Gold and digital scarcity

Gold is a natural resource. It is a metal that arose from the Big Bang. In contrast to other resources, the quantity of gold on our planet is literally very scarce comprising only 0.00000031% of the Earth’s crust. Gold is shiny and can be useful in the jewel or electronics industries. People decided to use it as a store of value. Thus, gold is a very expensive resource.

Gold has one big advantage that cannot be replicated in the digital world. Gold is naturally durable and does not depend on human activity or other natural events. Gold just exists independently of humankind. Longevity and durability are the most important prerequisite of scarcity if it is to be used as a store of value. Imagine it would be possible that wealth could unexpectedly disappear. Nobody would want to own such an unstable asset. People buy gold to preserve their wealth. They naturally do not want to lose it somehow accidentally. Gold is the greatest store of value on Earth. Bitcoin’s narrative is about digital gold or sound money. So the natural question is whether longevity and durability can be replicated in the digital world.

Permissionless open public networks like Cardano and Bitcoin are technologies. It is a piece of software that depends on the quality of the source code and its maintenance, the Internet, and electricity. Cryptocurrencies are products of human’s ability to create new things and innovate them. Cryptocurrencies would not exist without research and science. Bitcoin is a collection of technologies that have been invented long before Satoshi could put them together. Cardano and many other projects are just a natural continuation of evolution. In this article, we will not discuss the technical aspects of cryptocurrencies. Every software can fail, the Internet can have troubles, a blackout can occur. We will not deal with these events. We will focus on the economical part that is directly linked with the longevity and durability of cryptocurrencies.

Digital scarcity exists only in the digital world but digital coins have the value that allows us to buy physical things. The existence of digital scarcity depends on a decentralized network that consists of a bunch of computers. The owners of computers are economically incentivized to keep the network running and behave honestly. Hence, the longevity of a cryptocurrency depends on the presence of these people and the incentives to maintain the network. An economical model of every network must ensure that it has or is able to collect sufficient capital that is used for rewarding people that act in line with the best interests of the network. Let’s call the capital a budget. The budget is used for expenses of the network. Expenses are used for rewarding people that maintain the network and are involved in the ecosystem. The budget cannot be depleted otherwise people would stop maintaining the network. Thus, the economical model must ensure that the network will have sufficient income and the budget will never be depleted. It is only the budget that can ensure the needs of the network will be satisfied. The most important needs of the network are mainly the highest possible level of security and decentralization. So we could call the capital a security and decentralization budget.

As the decentralized network exists in the digital world, it can use only digital coins for rewarding. The network must be able to distribute digital coins as a reward but it must also be able to collect coins or create new coins via inflation. When never-ending inflation is not used then the network will be more dependent on collecting coins from users. It is the case for both Cardano and Bitcoin.

The budget depends on the economical model

An economic model is a simplified version of reality that allows us to observe, understand, and make predictions about economic behavior. The purpose of a model is to take a complex, real-world situation and pare it down to the essentials. Designers of the decentralized network have one important goal. They have to prepare an economical model that will ensure a sufficient budget in the long term. In the case of the attempt to create a digitally scarce resource, the model should work forever. It is a big challenge.

Both Cardano and Bitcoin have economical models with a capped number of coins that will be released by the network. ADA and BTC coins are scarce resources since their maximums are set in protocols. The Cardano network will have only 45,000,000,000 ADA coins. The Bitcoin network will issue only 21,000,000 BTC coins. The limited supply of coins represents the scarcity that can be perceived as the scarcity similar to or even better to gold. The demand for ADA and BTC coins gives them value in the real world.

The economical model consists of two pillars:

- Monetary policy: In the case of cryptocurrencies, monetary policy is a plan of action that is prepared in advance and that is unchangeable. The monetary policy is implemented in the source code. Developers can possibly change the policy but only upon the agreement of the majority of the community. There is a social contract between developers and the community that the policy will not be changed. The community can easily verify that the monetary policy has not changed with every newly released version of a client.

- Transaction fees: Users of the network have to pay for the usage. The mechanism of collecting the fees is also implemented in the protocol. Thus, transaction fees are also part of the budget. Notice that in the case of Cardano, fees are paid also for using smart contracts.

Monetary policy is predictable and known in advance while the quantity of transaction fees that will be collected in the future is unpredictable. To be more precise, the emission of coins is predictable since it is implemented in the protocols but the market price of coins is highly unpredictable. We do not know how the budget will look like in the future and whether it will be higher or lower than at the current moment. In other words, the monetary policy is fixed but due to the price volatility, it is unpredictable how the budget will look like.

The reward consists of the newly emitted coins and transaction fees. It can be generally said that the emission of new coins makes a major part of the reward in the early stages of a network’s existence. The reason is that when a network is not adopted the number of collected fees is very low. In addition, nobody would be willing to play with a new network if the transaction fees were high. The number of collected transaction fees grows in time as the adoption grows, thus the emission of coins can gradually decrease. It is expected that one day, the emission of new coins will be negligible (close to zero), and the main income of the network will depend on transaction fees. In the later stage of the network’s existence, the main income of the network will form transaction fees instead of monetary policy. In the ideal case, the stability of income should remain constantly similar (or be better) and there should be sufficient coins in the budget. Monetary policy can be perceived as more stable since the income is more predictable and sufficient. Once the network is more dependent on transaction fees, the budget can be less stable and predictable.

A decentralized network is a complex organism and the economic model goes hand in hand with technology. The ability to collect sufficient income will depend on the qualities of the transaction network. It can be assumed that people will use the best available network for sending transactions. Which network will be the best one? Probably a network that will be fast, scalable, and with low fees. Most importantly, that will have the highest network effect. In the digital world, there is no profitability without usability.

Monetary policy of Bitcoin and Cardano

In this section, we will deal only with the monetary policy of Bitcoin and Cardano. We neglect transaction fees. After this section, we will focus on transaction fees. Later, we will put both sections together.

We will try to calculate a daily budget of networks in USD. We could do it also in native coins of the networks but the budgets will be dependent more on transaction fees in a few decades so it is more interesting to see it in the context of USD.

In 2021, a block reward of Bitcoin is 6,25 BTC. The reward is paid in every newly mined block. A daily security budget can be calculated like this:

Daily budget = 6,25 * 144 * BTC price

The magic number 144 represents 6 mined blocks in one hour for one day. 6 * 24 = 144. The current market price of a single bitcoin is 57,000 USD. The daily budget is 51,3M USD. Notice that it is approximately the amount that is daily used by PoW miners for paying the electricity.

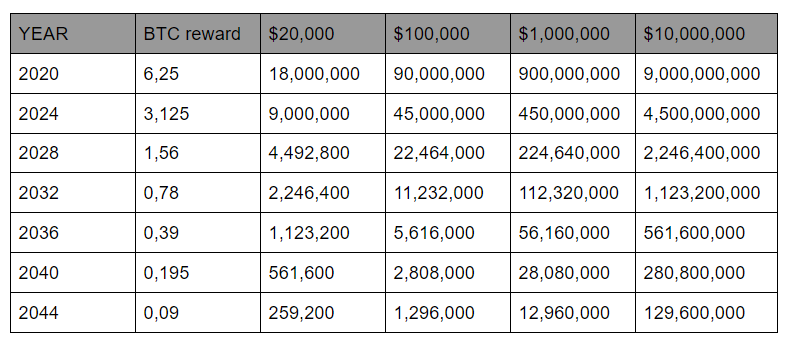

Let’s have a look at what will happen with the Bitcoin budget in the next two decades after the process called halving. The halving process will halve the reward every 4 years. The emission of new coins is thus highly predictable. We can easily calculate what the daily reward will be in USD when the price of BTC will be 20,000, 100,000, 1,000,000, and 10,000,000 USD.

[TABLE 1] Monetary policy of Bitcoin (a daily budget)

[TABLE 1] Monetary policy of Bitcoin (a daily budget)

The current daily budget is approximately 50M USD. As you can see in TABLE 1, If the price of BTC reaches 1M USD then the security budget would be 900M USD. The budget would be 18x higher than the current one. However, the consumption of electricity as well. The current consumption is approximately similar to the state of Argentina. Argentina has 45M people and the electricity consumption is 120 billion kWh per year. If BTC was for 1M USD in this bull run then the consumption of electricity would be as 18 states of Argentina. It is a negative side-effect of PoW, The electricity consumption rises together with the budget basically without limitations.

If BTC did cost $100,000 in 2024, so after the next halving, then the budget would be similar to the current one. The price of BTC must be around 1M USD in 2036 if the security should be the same as at the time of writing. Notice that the budget will decrease by half in 2040 if the price of BTC is not over 1M USD.

There are fundamental differences between Cardano and Bitcoin. A significant part of rewards in the PoW ecosystem is used for paying for electricity. Moreover, ASIC mining hardware also has to be paid for. A minor part of the block reward forms a profit for miners. Profit depends on the strategy of miners and the timing of selling bitcoins. The profit can range from 0–10%. Miners can be at a loss for a longer period of time. They can profit once the price of BTC goes up. Mining is a risky business and there is no certainty that it will be profitable.

The Cardano network pays a reward every 5 days. The 5-days cycle is called an epoch. The whole Cardano network consumes the electricity as a few family houses. Thus, the significant part of epoch reward forms profit. Moreover, the Cardano network rewards all stake-holders. Stake-holders that delegate their stake to pools do not have costs so their rewards form profits for 100%.

Cardano is designed for mass adoption from scratch

If we simplify it a bit we could say that crypto lacks only one important thing. It is mass adoption. Without adoption, there will be no crypto revolution.Read more

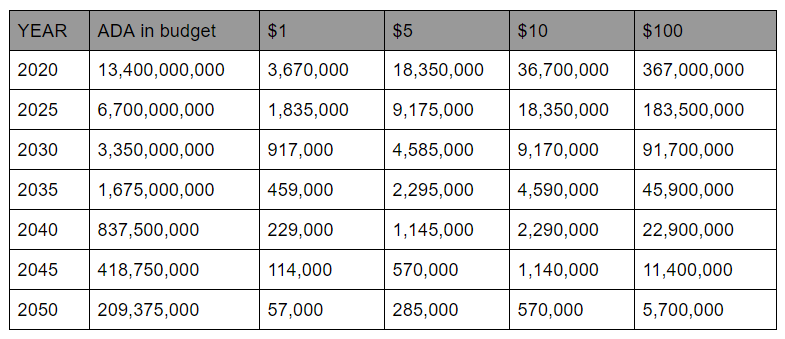

In the Cardano ecosystem, there is a similar mechanism to halving. Every 5 days a 0,3% is taken from a reserve and used as a reward and income of the project treasury. It is a more gradual process in comparison with Bitcoin halving. It is expected that half of the rewards will be consumed every four to five years. To calculate an average daily budget in 5 years period, we need to take half of the budget and divide it by 1825 (5 * 365 = 5 years). It is a bit simplified approach but it is sufficient for our purpose. Let’s calculate the daily budget for 1, 5, 10, and 100 USD.

Daily budget = (reward budget / 2) / 1825 * ADA price

[TABLE 2] Monetary policy of Cardano (a daily budget)

[TABLE 2] Monetary policy of Cardano (a daily budget)

Let’s calculate a reward for a stake-holder that has a 0,1% stake. Pool operators get a fixed amount of ADA coins and they can set a margin. So they get a bit more than delegators. Pool operators also have their pledges. As the decentralization and security of the Cardano network rely on and the distribution of coins, it is fair to calculate a reward for stake-holders regardless of whether we talk about pool operators or delegators.

In TABLE 2, you can see the daily budget for given prices of ADA coins. The price of ADA can realistically be over 10 USD in 2050 so the stake-holder with a 0,1% stake would receive ~500 USD a day. 2050 is a very distant future so 100 USD per ADA coin could also be possible and in this case, our stake-holder would receive 5000 USD a day.

2050 is a very distant future. Let’s consider what will happen in 2030. If ADA reaches the price of 5 USD then the 0,1 stake-holder will get ~4,500 USD a day. When the price of ADA will be only 1 USD in 2050 then the reward for our stake-holder will be only ~50 USD a day. It can be considered as the worst-case scenario but it is still worth holding ADA coins. Why is it so if the rewards are so low? In 2050, the budget of both Cardano and bitcoin will rely mainly on transaction fees.

As we said, we discussed only the monetary policy that forms the main part of rewards in the early stages after the launch of networks. Let’s have a look at transaction fees.

Transaction fees

After a few decades, transaction fees will become the major resource of income. It can be said that if people will not use a network then the budget will be low and the existence of the network will be uncertain. The existence of the network will depend on the willingness of people to pay a lot for transactions or the scalability must not be a problem. It is possible to collect a given amount of money either via a few expensive transactions or via a lot of cheap transactions. The second option is definitely preferable since people might not be willing to pay high fees. From a certain level, people will not want to pay more. What are the maximum transaction fees that people will be willing to pay? We do not know but we can guess. It seems that people declined to pay fees in the Ethereum ecosystem when they reached 200 USD. 200 USD is more than the monthly cost of electricity for a family house in Europe.

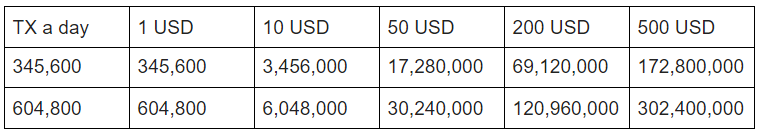

Blocks have a limited size so only a limited number of transactions can get into them. Block-time determines the frequency of block production. It is approximately 10 minutes in the case of Bitcoin and 20 seconds in the case of Cardano. Based on these parameters, we can calculate how many transactions can be processed per second. Bitcoin can process 7 transactions per second while Cardano 300. We should also take into account that the blocks might not be always full.

It should be said that there is no plan to decrease the block-time in the case of Bitcoin but it can be expected in the Cardano ecosystem.

A day has 86,400 seconds (60 * 60 * 24). Let’s have a look at how much the Bitcoin network can collect per day if the average transaction fee is 1, 10, 50, 200, 500 USD. We consider 4 and 7 transactions in a block.

[TABLE 3] The sum of collected fees in the Bitcoin network (a daily budget)

[TABLE 3] The sum of collected fees in the Bitcoin network (a daily budget)

As you can see in TABLE 3, if people were willing to pay 200 USD for transaction fees and the network processed 4 transactions per second then it would ensure that the budget would be the same as at the time of writing. With full blocks, the budget would be ~2x higher. 200 USD is a lot and we do not expect that it will be a standard fee. If the standard fee was 50 USD and all blocks were full then the budget would be 3x lower than we have today.

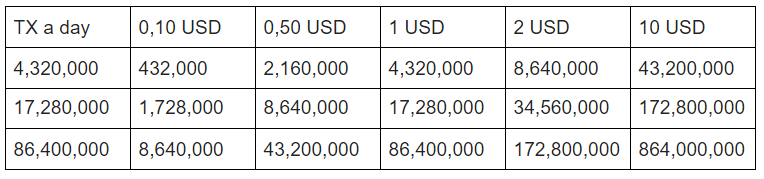

Let’s make a similar calculation for the Cardano network and check how much it can collect per day if the average transaction fee is 0,10, 0,50, 1, 2, 10 USD. We consider 50, 200, and 1000 transactions per second.

[TABLE 4] The sum of collected fees in the Cardano network (a daily budget)

[TABLE 4] The sum of collected fees in the Cardano network (a daily budget)

At the time of writing, Cardano processes on average 0,5 transactions per second for 0,22 ADA (~0,30 USD). Ethereum is the biggest smart contract platform and it processes 10 to 15 transactions per second for ~20 USD. The demand for sending transactions in the Ethereum ecosystem is much higher than the network is able to process. It can be assumed that 50 transactions per second could be an average number if the network was able to process it.

In a 10 years period, we assume that Cardano will process on average at least 200 transactions per second. You can see in TABLE 4 that the network will collect 1,7M USD per day if a fee will be 0,1 USD. If the fee was 0,5 USD the network would collect 8,6M USD. We expect that the transaction fee will be set to stay low when ADA coins have a higher price in USD. We do not expect that Cardano will ever have fees higher than 1 USD what could happen if ADA were for 5 USD. 8,6M USD can be collected when fees will be 0,1 USD and the network processes 1000 transactions per second. Our 0,1% stake-holder would receive 8,600 USD a day.

Monetary policy and transaction fees together

We discussed the monetary policy and the collection of transaction fees separately. However, the budget consists of both parts. The price of coins, the number of coins that a network releases as a reward, and collected fees will form the daily budget. If the price of coins will be relatively low, let’s say it will not grow a few X in the future, then only the collection of transaction fees can ensure a sufficient budget. A sufficient budget can be understood as a budget that we have nowadays. It would not be considered a healthy evolution if the budget gradually decreased.

People might not be willing to pay expensive fees for sending transactions and they will search for cheaper solutions. It is unpredictable how people will behave. People might be aware of the fact that Bitcoin remains secure only if they pay high fees but the majority might not be willing to pay high fees. If it is possible to tokenize BTC value and send transactions on the Cardano network cheaply, they will probably use the option. Some might use second-layer solutions like Lightning Network. In both cases, the issue is that fees will be paid elsewhere and the first layer will suffer from a low budget.

It can happen that everybody would like to have a secure first layer but nobody will be actually willing to pay high fees to ensure a sufficient budget for security. This economic behavior is described and known as the tragedy of commons.

In our view, Bitcoin needs innovations on the first layer and scalability must be increased. It can be the only way to ensure a sufficient security budget in the future. The other solution could be a very high price of BTC coins. If 1 BTC were for let’s say 3M USD and people would be willing to pay 50 USD for transaction fees then the security budget would be over 50M in 2044. So it would remain similar to the current one. Is that a realistic expectation? The market capitalization of Bitcoin would be much higher than the capitalization of gold. Is it possible that Bitcoin, with a similar function as gold, would overcome its competitor so quickly? At the moment, we do not see any reason for that. Bitcoin would have to be used as money, meaning people would have to be willing to pay by bitcoins on a daily basis. For that, again, we need cheap transactions on the first layer. It does not happen without improved scalability on the first layer since the current scalability is too low to onboard a significant number of people to the Lighting Network. If the price of BTC got under 100,000 USD in 2024 or 2028 then the budget would probably decrease. People would not probably regularly pay on average 50 USD fees.

We can assume that demand for decentralized transactions would be higher if the fees would be lower. The current adoption of cryptocurrencies is not higher than 5 % and the majority of users speculatively hold coins in their wallets. With the higher adoption and utility of decentralized services, it is possible to reach 1000 transactions per second cumulatively for all networks. Is that realistic? It is assumed that 1 billion users use smartphones for payments. Let’s assume that in the next 10 years, 5 % would use decentralized technologies. It would be 50M of users. If each user would make 1 transaction a day it would ~600 transactions per second. We are talking about payments via smart-phone but do not forget that Cardano is a platform and users will be able to send many tokens. It is possible that in the future it can be a few thousands of transactions per second. It is a question of which networks will be the most used one. There might be more competitors but it does not matter. If Cardano has let’s say 30% market share and processes 500 transactions per second it will have a sufficient budget.

The Cardano network can collect 8,6M USD on fees a day when it processes 1000 transactions per second for 0,1 USD. It can be the same amount if it is only 200 transactions per second for 0,5 USD. If the ADA coin is for 5 USD in 2030 then the daily budget can be 13M USD. A stake-holder with a 0,1% stake would earn 13K USD daily. If the number of processed transactions or the amount of collected fees is higher, then the income of the network will be also higher.

Let’s go back to the digital scarcity

We have provided some numbers but take it with a grain of salt. The only predictable parameter is the monetary policy. The price of ADA and BTC coins is basically unpredictable as well as adoption and thus the number of processed transactions.

It would be a surprise if Bitcoin or Cardano surpasses the market capitalization of gold. Digital scarcity is about adoption but the adoption itself cannot ensure longevity and durability. Public networks must have well-designed economical models. Digital scarcity in the form of public networks cannot survive without users of the networks that are willing to pay transaction fees. It was relatively easy to economically survive the first decade for Bitcoin and it will also be easy for Cardano. In both cases, the emission of coins is sufficient to incentivize people to behave honestly and maintain networks. Rich years will pass quickly and the technical properties of networks and their adoption will decide about the future.

The longevity and durability of digital scarcity depend on the high level of security and decentralization of the network and these properties depend on budget. There must be users that will be willing to pay for the digital scarcity. It is not the case of gold. Once you hold a piece of gold you can be sure that you will have it after 20 years and you do not pay anything. Gold does not disappear. This level of longevity and durability cannot be replicated in the world of software. At least not at the moment.

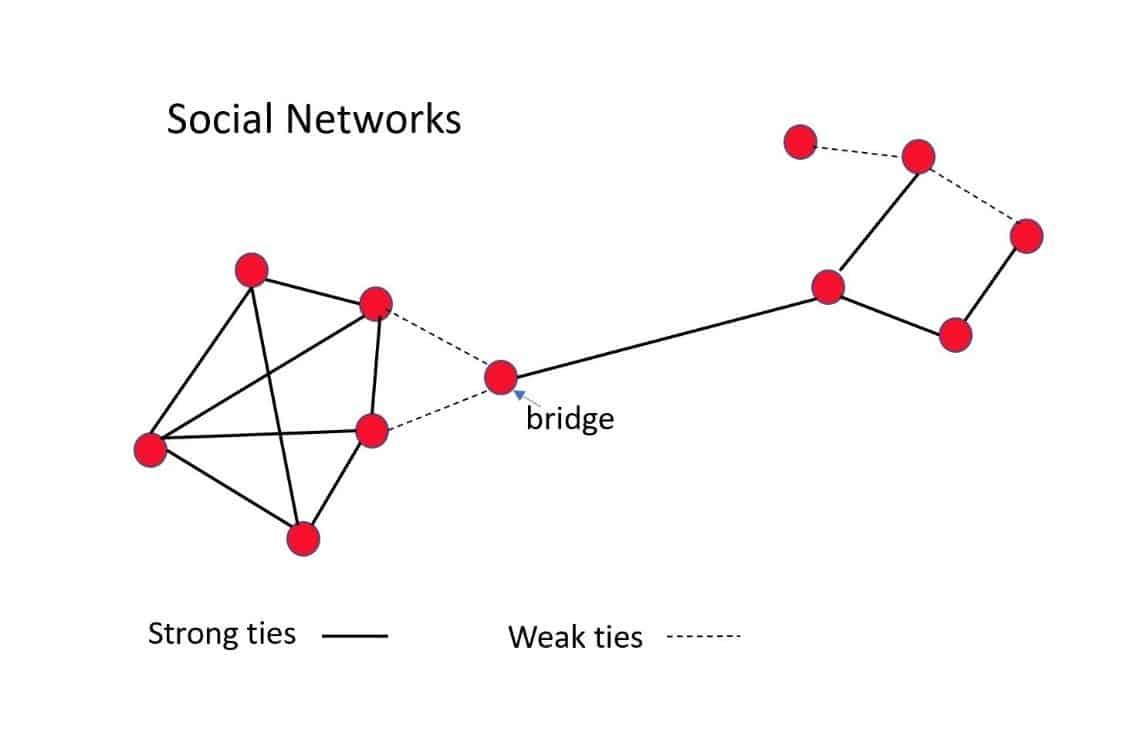

Scalability is probably the key to the longevity and durability of digital scarcity. The very basic functionality of every network is the ability to send transactions. It can be a pain for users if they are forced to pay a lot and wait hours for settlement. On the other hand, it can be a pleasure if transactions are fast and cheap. People are often searching for an intrinsic value of digital assets. The value of every network is the network effect. It is the number of users that are able to communicate with each other. The network effect will grow only on networks that will be the best for communication among users.

Some people say that the main property of Bitcoin is security. Well, in reality, security cannot exist without scalability. Security is something for which people must pay. As we said, security cannot rely only on the assumption that people will subsidy it via high fees. It can be fine in 2044 but it can fail in 2048. Or later. Who knows. This type of uncertainty is something that you would not expect when talking about the longevity and durability of digital scarcity.

The narrative of Bitcoin is strong but the practical usability of the network as a means of communication will probably decide about the future.

Cardano is better designed to become a network for a scarce resource. Cardano is a platform so its future stands on usage. One day, people will be able to send the BTC value via the Cardano network. Maybe just because it will be faster and cheaper. Paradoxically, it will make ADA coins more valuable since the network effect of Cardano will grow and more fees will be collected. It can be easier for Cardano to ensure the longevity and durability of ADA coins. Bitcoin without innovations will not be able to compete with Cardano regarding the ability to transfer value or use smart contracts. Basically, all networks can be the enemy of Bitcoin when it comes to budget. Including Lightning Network and all others in the Bitcoin ecosystem. Every network needs to have a working economical model. Decentralization and security are not for free.

PoW consensus has another side effect that can prevent success. It is the tremendous electricity consumption. The BTC price is about the willingness of big investors and companies to hold bitcoins. Once they realize that they actively hurt our planet by having bitcoins in their portfolios they can just sell bitcoins and never buy them back. Big investors are motivated to behave smartly and consider the impact of their decisions since people expect that. It cannot just be said that the huge electricity consumption is fine. It is not if there is no upper border. Maybe the current consumption is ok but what if it will be 10x higher? PoW protocol is great regarding security but its economic sustainability is uncertain and the negative impact on our planet should not be overlooked. Printing of money is not fair for common people. That is true but people should realize that we cannot print out our planet again. Once the functionality of PoS is verified by time then it will be smart to build a digital scarcity on it. It is better from the scalability point of view anyway and as we said, sustainable security cannot economically exist without high scalability.

Conclusion

We have not invented a digital scarcity yet since we are not able to ensure its long-term sustainability. It might be a surprise for you as many people consider Bitcoin as a store of value. It is just a narrative and it does not mean that it is realistic. We can see a lot of uncertainties and dependencies. Nothing that you would need to care of in the case of gold.

The narrative about the antifragile system is also a false story. In the case of software, the antifragile system must either be able to quickly respond to changes or do not change at all. It is nearly impossible to create a system that would not need a change since everything is constantly changing in our world. The monetary policy of cryptocurrencies can keep the network alive only in the early stages of its existence. Then, people’s behavior will be the main influencer of the future. What can be more changeable than mood or innovations? A decentralized network cannot be antifragile by definition. If people sell coins in a panic the security will immediately decrease. It can be fatal for the network. When networks will rely on fees they will be very vulnerable. Nobody is able to predict the future. Thus it is not possible to have a high level of certainty regarding the long-term sustainability of monetary policy and the collection of fees.

The only thing that can be done is to take into consideration all possible scenarios. Then, it is necessary to come up with a mechanism that ensures that the networks survive. The current decentralized networks are far from being ready to create digital scarcity. However, we can get to that point via innovations.

Bitcoin halving decreases a security budget every 4 years and bitcoin proponents believe that the always growing price of BTC coins will keep the budget sufficient. This alternative is in play and it is possible. Anyway, scalability is not a resolved topic for Bitcoin and people will face difficulties when they will try to use it. The Bitcoin adoption from the side of retail investors depends on scalability. If the fees remain high then Bitcoin will become a good speculative asset for big whales. Probably nothing else. Cardano, as a platform, can succeed via decentralized functionalities. ADA can become a lucrative asset just because the collected transaction fees are distributed to stakeholders. Maybe it is a new form of sustainable digital scarcity. Who actually knows the right definition of digital scarcity?