Cronos (ticker symbol CRO) is the native coin of Crypto.com exchange, called Crypto.com coin until it rebranded to Cronos in Feb 2022. Like Binance has a native token Binance Coin (BNB), CRO plays a role in trading fees, staking, borrowing and lending, earning interest on crypto, and more, with tiers of benefits.

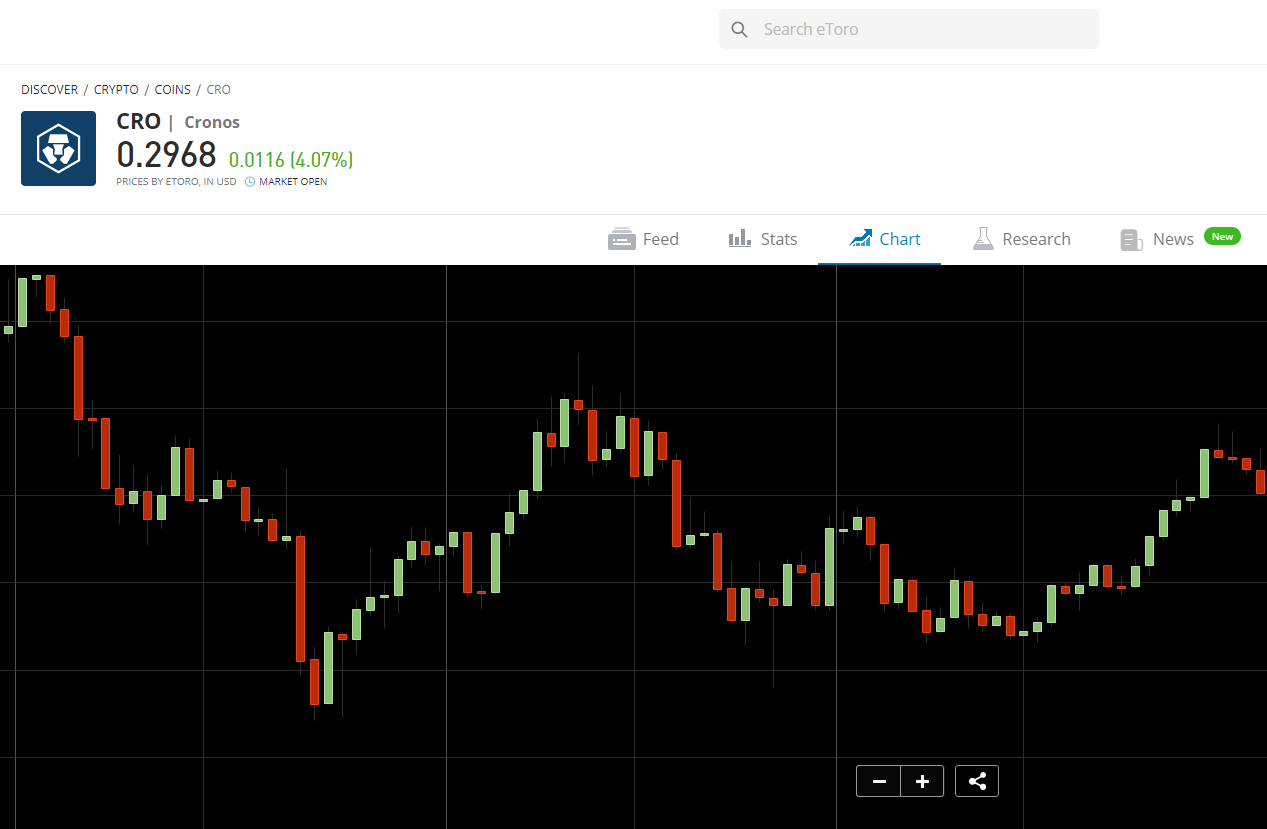

Some also buy CRO as an investment – CRO had a bull run in 2021 from a low that year of $0.057 to the current CRO all time high of $0.93 – a 16x gain in ten months. It then retraced 70% of that move to $0.26 since Bitcoin corrected and Crypto.com adjusted the rewards program for its debit card in May 2022.

Many investors are looking to buy the dip, as Crypto.com appear to be backtracking on some of the changes. In this guide we’ll review where to buy CRO coins, and how to buy Cronos step by step.

How to Buy Cronos – Quick Guide

Cronos is of course listed to buy on Crypto.com. It’s also now listed on FCA regulated platform eToro as well which some may prefer as it has copytrading features. In terms of how to buy Cronos on eToro:

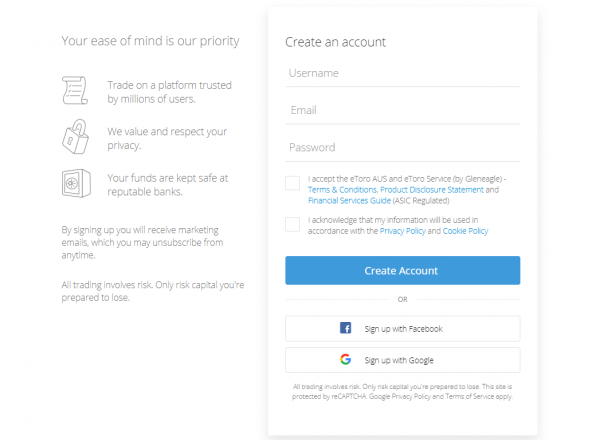

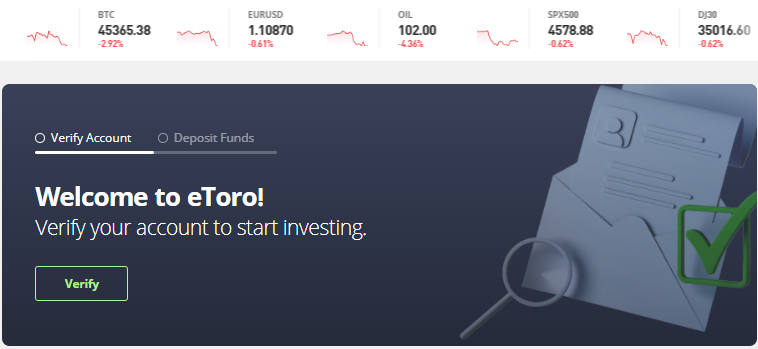

- ✅ Step 1: Open an account – Visit the official eToro website and fill out the registration form. You’ll then receive a prompt to upload KYC documents.

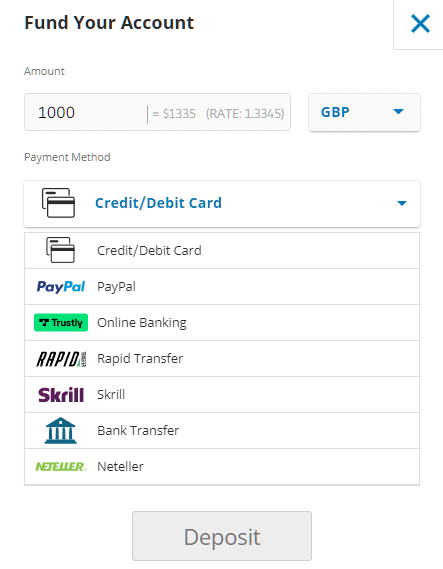

- 💳 Step 2: Deposit – eToro requires a minimum deposit of $10 in the US and UK to buy CRO. PayPal, bank wire, Neteller, Skrill, debit/credit cards and more are accepted.

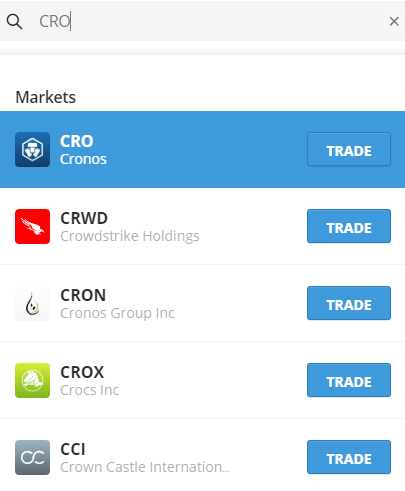

- 🔎 Step 3: Search for CRO: Enter “CRO” in the search bar. Click on the trade button to go to the CRO investment page.

- 🛒 Step 4: Buy CRO: Input the amount you want to invest in CRO. Click on the “Open Trade” button. eToro will send your CRO tokens to your wallet balance.

Where to Buy Cronos – Best Platforms Reviewed

Many crypto exchanges have now listed CRO because of its popularity owing to Crypto.com’s branding efforts – they sponsored the Formula One and hired Matt Damon for commercials. Here are the four best platforms to buy CRO coin safely:

1. eToro: Best Place to Buy CRO in 2022

eToro listed CRO on April 20th, 2022. This crypto platform was launched in 2007 operating a decade longer than Crypto.com and being one of the best regulated platforms in the industry.

eToro listed CRO on April 20th, 2022. This crypto platform was launched in 2007 operating a decade longer than Crypto.com and being one of the best regulated platforms in the industry.

Since its launch, eToro has gained 28 million users and now lists 60+ cryptocurrencies, with CRO being one of the latest additions, along with Ethereum Name Service (ENS). Alongside investing in cryptocurrencies such as BTC, ETH, and metaverse coins, eToro also offers stocks, forex and commodities.

The fee structure of eToro is different from other crypto exchanges. Instead of following the standard commissions model, it charges on a spread-only basis (+1%). There are no deposit charges on eToro if the funds are in US dollars.

eToro is beginner-friendly and provides a simple UI for users. Noteworthy features of this platform include eToro Academy, a collection of easily understandable blogs for those who want to know about the blockchain ecosystem and learn to trade.

As a social trading platform, eToro offers both Copy Trader and Copy Portfolio features (Smart Portfolios). You can use copytrading to copy the investment strategies of profitable investors you choose to follow, or trade by yourself. You can also network with other traders to hear their Cronos price predictions.

eToro has industry-leading security measures in line with regulation from the FCA, CySEC and ASIC. Investor funds are secured in tier 1 banks, and personal information is SSL encrypted. eToro is also very selective about which crypto assets to list.

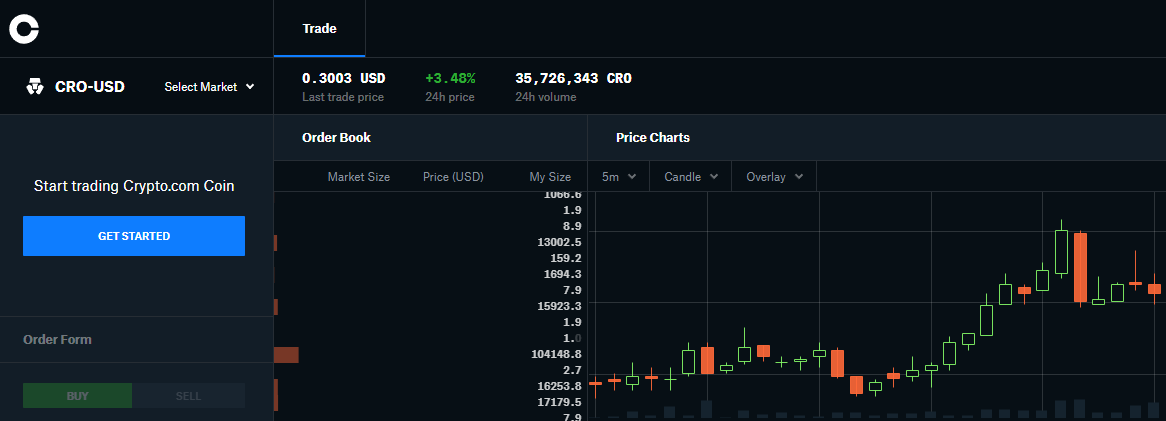

2. Crypto.com: Buy CRO on Leverage

Since its launch, Crypto.com has accumulated 10 million cryptocurrency investors. It is active in over 90 countries and handles a trading volume of over $2.6 billion daily. It has over 250 cryptocurrencies listed, including the majors and low cap DeFi coins. Crypto.com launched CRO in 2018, at first called Crypto.com coin.

Since its launch, Crypto.com has accumulated 10 million cryptocurrency investors. It is active in over 90 countries and handles a trading volume of over $2.6 billion daily. It has over 250 cryptocurrencies listed, including the majors and low cap DeFi coins. Crypto.com launched CRO in 2018, at first called Crypto.com coin.

The maker/taker fee of the platform is 0.4% per trade. Using fiat methods to invest in CRO, such as debit cards, has a 2.99% transaction fee. New users get a 30-day trial period though and don’t need to pay transaction fees during that time.

Beginners can use the simple spot trading feature (there are CRO/USDT, CRO/USDC, and CRO/BTC pairs) and for experienced traders, margin trading using leverage is available on perpetual trading pairs.

CRO holders can use its dedicated DeFi wallet to store their crypto assets and DeFi tokens. It’s a secure wallet with user-controlled private keys and biometric authentication methods. Crypto.com has partnered with Ledger and holds all crypto assets in cold storage.

The Crypto.com debit card is a prepaid metal visa debit card that allows you to pay retailers via crypto. Using this card paid rewards of up to 8% cashback, although that rewards rate being lowered later caused the CRO dump in price of May 2022.

Crypto.com allows users to earn interest on 40+ cryptocurrencies and stablecoins with its Crypto Earn program. Crypto holders can earn up to 14.5% per annum, and the stablecoin APY is up to 10%.

Crypto.com also has its own NFT marketplace, and is a yield farming platform – so there are many other options to make money with crypto besides just trading.

3. Huobi: Buy CRO with USDT

Huobi Global is a Crypto exchange founded in 2013 in China. It soon became the country’s leading trading platform. Then changes in China’s regulation regarding cryptocurrencies made Huobi relocate to Singapore to expand into the Asian market. It listed CRO token on July 12th, 2019.

country’s leading trading platform. Then changes in China’s regulation regarding cryptocurrencies made Huobi relocate to Singapore to expand into the Asian market. It listed CRO token on July 12th, 2019.

The main crypto trading platform is not directly available to US users however Americans can use HBUS, Huobi’s strategic trading partner.

Other than CRO, Huobi has listed 400+ cryptocurrencies. They include popular crypto assets such as Dogecoin, Ripple (XRP), and Polkadot. It adds new assets regularly.

Considered one of the most liquid trading platforms worldwide, Huobi offers deep liquidity for ETH/USDT and BTC/USDT pairs. Huobi has a vast crypto ecosystem, including the Huobi Eco chain and the Huobi token HT.

Huobi follows a maker/taker fee model. Discounts are available for high-volume traders that have HT tokens.

Huobi implements standard security features, including cold storage, two-factor authentication, and identity verification. It has also implemented security measures to fend off DDOS attacks. Huobi holds Bitcoin reserves to compensate clients who have lost their funds due to any hacking incident.

4. Coinbase: User Friendly Crypto Exchange

Coinbase listed CRO on November 4 2021. Launched three years after the arrival of Bitcoin , Coinbase has become the most well known crypto trading platform in the USA.

, Coinbase has become the most well known crypto trading platform in the USA.

Despite being one of the most expensive platforms to invest in crypto, it has gained over 89 million users. Currently, the platform has over $278 billion in crypto assets.

The deposit fee on Coinbase is high if you use fiat methods such as debit or credit cards (3.99%). But you can reduce the price by nearly half – 1.49% – by choosing ACH transfers.

Coinbase has listed 100+ cryptocurrencies that users can invest in if they have at least $2 in their Coinbase account. These crypto-assets include popular tokens such as Cardano, Solana, Polkadot, and Uniswap, to name a few. Coinbase also supports meme coins such as Shiba Inu.

Beginners in the cryptocurrency ecosystem will find it easy to use Coinbase. The UI is user-friendly, and the site also has a short tutorial video that beginners can watch before starting their investment journey.

Users can use Coinbase Pro to reduce the high transaction fees. It is a premium service by Coinbase that reduces the fees and provides advanced tools to analyze the current crypto market.

The maker / taker fee on Coinbase pro starts at 0.4% / 0.6%. Institutional users looking for deeper analytical tools and information can choose Coinbase Prime.

Investors looking for earning opportunities can become part of the Coinbase Earn Program. Participants can get free crypto, including GRT, XLR and AMP. It is an educational program that allows users to earn crypto while learning about the workings of specific cryptocurrencies.

What is CRO?

CRO is the native governance token of Crypto.com exchange. Crypto.com provides a suite of crypto-related products and services ranging from trading, payments, DeFi, staking, yield farming, wallets, and even a metal crypto visa debit card.

Each of these components involves CRO. The CRO token has the following uses:

- To buy the Crypto.com debit card;

- Acts as an intermediary currency to conduct transactions with merchants;

- Stake for additional yield;

- Trading discounts on the Crypto.com exchange;

- As a governance token for the Crypto.org chain and Cronos sidechain.

Cronos (CRO) started as an ERC 20 token called Crypto.com in November 2018. It had an initial supply of 100 billion tokens, all of which were initially under the possession of Crypto.com. When these tokens were first introduced, there was no presale, no public sale was available, and no ICO happened.

In February 2021, Crypto.com announced that it would be burning 70% of the initial supply of CRO – 70 billion CRO tokens. It was the largest amount of cryptocurrency burnt to date. It was done to prepare for the launch of the Crypto.org chain mainnet.

Crypto.org Chain

The Crypto.org chain was built using the cosmos SDK. It uses the tendermint Proof-of-Stake consensus algorithm. The algorithm is known to be scalable and secure but is somewhat centralized. Here are some of the features of the Crypto.org chain:

- Security: When it comes to safety, the crypto.org chain has had 100% uptime since its launch. It features code that is fully open source.

- Scalability: Not much information is available about the scalability of the Crypto.org chain. But, since it uses the tendermint Proof-of-Stake consensus algorithm, we can state that similar to other tendermint blockchains, it can process a few thousand transactions per second.

- Centralization: There are 100 validators of the Crypto.org Chain. All of the members of the Crypto.com community and staking partners.

Another security measure that the Crypto.org sidechain implements is the punishment mechanism. It removes the misbehaving validators and jails inactive validators. Inactive validators can only re-join the blockchain after completing the jailing period.

It also has a robust governance process. Taking a proposal requires a minimum deposit of 20,000 CRO tokens. To validate the proposal, at least 33.4% of the network’s voting power is needed, and for the proposal to pass, 50% of those votes must be “Yes.” Failure to meet these conditions leads to the burning of the proposal.

So far, five proposals have been submitted, out of which two have been accepted. One of them is the integration of Crypto.com’s NFT marketplace.

Cronos Sidechain

The Cronos Sidechain is the second component of Crypto.com’s native blockchain. Like the Crypto.org chain, the Cronos sidechain is built using Cosmos SDK and follows the tendermint Proof-of-Stake consensus mechanism. But unlike the Crypto.org chain, the Cronos side chain is smart contract compatible because of Ethermint – a cosmos-compatible Ethereum virtual machine.

It allows Ethereum developers to deploy Decentralized Apps – DApps – on Cronos blockchain. Accessing these Dapps is possible using Ethereum browser extensions like Metamask.

In this respect, Cronos Sidechain is similar to the Binance Smart chain, and Crypto.org Chain has similarities with the Binance Chain.

When it comes to security, Cronos sidechain mirrors the Crypto.org chain, also having a 100% uptime since its launch and featuring a fully open-source code that is yet to receive an audit. In terms of scalability, because of the involvement of Ethermint the Cronos sidechain is capable of processing 200 TPS.

CRO Tokenomics

Among the 70 billion CRO coins initially burned, only 60 billion were burnt right away. Crypto.com locked the remaining 10 billion in a smart contract – announcing to burn it monthly as the contract gets unlocked.

During the burning of those 70 billion tokens, the circulating supply of CRO coins was 24 billion, leaving 6 billion CRO tokens to be used by the platform. Crypto.com has set aside 5 billion CRO to reward chain validators and delegators. The remaining 1 billion CRO tokens were given to Particle B, a startup accelerator that incubates projects built on blockchains.

Is CRO a Good Investment?

Here are the points to consider before you decide to invest in CRO:

High APY for Staking CRO

Users can earn a high APY for staking CRO at the Crypto.com exchange. The yield ranges from 10 to 14%. To earn the highest yield you need to stake $40,000+ of CRO, and use three-month lockup terms.

Access to Syndicate Events

Staking CRO on Crypto.com will give you access to syndicate events. They are weekly events during which CRO holders get discounts on cryptocurrencies. These discounts can go up to 50%.

Tiered Discounts

Holding a certain number of CRO tokens will give you access to many perks. These include higher interest rates for staking and higher discounts on the Crypto.com trading platform.

Little Utility Outside the Crypto.com Ecosystem

Unfortunately, the utility of CRO tokens doesn’t extend beyond the Crypto.com trading platform.

Token or Security

The SEC is yet to fully accept CRO as a cryptocurrency. Since this token powers the entirety of Crypto.com’s ecosystem, the US regulator holds firm that the CRO tokens are securities.

What is CRO?

CRO is the native governance token of Crypto.com exchange. Crypto.com provides a suite of crypto-related products and services ranging from trading, payments, DeFi, staking, yield farming, wallets, and even a metal crypto visa debit card.

Each of these components involves CRO. The CRO token has the following uses:

- To buy the Crypto.com debit card;

- Acts as an intermediary currency to conduct transactions with merchants;

- Stake for additional yield;

- Trading discounts on the Crypto.com exchange;

- As a governance token for the Crypto.org chain and Cronos sidechain.

Cronos (CRO) started as an ERC 20 token called Crypto.com in November 2018. It had an initial supply of 100 billion tokens, all of which were initially under the possession of Crypto.com. When these tokens were first introduced, there was no presale, no public sale was available, and no ICO happened.

In February 2021, Crypto.com announced that it would be burning 70% of the initial supply of CRO – 70 billion CRO tokens. It was the largest amount of cryptocurrency burnt to date. It was done to prepare for the launch of the Crypto.org chain mainnet.

Crypto.org Chain

The Crypto.org chain was built using the cosmos SDK. It uses the tendermint Proof-of-Stake consensus algorithm. The algorithm is known to be scalable and secure but is somewhat centralized. Here are some of the features of the Crypto.org chain:

- Security: When it comes to safety, the crypto.org chain has had 100% uptime since its launch. It features code that is fully open source.

- Scalability: Not much information is available about the scalability of the Crypto.org chain. But, since it uses the tendermint Proof-of-Stake consensus algorithm, we can state that similar to other tendermint blockchains, it can process a few thousand transactions per second.

- Centralization: There are 100 validators of the Crypto.org Chain. All of the members of the Crypto.com community and staking partners.

Another security measure that the Crypto.org sidechain implements is the punishment mechanism. It removes the misbehaving validators and jails inactive validators. Inactive validators can only re-join the blockchain after completing the jailing period.

It also has a robust governance process. Taking a proposal requires a minimum deposit of 20,000 CRO tokens. To validate the proposal, at least 33.4% of the network’s voting power is needed, and for the proposal to pass, 50% of those votes must be “Yes.” Failure to meet these conditions leads to the burning of the proposal.

So far, five proposals have been submitted, out of which two have been accepted. One of them is the integration of Crypto.com’s NFT marketplace.

Cronos Sidechain

The Cronos Sidechain is the second component of Crypto.com’s native blockchain. Like the Crypto.org chain, the Cronos sidechain is built using Cosmos SDK and follows the tendermint Proof-of-Stake consensus mechanism. But unlike the Crypto.org chain, the Cronos side chain is smart contract compatible because of Ethermint – a cosmos-compatible Ethereum virtual machine.

It allows Ethereum developers to deploy Decentralized Apps – DApps – on Cronos blockchain. Accessing these Dapps is possible using Ethereum browser extensions like Metamask.

In this respect, Cronos Sidechain is similar to the Binance Smart chain, and Crypto.org Chain has similarities with the Binance Chain.

When it comes to security, Cronos sidechain mirrors the Crypto.org chain, also having a 100% uptime since its launch and featuring a fully open-source code that is yet to receive an audit. In terms of scalability, because of the involvement of Ethermint the Cronos sidechain is capable of processing 200 TPS.

CRO Tokenomics

Among the 70 billion CRO coins initially burned, only 60 billion were burnt right away. Crypto.com locked the remaining 10 billion in a smart contract – announcing to burn it monthly as the contract gets unlocked.

During the burning of those 70 billion tokens, the circulating supply of CRO coins was 24 billion, leaving 6 billion CRO tokens to be used by the platform. Crypto.com has set aside 5 billion CRO to reward chain validators and delegators. The remaining 1 billion CRO tokens were given to Particle B, a startup accelerator that incubates projects built on blockchains.

Is CRO a Good Investment?

Here are the points to consider before you decide to invest in CRO:

High APY for Staking CRO

Users can earn a high APY for staking CRO at the Crypto.com exchange. The yield ranges from 10 to 14%. To earn the highest yield you need to stake $40,000+ of CRO, and use three-month lockup terms.

Access to Syndicate Events

Staking CRO on Crypto.com will give you access to syndicate events. They are weekly events during which CRO holders get discounts on cryptocurrencies. These discounts can go up to 50%.

Tiered Discounts

Holding a certain number of CRO tokens will give you access to many perks. These include higher interest rates for staking and higher discounts on the Crypto.com trading platform.

Little Utility Outside the Crypto.com Ecosystem

Unfortunately, the utility of CRO tokens doesn’t extend beyond the Crypto.com trading platform.

Token or Security

The SEC is yet to fully accept CRO as a cryptocurrency. Since this token powers the entirety of Crypto.com’s ecosystem, the US regulator holds firm that the CRO tokens are securities.

CRO Price

The CRO price opened in January 2022 at $0.58. After dropping to $0.4 on January 10th, it traded between 0.4 to 0.5 until mid-March. It then started a bearish downtrend. It is a sharp contrast from last year when the CRO price had an explosive bull cycle.

CRO has three had three bull runs since launch. The first one started on February 8th, 2019. It lasted for 36 days, during which CRO price saw a massive increase by 749.2%, which increased the price of the token from $0.012 to $0.10.

The second bull run started March 2020, lasting for six months. During that time, the price of CRO tokens rose by over 500%.

CRO price chart via CoinMarketCap

The most recent bull cycle happened from May to November 2021. During that time, the price saw an over 800% increase.

In July 2021 Crypto.com secured a sponsorship deal with UFC worth $175 million. The very next day, the exchange announced becoming the first cryptocurrency platform to receive EMI – Electronic Money Institution – License from MFSA.

The price of CRO reached an all-time high in the final days of November 2021, when the price reached just under $1. That represented a 1600% increase in price over just under a year.

Other factors that contributed to CRO’s bull runs are as follows:

- The launch of Cronos sidechain testnet and integration of chainlink and band protocol Oracle at the end of July 2021;

- The announcement that users could withdraw USD to their bank using USDC stablecoin;

- Expansion of the Insurance program to cover losses up to $750 million;

- Launch of the global brand campaign starring Matt Damon;

- The announcement that users can transfer their CRO into their Coinbase Pro account ahead of CRO trading launching there.

The current market trends, however, look bearish.

Already trending down since entering 2022 (partly a result of Bitcoin correcting from $69,000), CRO dropped further after the announcement by Crypto.com that it would be eliminating rewards for its lowest tier debit cards. The trading platform has also cut down the returns of native investors.

Today, the CRO price has been trending between $0.26 to $0.3 with a daily trading volume of $100 million. The live market cap of the CRO token is just over $7 billion.

CRO Price Predictions

Crypto.com may be cancelling some of the ways they planned to cut rewards for the debit card users. That could lead to a recovery of the CRO price, at least back to retest the psychological $0.50 area.

The CEO of Crypto.com posted on Twitter 8% rewards will be reinstated for some members:

Also a 70% retrace is not uncommon for altcoin projects, and can be recovered from. For example Binance Coin (BNB), which plays a similar role to CRO, corrected from around $690 to $210.

Binance is also yet to list CRO – if it does, that could lead to another pump in price. CRO could be a good investment at this low price point.

Best Ways to Buy CRO

Below are some of the different ways to buy CRO:

Buy CRO using Debit/Credit Card

If you want to buy CRO using fiat methods – debit/credit card – we suggest using eToro. It provides the most cost-effective way to invest in cryptocurrencies when using debit or credit cards.

Buy CRO using PayPal

If you don’t want to enter the bank details on the crypto trading platform, you can choose to pay using PayPal. eToro, Crypto.com and Coinbase support PayPal payments. Huobi supported PayPal at one point but has suspended it as of January 30th, 2022.

Buy CRO without ID

All crypto exchanges listed in this guide require KYC verification to buy cryptocurrency. Since the crypto ecosystem is taking a more regulatory route, ID verification has been required on most crypto trading platforms.

You can trade a CROUSDT perpetual futures pair on Bybit, which doesn’t require KYC.

Best CRO Wallet

There are many CRO wallets available, most notably the Crypto.com wallet. Aside from that, the best choice is the eToro crypto wallet.

It supports 120+ cryptocurrencies. Security features it has include unlosable private keys and free recovery service.

How to Buy CRO Coin – Complete Tutorial

Here is a comprehensive guide to investing in CRO:

Step 1: Open an Account

The first step is to create an account on eToro. You’ll see a registration form. Fill it out with your email, username and password.

Step 2: Upload ID

After entering the user details, eToro prompts you to upload KYC documents. You can also explore the platform first before doing.

Step 3: Deposit

Deposit a minimum of $10 by clicking “Deposit funds” on the left panel of your home page, enter the amount, choose the payment method and click on deposit.

Step 4: Search for CRO

Enter “CRO” in the search bar. Click on the “Trade” button, and you’ll be directed to the CRO trading page.

Step 5: Buy CRO

Enter the amount you want to invest in Cronos. Then confirm your buy order by clicking “Open Trade”.

How to Sell CRO

The process is the same to sell CRO on eToro as it is to buy CRO. Click on the “Trade” button again when you’re ready to take profit.

Selling CRO might be categorized as a taxable event depending on the country in which you reside.

Conclusion

Crypto.com’s native token CRO had a good run in 2021 but so far in 2022, the CRO price has been in a downtrend. This could be a ‘buy the dip’ opportunity as the CEO has addressed investor concerns well and adjusted some the Crypto.com rewards rate changes.

The CRO dump also stopped at the 2021 yearly high, so may simply be a retest of that support level, before continuation to the upside and a new all time high. CRO has still been in a bullish uptrend since 2019.

In terms of where to buy CRO on a safe regulated platform, eToro listed CRO and offers the option to copy trades the buys and sells of pro investors, rather than monitoring the 24/7 crypto markets yourself. That’s a beginner-friendly way to gain exposure to CRO with low risk.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney