Since mid-November, Solana bulls were repeatedly driven back from the $15 resistance zone. The technical indicators did not yet show strong upward momentum or large buying pressure behind SOL yet.

Read Solana’s [SOL] Price Prediction 2023-2024

A recent article highlighted why the $15 mark was critical. Here we take a look at how short sellers can look to trade SOL, and how this bearish notion can be invalidated.

The H4 bearish breaker was not yet breached and could offer a selling opportunity

Source: SOL/USDT on TradingView

On the four-hour chart, the Relative Strength Index (RSI) fell below neutral 50 to stand at 44 at press time. However this did not show a downtrend in progress. Meanwhile, the On-Balance Volume (OBV) has been flat over the past two weeks as well. The Chaikin Money Flow (CMF) was at -0.05, and any move lower would be an indication of significant selling pressure in the market.

The price action on the lower timeframes such as one-hour showed a lack of a definite trend. Solana bounced between the $13.14 and $15 values since 23 November, with two individual drops to the $12.8 level.

At the time of writing, Bitcoin ventured to the $16.7k mark but quickly moved upward as demand crept in. Further gains and a move past $17k could see SOL register gains as well. Yet, based on SOL’s chart, a shorting opportunity was more evident.

This was because of the confluence of a bearish breaker on the 4-hour timeframe alongside the range highs at $15. The $14.5-$15 area can be used to enter short positions. Invalidation of this idea would be a four-hour session close above $15.6. Meanwhile, to the south, the $13.15 and $11.3 levels can be used to take profit.

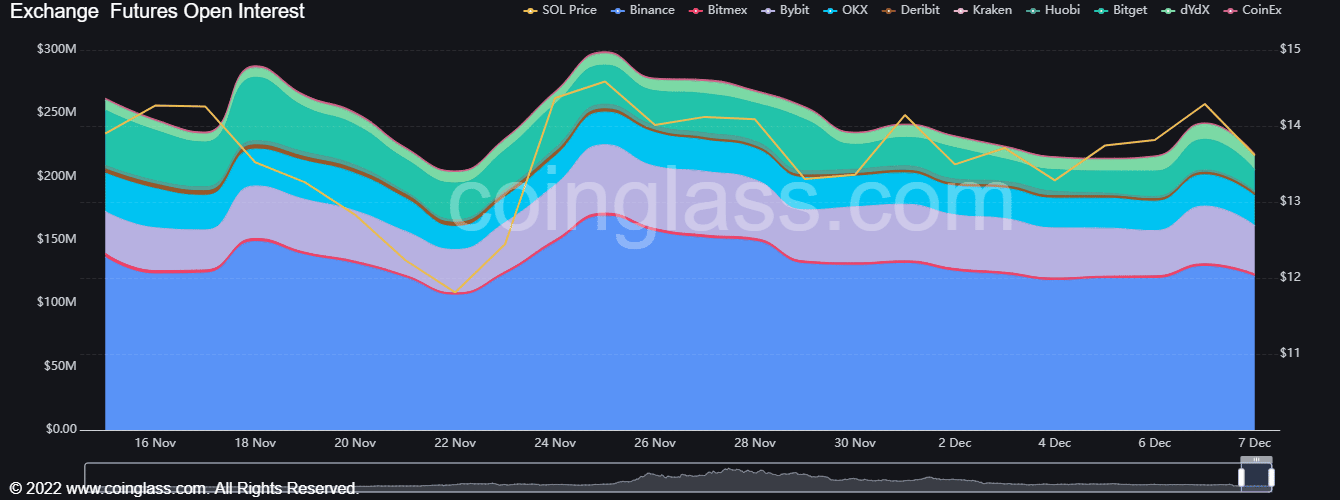

Futures traders were unenthusiastic about SOL breakout prospects

Source: Coinglass

Since 24 November, the Open Interest behind Solana has waned. Even though SOL has tested the bearish breaker multiple times and the price consolidated beneath the $14 mark in the past two weeks, OI has declined from $298 million to $217 million.

In the event of a breakout past $15, the OI would likely see a large move upward. This could warn sellers that the bearish winds have shifted.