Ahead of its 12th network upgrade, XTZ, the native coin that powers the Tezos ecosystem, received a listing from Coinbase Japan (a subsidiary of Coinbase that operates in Japan) on 6 November.

In a press release, the open-source blockchain stated that XTZ’s listing on a leading exchange in Japan would further increase Tezos’ presence in the Asian market.

Read Tezos [XTZ] Price Prediction 2023-2024

The Coinbase Japan listing of XTZ is of significant importance as it came ahead of Tezos’ 12th network upgrade – the Lima upgrade.

According to the Lima Upgrade proposal published in October, the 12th upgrade would introduce a number of key improvements to the Tezos network. These would include a Kernel-based optimistic rollup, consensus keys for “bakers” on the network, an improved ticketing system, and pipelining, amongst others.

XTZ says no to the Coinbase effect

Data from cryptocurrency price tracking platform CoinMarketCap showed that prior to Coinbase Japan’s confirmation that it now supported XTZ trade, the alt exchanged hands at a high of $1.02.

While its price had started to fall prior to the announcement, as mentioned earlier, it fell further after the news broke. This was in contradiction to the popular Coinbase effect, in which many believe that listing a coin on Coinbase would cause a rally in the coin’s price.

In a 2021 report titled “Analyzing the Crypto Exchange Pump Phenomenon,” Roberto Talamas of Messari analyzed the performance of some tokens within the first five days of listing on Coinbase. Talamas found that when tokens are listed on Coinbase, they record an average price growth of 91% in the first five days of listing.

The Coinbase effect might not play out in the current market as the year so far has been plagued with a series of issues, from failed projects to a market downturn aggravated by FTX’s sudden collapse.

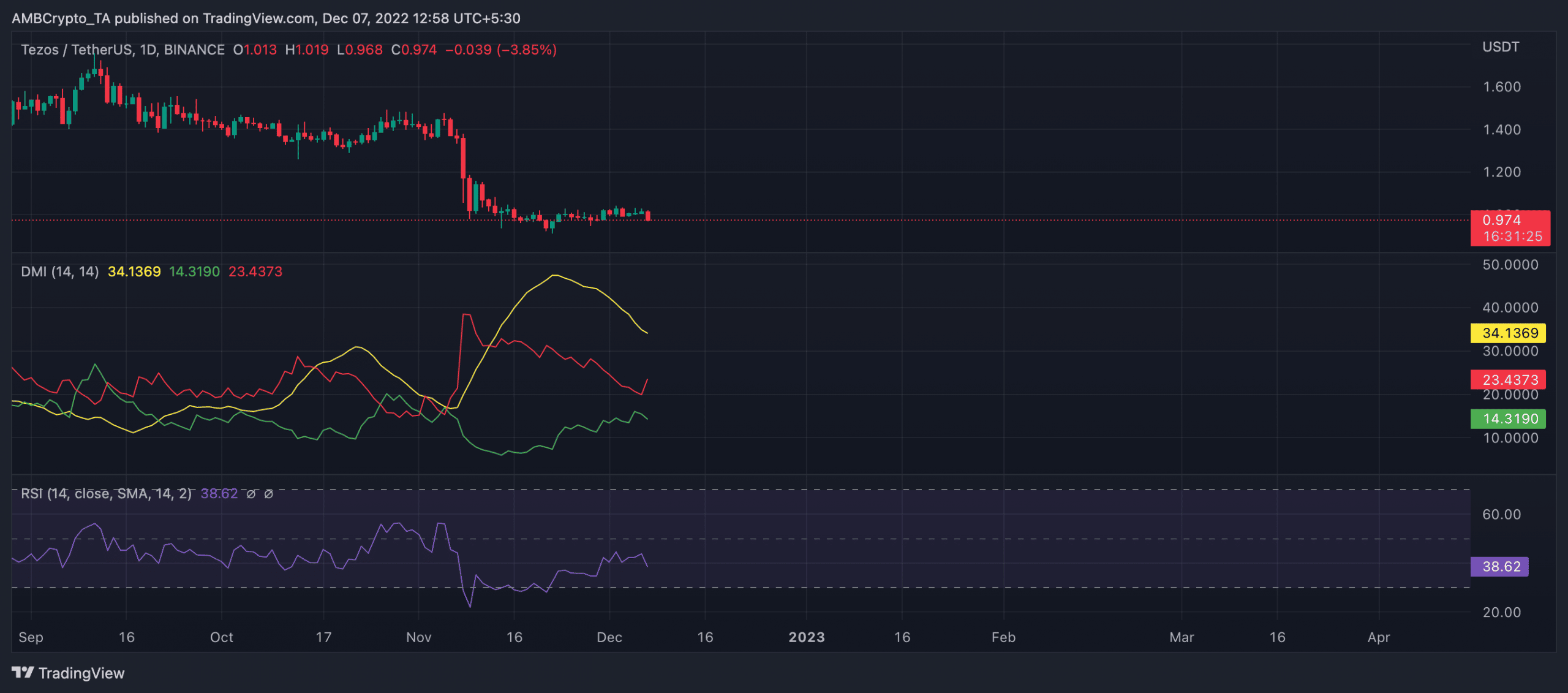

XTZ on a daily chart

Following FTX’s demise in early November, XTZ’s price has plummeted by 27%. Exchanging hands at $0.993, XTZ traded at levels last seen in March 2020. On a year-to-date basis, XTZ’s price has fallen by 78%.

Since FTX collapsed, sellers have been in control of the XTZ market. The Directional Movement Index (DMI) showed that their strength (red) rose above those of the buyers (green) on 8 November, soon after the FTX debacle started.

As of this writing, the sellers’ strength at 23.43 rested solidly above the buyers’ at 14.31.

Further, a key indicator such as the Relative Strength Index (RSI) pointed out the severity of XTZ sell-offs that have taken place since FTX collapsed. Still ongoing at press time, the RSI rested at 38.62.

Source: TradingView