Ethereum’s [ETH] co-founder, Vitalik Buterin, said in his 5 December blog post that DAO stablecoins could be integral to the project’s future. The crypto bigwig noted that the ability of these coins to allow collateralization makes them the most qualified.

Vitalik also mentioned that governance-backed stablecoins like RAI might have been considered. However, its negative interest rate and vulnerability made it out of the option.

Read Ethereum’s Price Prediction 2023-2024

Choose DeFi, get efficiency

In further defense of his opinion, the founder pointed to MakerDAO [MKR] and its stablecoin, DAI, as a suitable project to lead the charge. Still, he noted that MKR had some flaws even with its innovation. He added that MKR might only be ideal long-term unless the project improves efficiency. Vitalik said,

“Maker is a fine model to get a stablecoin started, but not a good one for the long term. Hence, making decentralized stablecoins work long term requires innovating in decentralized governance that does not have these kinds of flaws.”

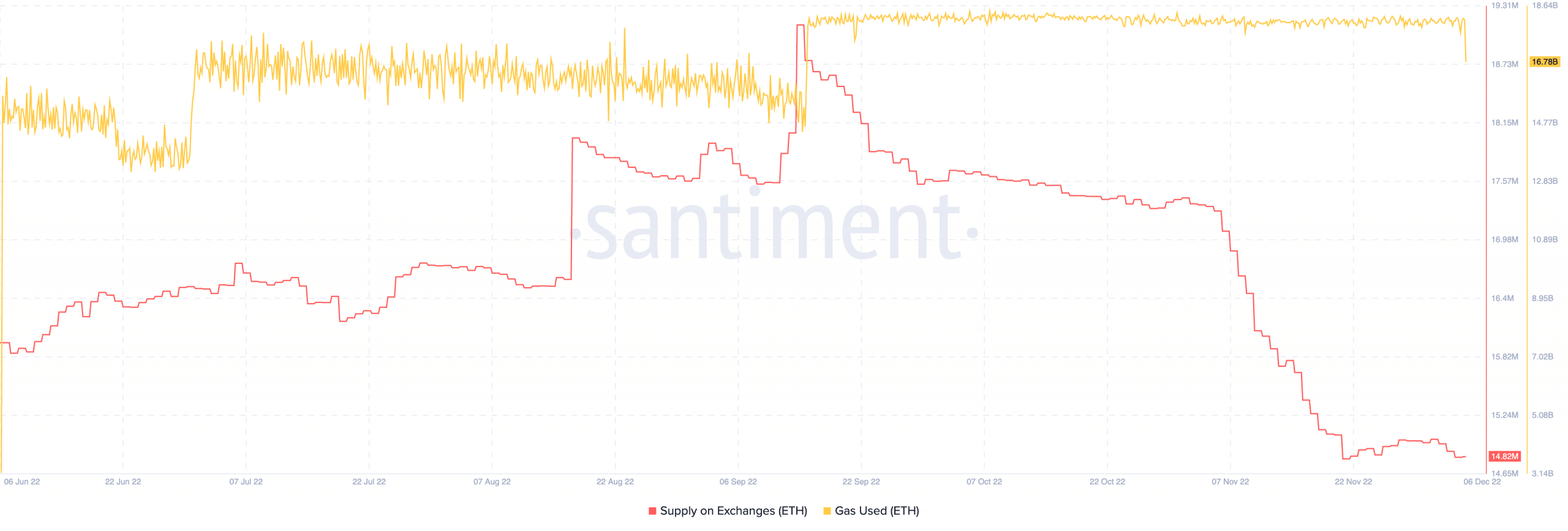

Further examination showed that the FTX collapse had not helped matters with exchange deposits, especially from the Ethereum community. According to Santiment, the supply on exchanges has significantly dropped.

At press time, the ETH exchange supply was down to 14.82 million. So, this explains the notion that investors might align with Vitalik’s opinion by taking advantage of the decentralization perks.

Source: Santiment

In spite of that, recent transactions using the Ethereum blockchain were not impressively active. This was because the gas used as of this writing had slid to 16.78 billion. Hence, this was part of the reasons ETH had struggled to remain profitable.

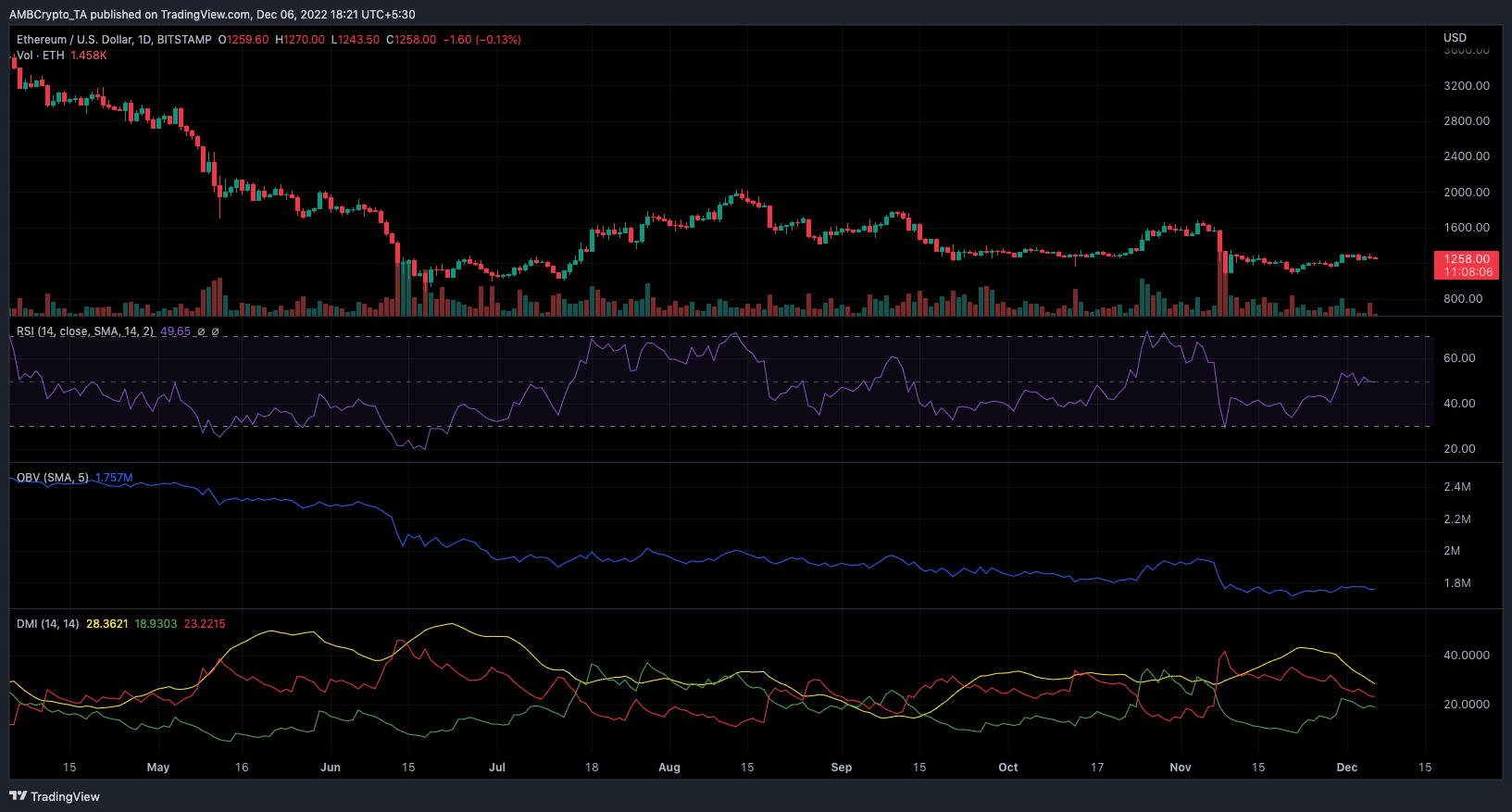

Skating on the charts

For ETH, CoinMarketCap showed that the 24-hour performance was a 3.08% decrease in the last 24 hours. Based on the four-hour chart, the Relative Strength Index (RSI) was 49.65. This point meant that ETH was at a solid buying momentum.

Having exited its previous oversold situation, quite a significant volume ignored flowing into Ethereum. This was because the On-Balance-Volume (OBV), showed a weak signal. With the OBV down at 1.757 million, it implied that ETH had not been able to overcome selling pressure.

Source: TradingView

The Directional Movement Index (DMI), as seen above, signaled agreement with the OBV’s indication of seller control. This conclusion was because the negative DMI (red) lay station above the positive DMI (green).

But with the Average Directional Index (ADX) at 28.38, it could be challenging for ETH to recover. Even so, investors should not lose hope.