Uniswap [UNI] fell below $6.381 after Bitcoin [BTC] dropped below $17.32K on 5 December. At press time, UNI was trading at $6.17, and BTC was holding just above $17K support. Thus, any further downward movement in BTC could lead to UNI breaking the bullish order block and the support zone at $6.10.

Read Uniswap’s [UNI] price prediction 2023-2024

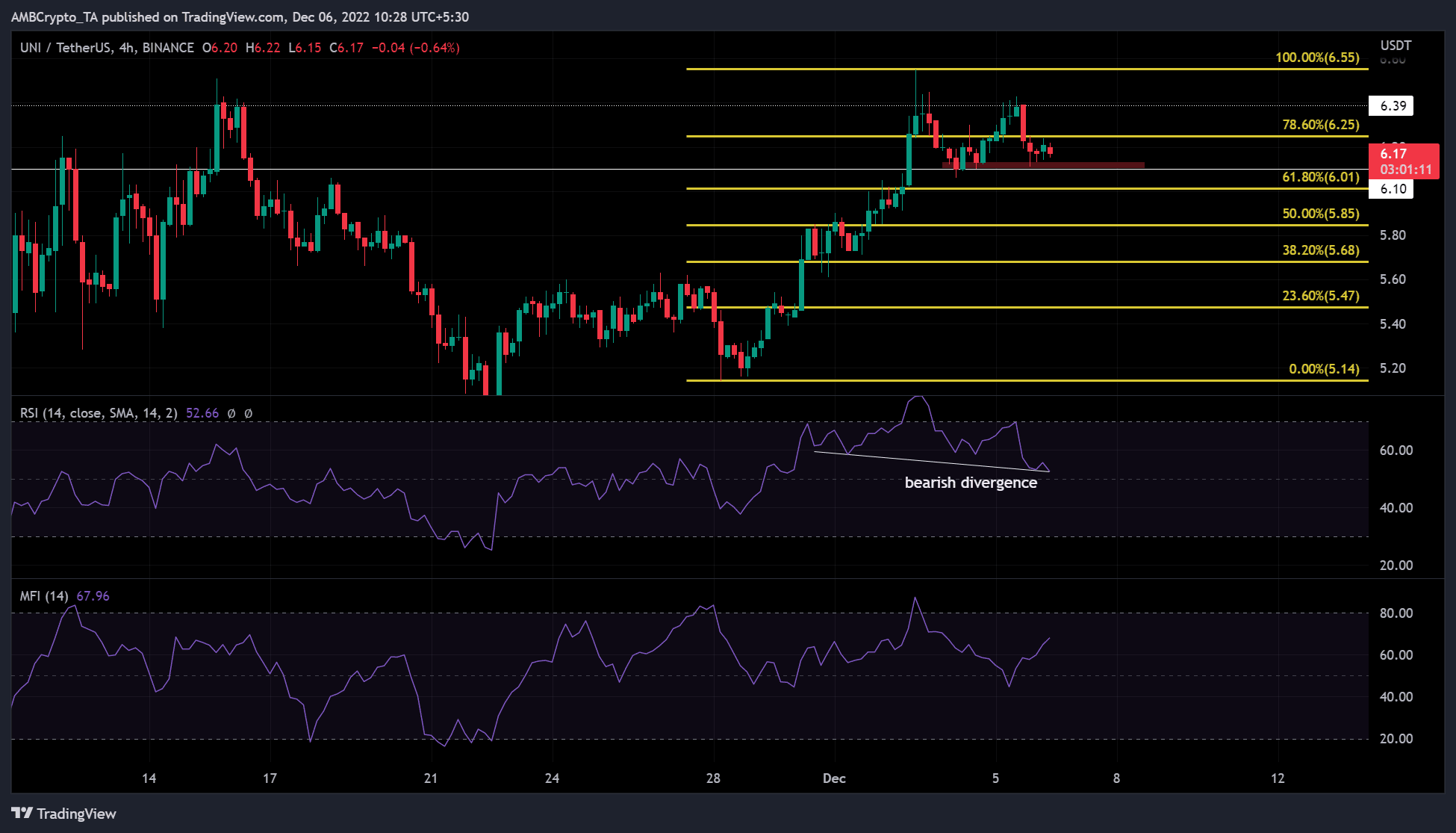

The above break below $6.10 could provide a short opportunity if UNI falls to the 61.8% Fibonacci retracement level ($6.01). But can the bears sustain the momentum?

UNI is showing a bearish divergence: Will the bears push it lower?

Source: TradingView

UNI has been in a correction that could retest or break the current support level of $6.10. However, based on technical indicators, it was more likely that UNI will break the current support level and head lower.

In particular, the four-hour chart showed a declining Relative Strength Index (RSI). This indicated that buying pressure was steadily weakening, giving massive leverage to sellers. In addition, there was a bearish divergence between the RSI and the price action. This could indicate a possible further downtrend for UNI.

Therefore, UNI can fall to $6.01 if sellers continued to gain leverage. This would be the short-selling target, so traders could pocket the difference if they sell at $6.10 and buy again at $6.01.

However, the risk-reward ratio wasn’t very high, and a break of resistance at $6.25 would negate the above bearish outlook. In this case, the immediate target for the uptrend could be the bearish order block at $6.39.

UNI recorded profits and a slight decline in development activity

Source: Santiment

According to Santiment, the 30-day Market Value to Realized Value (MVRV) ratio was positive. This showed that short-term holders of UNI recorded gains in recent days.

However, UNI’s development activity decreased sharply at the time of publication after rising steadily recently. Given the significant impact on the price of UNI, such a sharp decline could lead to a further downward trend. However, if BTC develops a bullish sentiment, UNI could enter an uptrend and invalidate the above bearish forecast.