Cardano (ADA) has been fighting a vicious battle trying to secure its place in the DeFi market in the past few months.

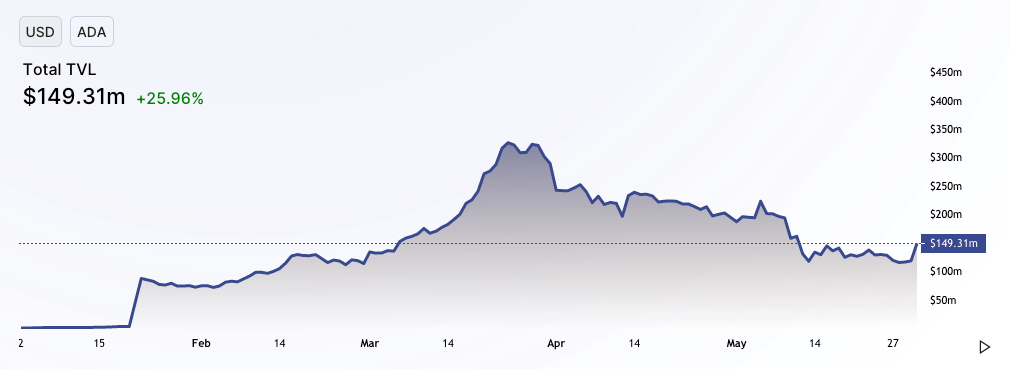

Since the coveted Alonzo Hard Fork upgrade in September 2021, the development efforts at IOHK, EMURGO, and the Cardano Foundation had ramped up, culminating at the end of March when the blockchain reached its all-time high in total value locked (TVL).

On March 24th, the TVL on Cardano reached $326 million — nearly a 38,500% increase from the $845,000 in TVL it recorded at the beginning of the year.

Chart showing the total value locked in Cardano from January 1st, 2022, to May 31st, 2022 (Source: DeFi Llama)

Chart showing the total value locked in Cardano from January 1st, 2022, to May 31st, 2022 (Source: DeFi Llama)

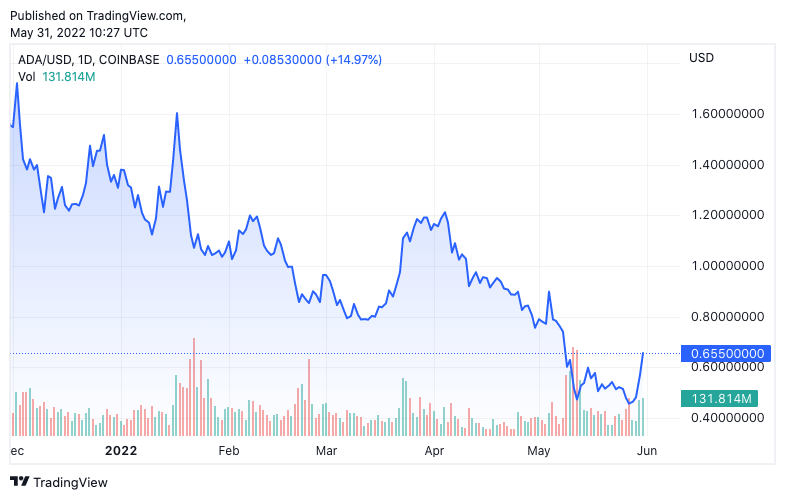

This growth in the value locked in various dApps on the blockchain defied ADA’s overall price trend, steadily declining since its all-time high in September 2021. Since the beginning of the year, ADA lost over half of its value, dropping from $1.37 on January 1st to $0.65 on May 31st.

Chart showing the price of ADA from January 1st, 2022, to May 31st, 2022 (Source: CryptoSlate ADA)

Chart showing the price of ADA from January 1st, 2022, to May 31st, 2022 (Source: CryptoSlate ADA)

The disparity between the increasing TVL and decreasing price indicates that the interest in Cardano isn’t tied to price action.

That same interest has been rising due to a notable increase in the number of projects building on Cardano and the number of dApps launched on the platform. According to IOHK, nearly 900 projects were built on Cardano at the end of April, including DEXs, marketplaces, stablecoins, lenders, wallets, and NFTs.

Despite an abundance of activity and interest, Cardano hasn’t been immune to the Terra blowback and has seen its price and its TVL drop alongside the rest of the market. However, the 65% decrease in TVL the blockchain saw over the past two weeks was much more aggressive than expected, raising the question of what caused this sharp drop.

Easy come, easy go liquidity

Since the Alonzo Hard Fork launch in August 2021, 94 dApps have launched on Cardano. Out of the various DeFi protocols using the Cardano platform, five decentralized exchanges (DEXs) have driven most of its TVL since the beginning of the year.

Being the first trading protocols launched on the blockchain, the bustling Cardano community quickly used them. Minswap (MIN), SundaeSwap (SUNDAE), MeowSwapFi (MEOW), ADAX Pro (ADAX), and MuesliSwap (MILK) all saw a massive increase in liquidity at the end of March, seeing record volumes and engagement.

However, the money that was quickly poured into these protocols was also fast to exit.

According to DeFi Llama, ADAX Pro was the biggest loser in this sharp decline, losing 97.7% of its TVL between April and May. MuesliSwap came in a close second with an 86.7% decline in TVL, followed by SundaeSwap with its 79% drop in TVL.

MeowSwapFi and MinSwap shared the third place with a 74% decrease, while trading protocol WingRiders (WRT) posted the smallest loss with a 54% decrease in TVL over two months.

These drops in liquidity have caused the TVL on Cardano to drop from its ATH of $326 million to $115.7 million in the final days of May.

Quick recovery shows a promising summer ahead

The volatility in TVL Cardano has seen in the past two months seems to be ending. After dropping to $115.7 million on May 27th, the TVL increased by 29%, reaching $149.31 million on May 31st.

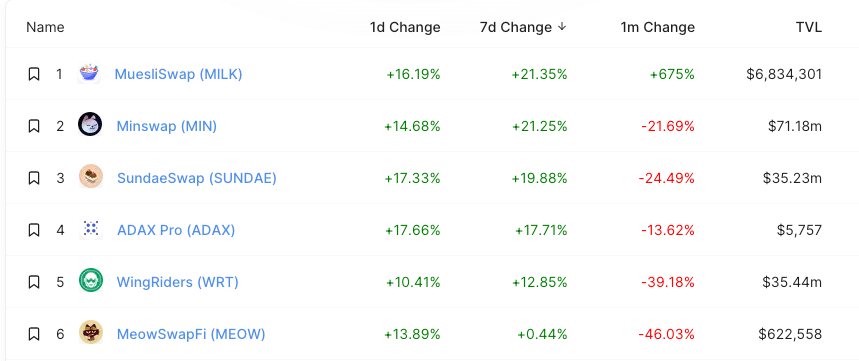

The DEXs that posted significant losses in the past couple of months have all begun to recover, with every one of them seeing their TVLs increase in the last week of May.

Table showing the increase in TVL for Cardano DEXs (Source: DeFi Llama)

Table showing the increase in TVL for Cardano DEXs (Source: DeFi Llama)

Minswap, which accounts for almost half of all the value locked in Cardano, saw its TVL increase by over 21% in the past seven days. The second-largest DEX on Cardano, SundaeSwap, saw its TVL increase just under 20% during the same period, while WIngRiders’ TVL of $35.44 million increased by over 12%.

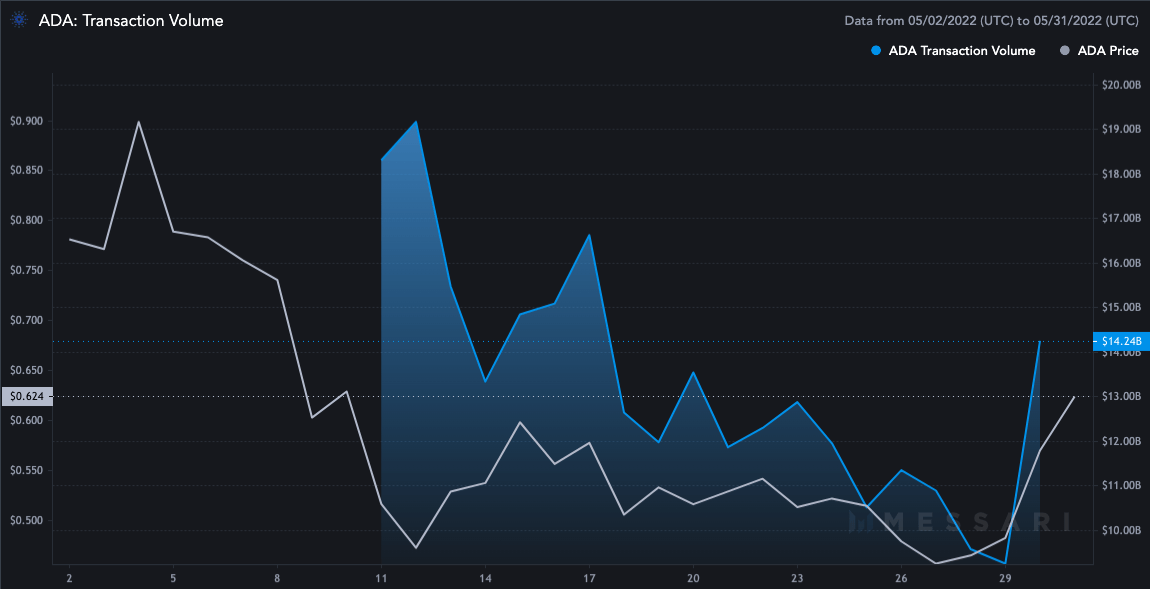

This increase follows the equally significant growth in transaction volume Cardano has seen. The transaction volume of ADA, Cardano’s native token, increased by 30% between May 27th and May 31st, rising from $10.88 billion to $14.24 billion.

Chart showing the 30-day Cardano (ADA) transaction volume (Source: Messari)

Chart showing the 30-day Cardano (ADA) transaction volume (Source: Messari)

All of these metrics point to a promising summer ahead for Cardano. As the market is slowly nearing the end of its third quarter, Cardano could see even more activity. The launch of Iagon, a cross-chain bridge between Cardano and ERC-20 tokens, is also set to bring more liquidity to the rising number of DeFi protocols and dApps launching on Cardano.

With dozens of protocols set to launch on the blockchain in the coming months, we are bound to see more of these volatility periods that give way to overall activity growth.