OpenSea, the world’s largest marketplace for NFTs (non-fungible tokens) has integrated BNB Chain. Thus, providing immense market exposure to the already vibrant NFT ecosystem on the chain. While NFT creators and users will benefit more from the BNB Chain platform, can BNB holders benefit from the partnership?

In a Twitter statement, BNB Chain affirmed that the partnership is a good step towards an exceptional NFT experience for its users and creators.

Similarly, OpenSea stated that integrating BNB Chain and other chains is a noble step towards democratizing the NFT space. This could lead to more NFT trade and creative additions in the future.

Will the Opensea integration offer any value to BNB holders?

Can BNB owners benefit from this development now that BNB chain NFT creators and users have received an early Christmas present? A few hours after the announcement, we observed mixed results.

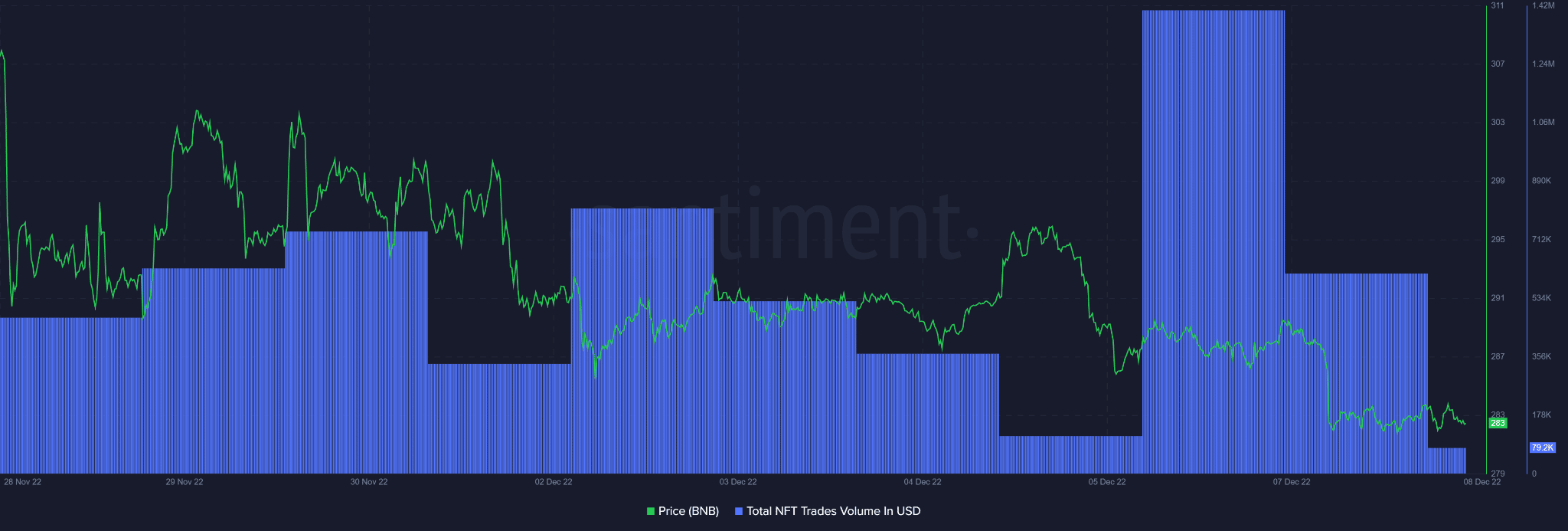

For example, BNB Chain saw the highest NFT trading numbers in the last few hours after the announcement. According to Santiment, total NFT trading volume rose to $1.4 million, up from about $100,000 on 5 December.

Source: Santiment

DappRadar, a decentralized application tracking platform, also confirmed the above improvement in BNB Chain’s NFT ecosystem.

Specifically, DappRadar’s data showed that BNB Chain’s unique active wallets (UAW) and trading volume on OpenSea increased by over 100% in the last 24 hours.

Moreover, transactions increased by 200% over the last day. In other words, BNB Chain has significantly benefited from the partnership.

We also saw an overall improvement in OpenSea. Measured against the overall performance of all chains, OpenSea saw an increase in trading volume of more than 40%, or about $10 million, in the last 24 hours. In addition, NFT transactions increased by 60%, while UAW increased by 7%. So the partnership is a win-win situation.

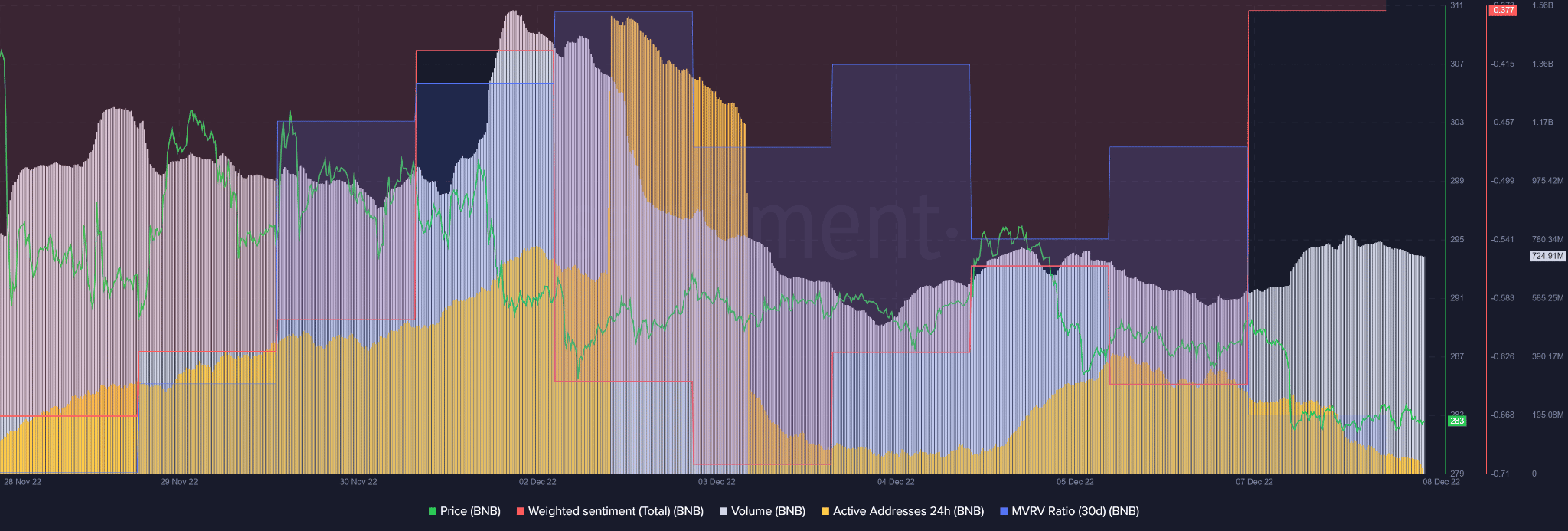

Unfortunately, at the time of publication, BNB holders seemed far from gaining anything from the deal. BNB’s active addresses and volume dropped in the last 24 hours.

In addition, BNB recorded negative weighted sentiment, which could indicate a bearish outlook. However, it is worth noting that sentiment has pulled back from deeper negative territory and moved up, which is a slight improvement.

Source: Santiment

Nonetheless, the 30 and 365-day ratios of market value to realized value (MVRV) were negative. This shows that short and long-term BNB holders still suffered losses despite the partnership.

In addition, technical indicators on the price charts suggested that BNB prices may continue to fall in the long term.

Source: BNB/USDT on TradingView

On the daily chart, the Relative Strength Index (RSI) fell below the neutral 50-level and was moving down, at press time. This showed that buying pressure had eased, and sellers were slowly gaining influence.

Accordingly, On Balance Volume (OBV) was moving sideways, followed by a downward trend at the time of publication. It revealed that the trading volume was stagnant and could tank, thus, undermining the buying pressure.

Therefore, BNB could break the current support at $285 and find new support at $268.8. However, a bullish BTC could catapult it above $306 and invalidate the above forecast.

Although BNB sentiment has improved slightly after the partnership, there is still a long way to go before a bullish outlook. So BNB holders could wait longer to benefit from the above collaboration.