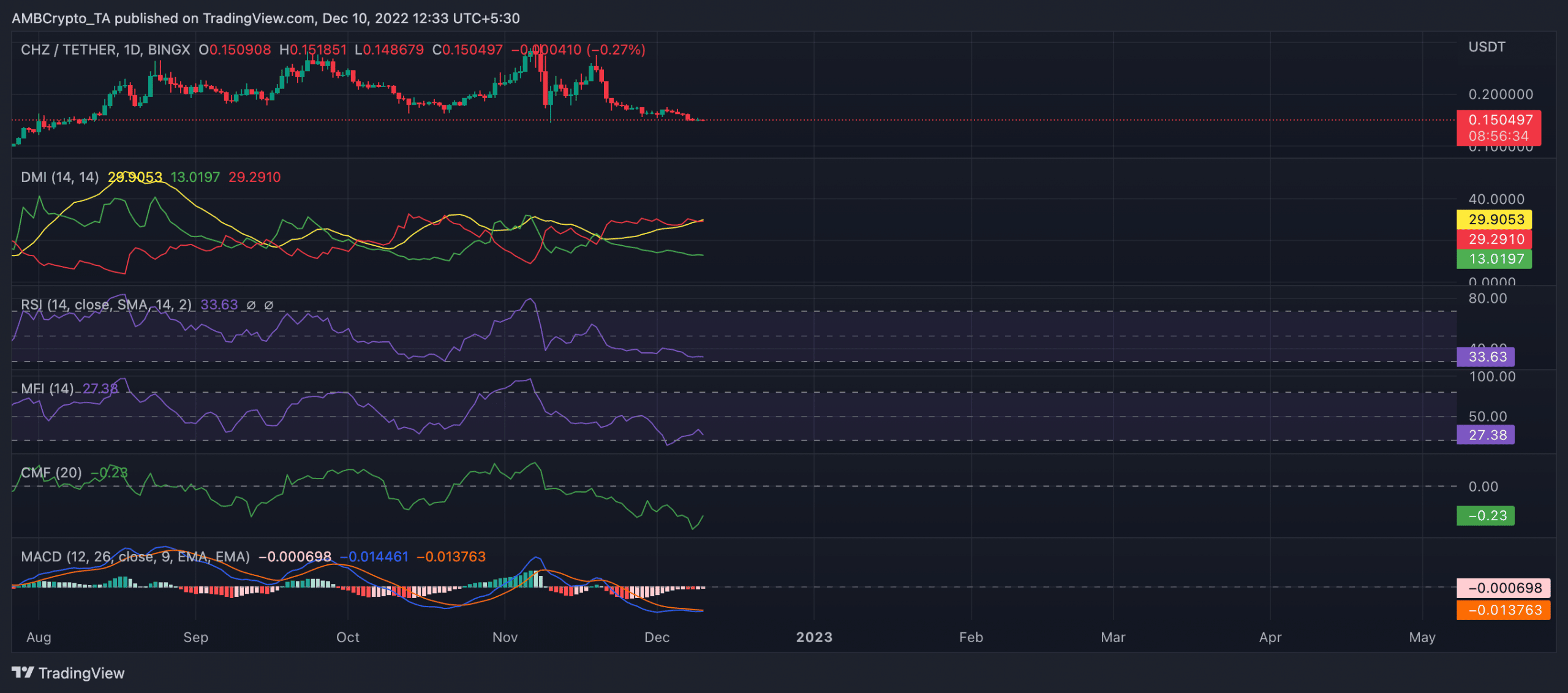

The rapid fall in CHZ accumulation following FTX’s fall culminated in the commencement of a new bear cycle on 20 November. The Moving Average Convergence Divergence (MACD) line (blue) intersected the trend line (orange) in a downtrend and has since posted red histogram bars.

Indicating that CHZ was oversold at press time, the Relative Strength Index (RSI) rested at 33.63. Likewise, its Money Flow Index (MFI) was spotted at 27.38.

Further, the alt’s Chaikin Money Flow (CMF) posted a negative -0.23 at press time. Positioned southward, the dynamic line (green) of the CMF indicated that selling pressure exceeded buying momentum.

An assessment of the alt’s Direction Movement Index (DMI) confirmed that sellers had control of the market and have since overpowered buyers since FTX collapsed. As of this writing, the sellers’ strength (red) at 29.29 rested solidly above the buyers’ (green) at 13.01.

Source: TradingView