Crypto markets saw billions of dollars in gains Monday morning after months of ‘ranging,’ data from multiple sources shows.

Leading the charge was Bitcoin, the world’s largest cryptocurrency by market cap, with a jump of over 10%—from $35,000 to $38,000—reaching as high as $39,000 below seeing a brief correction.

Bitcoin trades well over its 34-period moving average (a popular tool used by traders to determine market trends based on historic asset prices) as of Monday morning but has seen selling at the ‘resistance’ level of $38,000. The $40,000 mark, furthermore, remains another resistance level.

Image: BTC/USD via TradingView.

Image: BTC/USD via TradingView.

Dogecoin, Cardano bump skyward

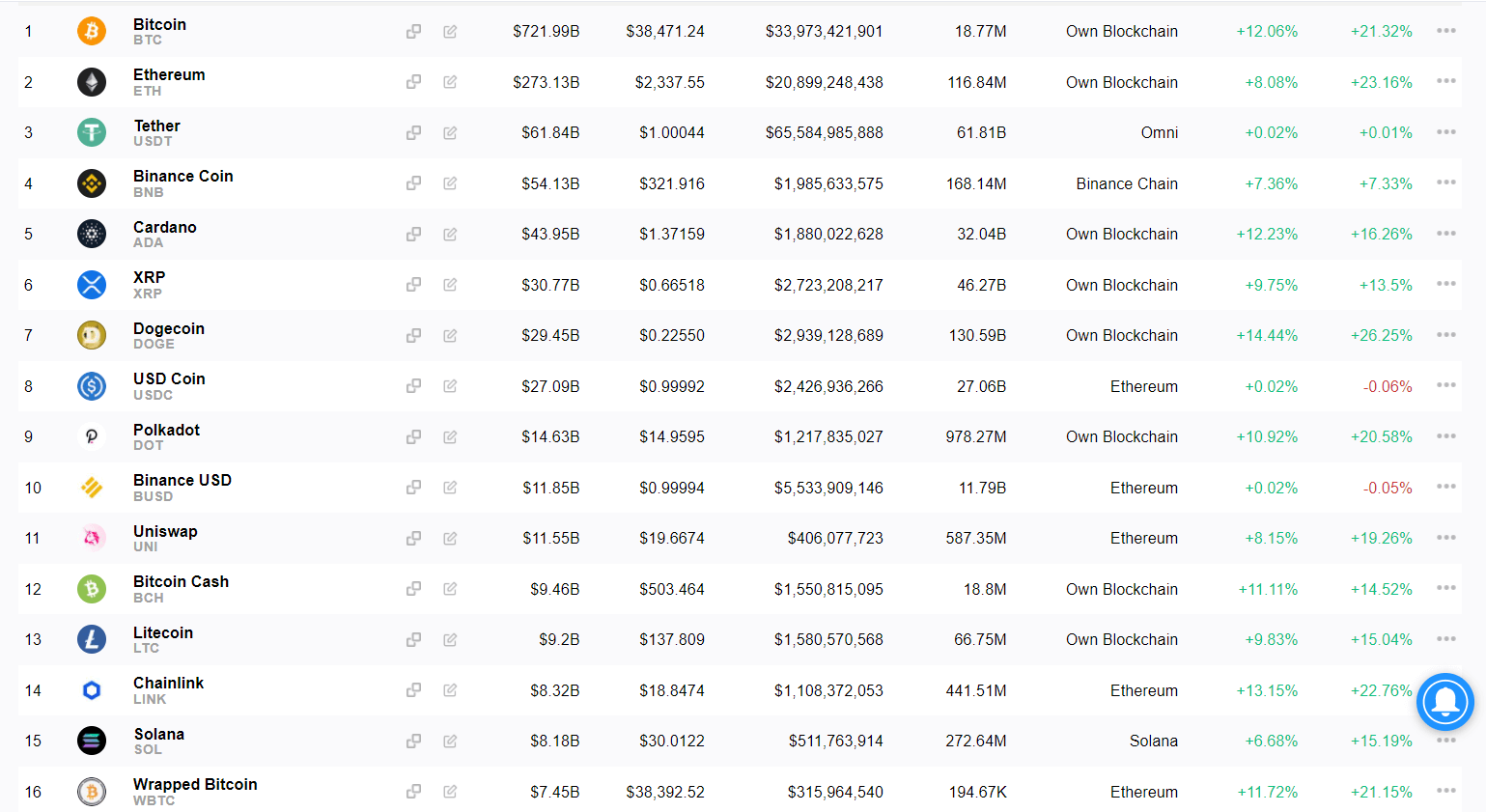

Bitcoin’s move saw large-cap cryptocurrencies like Cardano, Dogecoin, and Chainlink follow and lead the price charts with mid-double-digit percentage gains. As such, the fifty largest cryptocurrencies (by market cap) also showed high single-digit percentage gains as of press time.

Decentralized oracle service Chainlink was up 12%—from $16.62 to $18.86—at press time, followed by meme token Dogecoin (+13%, from $0.19 to $0.22) and proof-of-stake blockchain platform Cardano (+11%, from $1.22 to $1.37).

Image: BTC/USD via TradingView.

Image: BTC/USD via TradingView.

Other large-cap market leaders were XRP (+9%), Polkadot (DOT; +10.3%), Bitcoin Cash (BCH; +11.3%), and Ethereum Classic (ETC; +13.3%).

Is Amazon buying Bitcoin?

Some market observers in crypto circles on Twitter linked the moves to ‘insider’ reports of global online marketplace Amazon wanting to integrate Bitcoin payments for its services by 2022 and launching its own coin. These, however, remain unsubstantiated at press time.

“It begins with Bitcoin – this is the key first stage of this crypto project, and the directive is coming from the very top… Jeff Bezos himself.”https://t.co/vyAvu0CPc2

— Will Clemente (@WClementeIII) July 25, 2021

Meanwhile, not all traders made bank. Data from market tool Bybt shows nearly $1 billion worth of ‘short’ traders—individuals betting on a market decline—were liquidated this morning, with $480 million of that amount coming from Bitcoin trades alone.

There was then the weird. Futures markets for Bitcoin on Binance saw a temporary price wick to as much as $48,000, arguably liquidating thousands of traders who may have posted their stop losses much higher than current prices.