So you want to know how to choose a Cardano stake pool to delegate your ADA. There are several factors when choosing a Cardano stake pool to delegate to in order to get your rewards. Keeping these factors in mind will ensure that you get the most out of delegation and ensure you get your return on ADA.

Overall, simply follow these rules to choose a Cardano stake pool:

- Pool that has produced blocks

- 60% or less saturation unless you are watching your delegation every epoch to be able to change when saturation is exceeded

- You can contact and talk to your stake pool operator

- The stake pool operator shows competency and knowledge in what they are doing to run and manage the pool

Our pool has a saturation level of 14% and is consistently minting blocks on a regular basis. Please use the ticker ADAOZ to find our pool to delegate.

- How to Choose a Cardano Stake Pool

- The Metrics

- ROA 1M / Lifetime

- Stake & Saturation

- Variable Fees & Fixed Costs

- Luck

- BPE (Block per Epoch)

- Pledge

- Delegation Costs

- Interview Your Stake Pool Operator and Build Trust

- Support Small Pools

- Pool Hopping

- References

- Consider Delegating to Our Pool

How to Choose a Cardano Stake Pool

There are several places to search and choose a Cardano stake pool to delegate to including the wallet applications themselves such as Daedalus or Yoroi.

At the time of writing this article, the Daedalus stake pool scoring and ranking system is something to be desired, showing pools that are over saturated as being highly ranked leaving users not know about saturation penalties delegating to these pools.

Yoroi on the the other hand uses the data from ADAPools.org which has a different scoring system along with additional filters to help you rank and sort pools by various metrics.

The Metrics

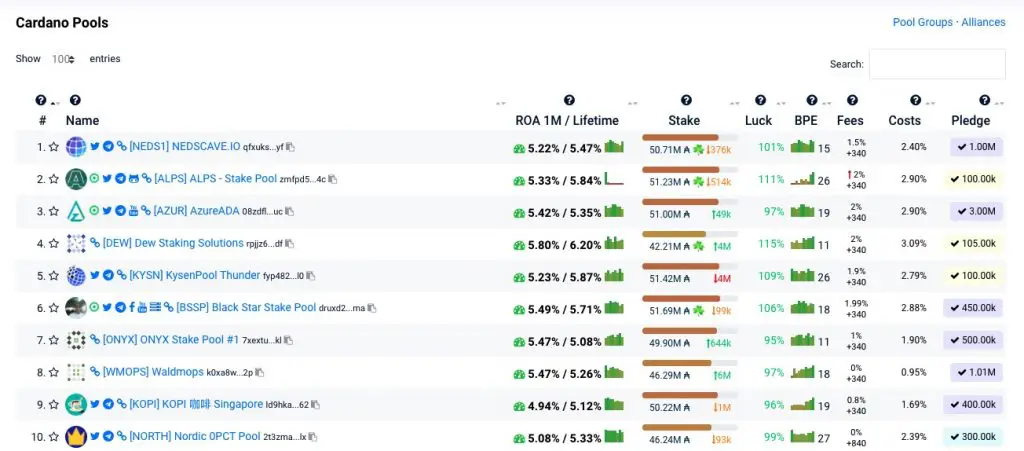

Current top 10 Cardano stake pools

Current top 10 Cardano stake pools

For this article, we'll be using ADAPools to sort and filter pools by metrics to understand what they are and choose a Cardano stake pool. Sorting by ranking and name are obvious so we won't dive into those.

ROA 1M / Lifetime

This is the current return on ADA that the pool is producing over one month compared to the lifetime of the pool. On average, you will see pools producing a return between 4.5%-5.5% on your ADA. This value fluctuates on smaller pools that don't produce as many blocks as the bigger pools do.

Stake & Saturation

The stake value indicates how much ADA has been delegated to that pool. Pools currently have a saturation limit of 61m ADA. Pools that have a higher stake total than the networks saturation limit have a negative effect on their rewards for the pool. This encourages users to delegate to smaller pools.

Variable Fees & Fixed Costs

Fees and costs are collected by the stake pool operators for managing and maintaining a pool. The current minimum fixed cost is 340 ADA. Some pool may charge more and it is important to note.

Pools can also charge an additional variable percentage fee which is taken out of the total rewards that delegates receive.

The variable fee is not charged to the delegate. The variable fee is taken from the rewards that are distributed to the pool. For example, if the pool is rewarded 1000 ADA as a reward to its delegates, a pool with a variable fee of 2% will claim 20 ADA for the pool.

The variable fee can range between 0-100% but the common values that are seen are between 0%-5%. Fees can be used to pay to operate, market and manage a pool, increase the pledge of a pool or even fund charities and other causes and missions that the pool operator may be aligned with.

Pools that have 100% variable fees are usually private pools and should not be delegated to, as you will not receive any rewards for your delegation.

Luck

Luck is simply a measure of how many blocks that have been produce vs the amount that pool is expected to produce. For example, if the pool is predicted to produce 6 blocks, but during the epoch it produces 10, then it is considered lucky and would show a high luck measure. This doesn't really affect your return on ADA.

BPE (Block per Epoch)

This measurement metric shows how many blocks have been produced by the pool in the current epoch (5 days).

Pledge

The stake pools pledge is the value that the stake pool operator themselves have allocated to the pool as their own personal investment to the pool. Usually the higher this is the better as it effects reward calculations.

Currently, we have a 1,024,000 ADA pledge allocated to our pool.

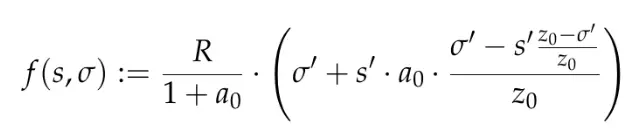

To find out more about the calculation of reward, please refer to the explanation of the reward calculation from the Cardano project.

Cardano's formula to calculate rewards

Cardano's formula to calculate rewards

Delegation Costs

There is a small cost for delegating to a pool. Similar to transfer fees when moving ADA from wallet to wallet, there is a similar cost to delegate to a pool. Keep this in mind if you're delegating and re-delegating ever epoch.

Interview Your Stake Pool Operator and Build Trust

Building up trust and a relationship with your stake pool operator may be the most important factor when it comes to choosing a pool. Knowing that they can run a pool and manage it will ensure that blocks are produced, and you actually get your return on your ADA.

Since the beginning of 2021, when I started learning about operating a stake pool, I've connected and learnt from many other skilled people in the community. It takes a level of expertise to run and manage web servers, understand bash commands in Linux/Unix, keep it all running, and then install and manage all of the code required to run the Cardano stake pool itself.

As a day job, I create web solutions for our clients with our team at PB Web Development. We design and build websites and manage the cloud infrastructure that delivers them to our clients. We manage websites that see major spikes in traffic that create huge strains on servers.

To manage this and keep the websites up, we build out our own servers on AWS and scale them in various launch configurations to ensure high availability. We have seen court case releases that pulled in over 10,000 unique visitors a minute and ticket sales through e-commerce sites that sell out within 30 minutes. These skills in managing, securing and scaling these web solutions translate directly into managing a Cardano stake pool.

Please ensure you get to know your operator when you choose a Cardano stake pool.

Do you want to get to know us? Join our Discord server and have a chat to the community we have created around our pool or join us on our Facebook Group.

Support Small Pools

When you choose a Cardano stake pool to delegate to, consider small pools as they are likely to be independent and need a helping hand to get boosted to start minting blocks for the pool.

Delegating to the small pools ensures that the network remains decentralised and ADA delegation isn't all being sent to the biggest pools. This is why the saturation factor is so important.

Over time the saturation limits will be reduced to help the spread of ADA to the smaller pools. In the meantime, you can find a smaller pool, such as ourselves (ADAOZ), and delegate to help get the pool up and running.

Pool Hopping

This is a delegation strategy where delegates hop from pool to pool to try and ride the fluctuating returns from different stake pools. Since the returns from small stake pools fluctuate every epoch from month to month, a pool that is currently returning low returns will eventually get a higher rate later on.

Pool hoppers try and gather the data and hope from pool to pool to catch those spikes and troughs on pool luck.

In the long term, a pools luck will always try to target a 100% luck rate and thus a standard ROA of 5%. If you're in it for the long term and prefer a set and forget strategy, a active pool will give you that return of 5% ROA per year.

Hopping has its own element of luck for the delegate as it is completely unpredictable to know if one poole will return more than another at any point in time.

Pool hoping is fun, but you might be worse off. Don't forget the fees that you have to pay each time you redelegate you wallet too.