Polygon, the most popular scaling solution of Ethereum, has witnessed numerous partnerships this year. Each partnership brings web3 a step closer to the mainstream business world.

The latest one was a partnership with Warner Music to launch music NFTs in January of next year. These developments impact the value of its native token MATIC to some extent.

Read Price Prediction for MATIC for 2023-24

The Polygon network supports a number of projects and DeFi exchanges. The network boasts over 1.45 million active users per week who make more than 3 million transactions every day.

Decentralized exchanges have been thriving on the network. SushiSwap’s user base has gone up by a whopping 68% since last week. Meanwhile, KyberSwap and QuickSwap have expanded their user base by 46% and 53% respectively.

On-chain analytics firm Messari reported recently that Polygon’s NFT market has fared relatively well amid the market downturn. The report revealed that Polygon saw a whopping 191% increase in NFT sales since the end of September, thanks to web2 firms that are turning towards the integration of NFTs into their platforms.

On 21 November, Polygon co-founder Sandeep Nailwal took to Twitter to share some key stats about the project’s zero knowledge Ethereum Virtual Machine (zkEVM) testnet. He revealed that more than 14,000 transactions had been performed. Additionally, almost 6000 addresses as well as 1622 smart contracts had been deployed.

A new report published by Blockchain analytics firm Messari shows that the third quarter of 2022 saw a 180% increase in the number of active addresses Q0Q, with total transactions for the quarter coming in at 2 billion.

Additionally, Polygon’s partnership with Warren Buffet-backed Nubank, which was announced last week, is being seen as a positive development for the network.

Popular TV Network SHOWTIME recently announced a collaboration with Polygon and Spotify.

In other news, Polygon informed users that Ethereum’s Merge had dramatically reduced its carbon dioxide emissions.

Polygon Network reached a new milestone on 15 November after the number of unique addresses reached 191.2 million. Data from polygonscan shows that the daily transactions on the Polygon chain took a significant hit following the news of FTX’s bankruptcy. As of 15 November, the total transactions stood at 3.26 million.

Polygon announced a partnership with Nike earlier this week. This joint venture will see the sportswear apparel brand bild it’s web3 experiences exclusively on Polygon.

MATIC’s YTD chart may suggest a buy signal, given that the crypto is currently well above $1, compared to $2.58 towards the beginning of the year. While this may look like a ripe opportunity to beef up MATIC holdings at a discounted price, it is important to look at other factors while making an investment decision.

Numbers from the trading volume, however, are quite worrisome. Ethereum’s most popular layer 2 scaling solution has lost more than 62% of its daily trading volume over the last seven days. $361 million worth of MATIC was traded over the past 24 hours, compared to $525 million two weeks ago.

One possible reason for the sharp decline in the daily volume of MATIC is the Ethereum Merge that took place on 15 September. The crypto has taken a hit following the Merge event, with both market cap and daily volume on a downtrend.

Polygon recently published an analytical insight into its bridge flow between January and August 2022. A closer look at the numbers revealed that in these 8 months, more than $11 billion entered the Polygon ecosystem from multiple chains. Ethereum and Fantom Opera contributed the most with an inflow of $8.2 billion and $1.06 billion, respectively, which also puts it at the top in terms of net volume.

As far as bridges are concerned, Ethereum’s PoS bridge and Plasma bridge accounted for a net volume of $1 billion and $250 million within this time period. Meanwhile, Ethereum’s PoS and Fantom Opera’s Multichain bridge accounted for a combined outflow volume of more than $7.2 billion. Considering all 43 bridge chain pairs, the average volume comes out to be $48 million.

At press time, MATIC was trading at $0.9061.

Source: TradingView

In February 2021, Matic rebranded to Polygon in a bid to provide a scalable version of Ethereum’s infrastructure and introduce overlay rollups to combine another layer 2 platforms for instant transactions, among other things. Polygon retained the name of its native token MATIC. The token proceeded to gain by over 200% over the next 30 days. Polygon runs on the proof-of-stake consensus protocol and can be described as an Ethereum layer 2 scaling solution with the best of both worlds.

In 2021, MATIC’s price went soaring thanks to the increasing popularity of Ethereum and surging activity in NFTs and play-to-earn games like Axie Infinity. MATIC began the year at a humble $0.018 and a market cap of $81 million. By the end of the year, MATIC’s market cap hit a whopping $20 billion, with the altcoin touching its all-time high of $2.92 on 27 December.

On 12 May 2021, Ethereum co-founder Vitalik Buterin donated crypto worth $1 billion to the India Covid-19 relief fund set up by Nailwal. This seemingly unrelated event caused MATIC to surge by 145% within the next 48 hours. By 18 May, the token had gone from $1.01 all the way up to $2.45, gaining 240%.

In May 2021, Polygon was in the news after it received backing from billionaire investor Mark Cuban, who revealed plans to integrate his NFT platform Lazy.com with Polygon. Following his investment in Polygon, Cuban claimed that the Polygon Network was “destroying everybody else” at the Defi Summit Virtual Conference in June 2021.

Since the beginning of 2022, Polygon has secured various partnerships, most notably with Adobe’s Behance, Draftkings, and billionaire hedge fund manager Alan Howard for the development of Web3 projects. Polygon boasts partnerships across various industries. Instagram and Polygon have collaborated on NFTs too.

Stripe has launched global crypto pay-outs with Polygon. Fashion brands like Adidas Originals and Prada have launched NFT collections on polygon

Based on gathered adoption metrics, Alchemy has described Polygon to be the best-positioned protocol to drive the booming Web3 ecosystem. Data from Alchemy also showed that at press time, Polygon hosted more than 19,000 decentralized applications (dApps) on its network.

On 27 May 2022, Tether (USDT), the largest stablecoin by market capitalization, announced that it was launching on the Polygon Network. MATIC rose by more than 10% following news of the launch.

Citigroup released a report in April 2022, one in which it described Polygon as the AWS of Web3. The report went on to claim that the Metaverse economy is estimated to be worth a whopping $13 trillion by 2030, with most of it being developed on the Polygon Network. Citigroup also believes that Polygon will see widespread adoption thanks to its low transaction fees and developer-friendly ecosystem.

The Terra network’s collapse in May 2022 triggered an exodus of developers and projects. Polygon soon announced a multi-million dollar, Terra Developers Fund, in a bid to help the migration of anyone looking to switch networks. On 8 July, Polygon Studios CEO Ryan Wyatt tweeted that over 48 Terra projects had migrated to Polygon.

Crypto exchange Coinbase published a report on 8 August 2022 that claimed that the future of Layer 2 scaling solutions could very well be a zero-sum game, hinting that layer 2 solutions like Polygon could overtake Ethereum in terms of economic activity.

On 8 August 2022, blockchain security form PeckShield reported a rug pull by the Polygon-based play-to-earn game Dragoma, following a sharp decline in the value of its native token DMA. The same has been corroborated by data from Polygonscan which shows a clear surge in token transfers and transfer amount on the day of the alleged rug pull which led to a loss of over $1 million.

In the week following Polygon’s announcement of the Gnosis bridge, MATIC surged more than 18% breaking the crucial resistance at $1 for a brief period. This feature paves the way for Web3 teams like DeFi protocols and DAOs to transfer assets between Ethereum and Polygon, for considerably fewer gas fees without compromising on security.

Numbers from the 32nd edition of PolygonInsights, a weekly report published by Polygon outlining key network metrics, indicated that in spite of dropping down from the $1 mark that MATIC had reclaimed barely a week before, not all was lost. Weekly NFT volume stood at $902 million, a whopping 800% increase from the previous week. Meanwhile, active wallets grew by 75% to 280,000.

In an industry that is often bashed for being energy intensive and harmful to the environment, Polygon has distinguished itself by achieving network carbon neutrality after offloading $400,000 in carbon credits. This nullified the carbon debt accrued by the network. As per the ‘Green Manifesto’ published by Polygon, they now plan to achieve the status of being carbon-negative by the end of 2022. In fact, they have pledged $20 million towards that milestone.

Cercle X, the world’s first decentralized application for waste management solutions, announced on 15 August that it had integrated with Polygon to leverage Web3 to digitize the garbage disposal process by developing a waste management dashboard.

Whale Movement

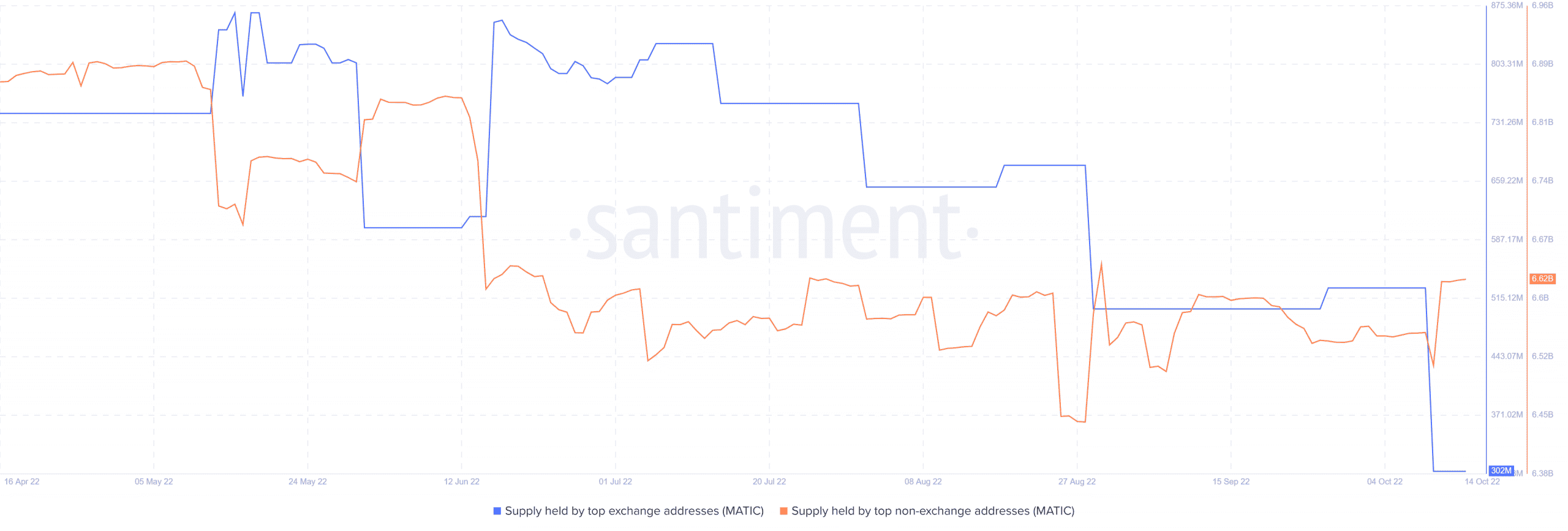

Source: Santiment

Data from blockchain analytics firm Santiment showed that following the market-wide sell-off triggered by the collapse of Terra, almost 30% of the supply held by top exchange addresses (whales) was taken off of exchanges, the same is corroborated by the visible spike in supply held by non-exchange addresses which indicate that supply held by non-exchange addresses soared all the way to 806 million MATIC.

However, come mid-June, this transfer was reversed, with investors rushing their MATIC holdings into exchanges and non-exchange holdings dropping by 240 million MATIC.

It would be safe to assume that these holdings came from non-exchange addresses as a sharp decline in supply held by them is visible. For over a month the holdings were rather dormant in their respective places, but by the end of July, supply held by top exchange addresses was slashed again, this time by 120 million MATIC. At the same time, non-exchange addresses held a whopping 6.6 billion MATIC.

Latest Stats

On August 30, Polygon released the 34th edition of PolygonInsights, a weekly analytics report where key metrics about the network, dApps and NFTs are published.

With 817,000 weekly active users, the network registered a 14% growth, compared to the 805,000 active users in the previous week. While daily transactions fell by 3%, the overall transactions were 12% cheaper than the week before. The average daily revenue came out to be $45,100.

Numbers in the NFT department were a lot more optimistic. The weekly NFT grew by a whopping 400%, reaching $656 million. The number of new NFT wallets surged by almost 60% with 60,000 new users registering with the network. Mint events and total NFT transactions were the two areas that didn’t see growth, with both numbers declining by 12% and 9% respectively.

dApp stats revealed that Arc8 and SushiSwap were the top two movers in the top 25 protocols. Arc8 registered more than 30,000 new users, a 51% increase from the previous week. SushiSwap on the other hand registered 8200 new users, reflecting a massive 88% increase over the previous week.

Polygon Tokenomics

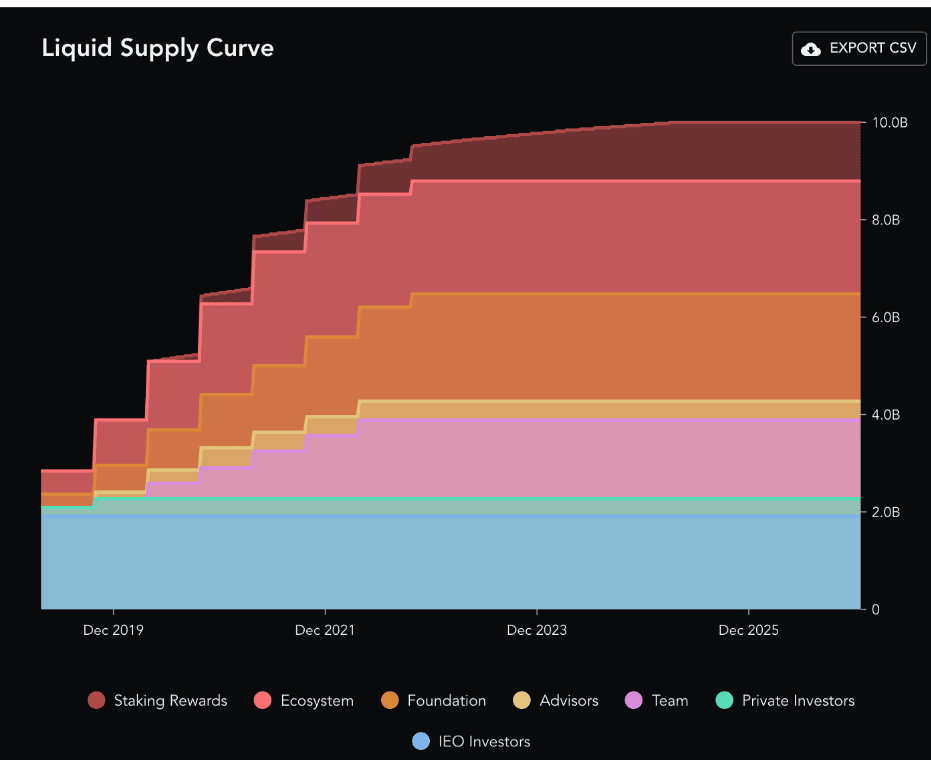

Polygon has a maximum total supply of 10 billion tokens, out of which 8 billion are currently in circulation. The remaining 2 billion tokens will be unlocked periodically over the next four years and will primarily be disbursed through staking rewards. The initial exchange offering was held on Binance through the Binance Launch Pad to facilitate the sale of 19% of the tokens.

Source: Polygon Forum

Following is the breakdown of the current supply –

- Polygon Team – 1.6 billion

- Polygon Foundation – 2.19 billion

- Binance Launchpad – 1.9 billion

- Advisors – 400 million

- Private sale – 380 million

- Ecosystem – 2.33 billion

- Staking Rewards – 1.2 billion

Understandably, there are many who are very bullish on MATIC’s future. Some YouTubers, for instance, believe MATIC will soon be worth $10 on the charts. In fact, he claimed that a “glorious” double-digit valuation for the token is inevitable.

“We’ve seen Polygon really picking up in the number of NFTs sold. We can see from July, when we had 50,000 Polygon-based NFTs sold, to now where we have… 1.99 million NFTs sold in the month of December on Polygon on OpenSea. That’s absolutely massive, massive growth for the Polygon ecosystem.”

MATIC Price Prediction 2025

After analyzing the altcoin’s price action, crypto-experts at Changelly concluded that MATIC should be worth at least $3.39 in 2025. They forecasted a maximum price of $3.97 for that year.

According to Telegaon, MATIC should be worth at least $6.93 by 2025, with an average price of $7.18. The maximum price projected by the platform is $9.36.

MATIC Price Prediction for 2030

Changelly’s crypto-experts believe that by the year 2030, MATIC will be trading between $22.74 and $27.07, with an average price of $23.36.

Here, it’s worth pointing out that 2030 is still a long way away. 8 years down the line, the crypto market could be affected by a host of different events and updates, each of which is difficult to ascertain. Ergo, it’s best that predictions like these are taken with a pinch of salt.

On the bright side, however, MATIC’s technicals flashed a BUY signal at the time of writing. It is no wonder then that most are optimistic about the fortunes of the altcoin.

Conclusion

MATIC’s recovery since the market-wide sell-off in May has been impressive, but it is possible that the trend reverses if investors choose to book their profits. Especially given that a lot of them have seen their holdings diminish due to the ongoing crypto-winter and the prospect of leaving in the green will be tempting.

Speaking at the Korea Blockchain Week 2022, co-founder Sandeep Nailwal suggested that bearish conditions such as the ongoing crypto winter provide a ‘noise-free’ environment suitable for talent acquisition and marketing. This could mean that Polygon comes out ahead once the trend reverses and the bulls are back in charge of the market.

Crypto experts seem to be divided over the aftermath of the much-anticipated Ethereum merge which is scheduled for next month. Some believe that when ETH 2.0 arrives, it may make scaling solutions redundant – or at least less important.

The other side of experts has argued that the merge will make Ethereum more eco-friendly by reducing energy consumption, and by extension will benefit layer 2 scaling solutions like Polygon by increasing its appeal to investors as environment-friendly crypto. In addition to this, MATIC would also be poised for a surge in value since Ethereum’s merge will have no effect on its controversially high gas fees, effectively advertising Polygon’s use case.

In a blog post on 23 August, The Polygon team addressed the community’s concerns regarding the merge and its impact on the network.

The team assured users that the merge is good news and nothing to worry about. The team went on to explain that while the merge will reduce Ethereum’s energy consumption significantly, it will not have any effect on the gas fees or transaction speed, which is a major problem for the network. “the network depends on Polygon and other Layer 2 solutions to solve for this. “ the team added.

The team reiterated that the growth of Ethereum will lead to the growth of Polygon and that the future of both networks is symbiotic.

This statement from the Ethereum Foundation will come as a relief to those worried about the impact of the merge on the polygon network, “The Ethereum ecosystem is firmly aligned that layer 2 scaling is the only way to solve the scalability trilemma while remaining decentralized and secure.”

When ETH 2.0 comes, it may make scaling solutions redundant – or at least less important. The counter to that is Polygon plans to expand to other blockchains and the interoperability capabilities in the future will offset any threat that Ethereum’s Merge presents.

The major factors that will influence MATIC’s price in the coming years are –

- Successful rollout of zero-knowledge EVMs

- Expansion to new blockchains

- Growth in dApps hosted on the network

Predictions are not immune to changing circumstances and will be updated with new developments. Do note, however, that predictions are not a substitute for research and due diligence.

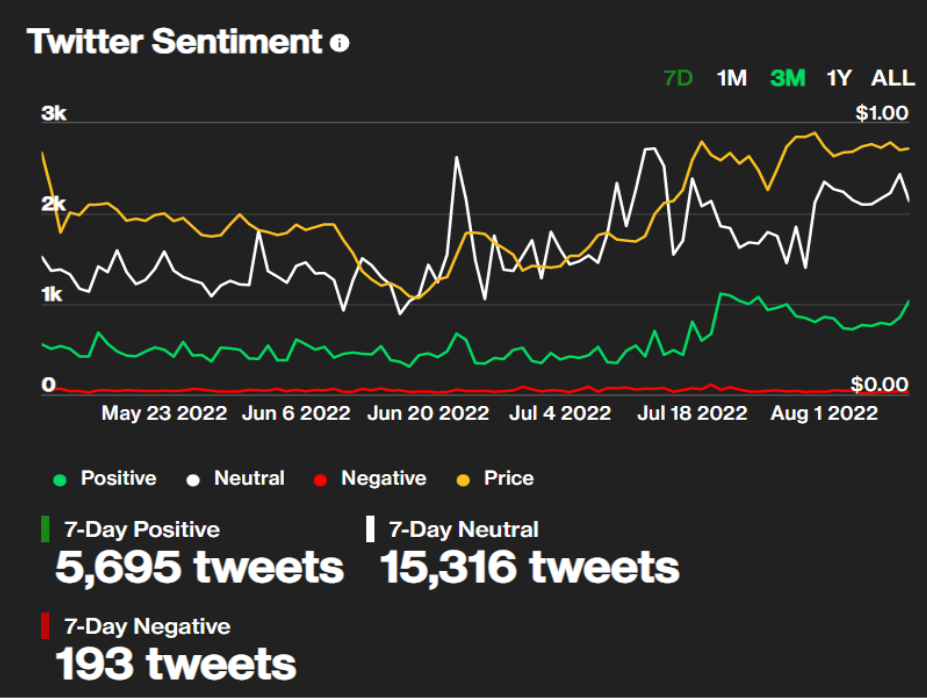

It’s worth pointing out here that as far as social sentiment is concerned, all are on the positive side for Polygon.

Source: CoinDesk

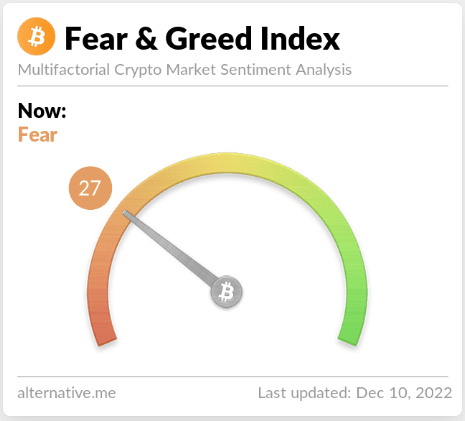

The Fear and Greed Index has degraded over the past week.

Source: Alternative