Blockchain, DApps, and smart contracts; are all, to varying extents, futuristic technologies with various applications. But what happens when these technologies need real-world data to work? This is when projects like Band Protocol, which supplements off-chain datasets to blockchain apps, come to the fore. This Band Protocol price prediction piece will consider the popularity of this decentralized project. How far can its native token, BAND, go in terms of its short-term and long-term price action? Let’s take a look, starting with fundamental analysis.

#BonusHunter 💹 We pick the best deals on the market for you: enjoy your bonuses. Maximize your ROI

🔥Bybit – buy BAND, participate in Bybit 4th anniversary: receive a guaranteed bonus of $5 in BIT and get a chance to win BMW X5 or one of iPhone 14 Pro| Sign up and claim your reward here

In this price prediction:

- Band Protocol price prediction and the role of fundamental analysis

- Band Protocol tokenomics and the possible impact on prices

- Band Protocol and the market-related insights

- On-chain metrics and the impact on the price of Band Protocol

- Band Protocol price prediction using technical analysis

- Band Protocol (BAND) price prediction 2023

- Band Protocol (BAND) price prediction 2025

- Band Protocol (BAND) price prediction 2030

- Band Protocol (BAND’s) long-term price prediction (up to 2035)

- Is the Band Protocol price prediction accurate?

- Frequently asked questions

Band Protocol price prediction and the role of fundamental analysis

Band Protocol is a cross-chain oracle platform. With this project, blockchains can access real-world data with ease. The data movement is managed by APIs that connect to blockchain-specific smart contracts and external oracles.

With the world shifting towards web3, oracle platforms like the Band Protocol have the potential to become the holy grail for blockchain apps.

Here are a few fundamental points about the Band Protocol that will be of use if making an investment-specific call:

- It aims to scale blockchains by making data available with close-to-zero latency.

- It was originally built on the Ethereum blockchain but later migrated to its own chain (BandChain) on the Cosmos network.

- Weather, sports, and other real-world dependent DApps can be built easily with Band Protocol supplementing real-world data.

- Oracle nodes offer more than real-world data. They also help validate blocks using the delegated proof-of-stake consensus.

- BAND — the native cryptocurrency of this oracle network — works as collateral for the nodes. It is also a means of transaction and payment for users needing data.

- BAND tokens also support staking.

Band Protocol looks like an innovative oracle solution. Its future prices will depend on which project — Band Protocol or Chainlink — serves more data-specific requests.

Band Protocol tokenomics and the possible impact on prices

First, the native BAND is both an ERC-20 token and a mainnet token. It is meant for staking for validation, on-chain governance, and usage as transaction fees.

Also, the max supply cap for BAND is set at 100 million. We expect the circulating supply to equal the same by 2025. Plus, the Band Protocol raised funds for the project by offering 27.37% of its total supply as part of three sale rounds.

The supply breakdown looks like this:

Band Protocol supply breakdown: Messari

Band Protocol supply breakdown: Messari

The token model is inflationary, with the issuance rate ranging between 7% and 20%. However, half of all the transaction fees relevant to the mainnet are burned, which controls the demand-supply curve.

We might see a steeper surge in the prices of BAND once the entire supply becomes liquid in 2025.

Band Protocol and the market-related insights

Now we can shift our attention to the market cap and trading volume of BAND, both at its peak and at the current levels:

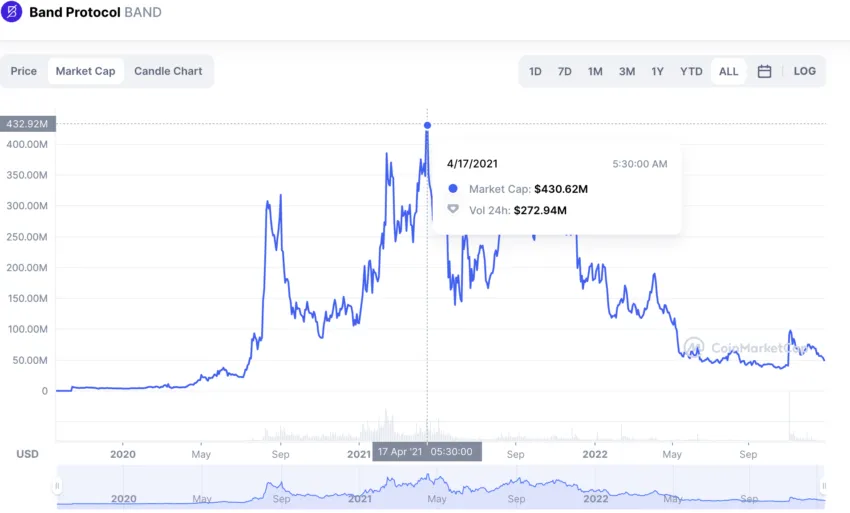

Band Protocol market cap: CoinMarketCap

Band Protocol market cap: CoinMarketCap

At its peak — on April 17, 2021 — BAND had a market cap of $430.62 million and a trading volume of $272.94 million. That translates into a turn-over ratio of 0.63.

At the current level, as of Dec. 28, 2022, the trading volume is $14.81 million, and the market cap is $48.25 million. The turnover ratio using these values comes to be 0.30. Hence, BAND is currently more volatile than at its peak levels. This is why it is necessary for any digital asset to have trading volumes.

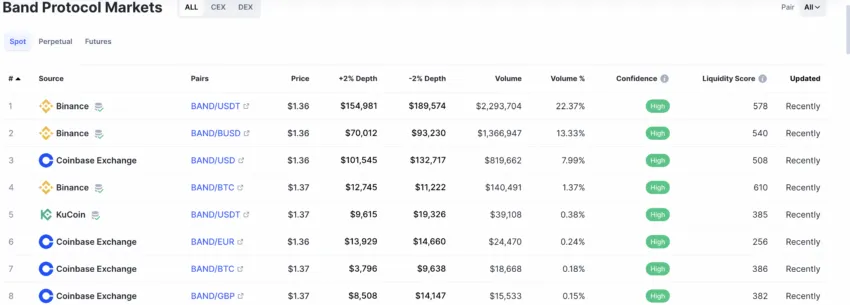

Coming to the trading volume, the spot market spread of BAND is pretty decent. Most popular exchanges have BAND listed. However, Binance’s BAND-USDT and the BAND-BUSD pairs dominate most of the trading volume and liquidity.

Band Protocol trading markets: CoinMarketCap

Band Protocol trading markets: CoinMarketCap

BAND is extremely tradable despite the drop in market cap and trading volume. Therefore, investor interest hasn’t dropped much in comparison.

On-chain metrics and the impact on the price of Band Protocol

If you look at the transaction volume of BAND, there is a noticeable peak in early November. This might mean an increase in demand for real-world data. And if the peaking transaction volumes persist, we might also see the price of BAND looking up.

Band Protocol price prediction using transaction volume: Santiment

Band Protocol price prediction using transaction volume: Santiment

Another positive movement occurred in November when the supply (held by top BAND addresses) dropped. A price rally followed. But following this, prices have returned to usual. In the future, if smaller addresses start holding BAND, we might see a trend shift, even in regard to prices.

Band Protocol supply held: Santiment

Band Protocol supply held: Santiment

Again, the daily active addresses peaked in early November, resulting in a price surge. However, in December 2022, daily address additions stayed low yet steady.

Band Protocol active addresses: Santiment

Band Protocol active addresses: Santiment

We know the metrics that might trigger a BAND rally. However, most of them are looking bearish at the moment.

Band Protocol price prediction using technical analysis

Before we begin the technical analysis, here is a daily chart that shows a BAND forming a “Head and Shoulders” pattern.

Band Protocol price prediction using pattern: TradingView

Band Protocol price prediction using pattern: TradingView

Do note that the price of BAND tokens dropped immediately after the pattern concluded. Since the downtrend, BAND has been trading in a range.

Also, here are some of the other insights about BAND that you might find useful:

- The maximum price of a BAND token was $23.19 on April 15, 2021.

- BAND’s all-time low surfaced on Nov. 25, 2019, at $0.2042.

- The short-term price analysis paints a weaker picture. BAND is currently trading inside a pennant pattern, waiting to break out in either direction.

- The RSI shows a bearish divergence, making lower lows, while the price chart shows higher lows.

- And the 200-day simple moving average line (Blue) just crossed above the 100-day moving average line (Green). This hints at a death crossover and some near-term correction.

Band Protocol price prediction short-term: TradingView

Band Protocol price prediction short-term: TradingView

Now let us look at the broader chart and analyze whether there is a clear pattern.

Pattern identification

Here is the weekly chart.

Band Protocol price prediction symmetrical patterns: TradingView

Band Protocol price prediction symmetrical patterns: TradingView

Notice that the two encircled zones look similar in terms of movement. This shows that BAND’s weekly chart might just be trading in a mirror-like pattern. Now we can divide the chart into Pattern 1 and Pattern 2.

Band Protocol price prediction using the Foldback pattern: TradingView

Band Protocol price prediction using the Foldback pattern: TradingView

If BAND’s price chart follows the concept of foldback, by the end of Pattern 2, Pattern 1 has a chance of being repeated.

Now let us find the distance and price change percentage between all the higher highs in pattern one and swing highs (lower highs) in Pattern 2.

Price change

Our task is to find the next A or A2, which will be at the start of the new pattern.

Let us now plot the distance from A to D and A1 to D, going through all the lows:

BAND price change between highs Pattern 1: TradingView

BAND price change between highs Pattern 1: TradingView

Pattern 1: (data set 1)

A to X = 175 days and -93.21% change; X to B = 154 days and 8407% change; B to Y = 70 days and -81.31% change; Y to C = 112 days and 513.13% change; C to Z = 14 days and -47.35% change; Z to D = 49 days and 115.21% change

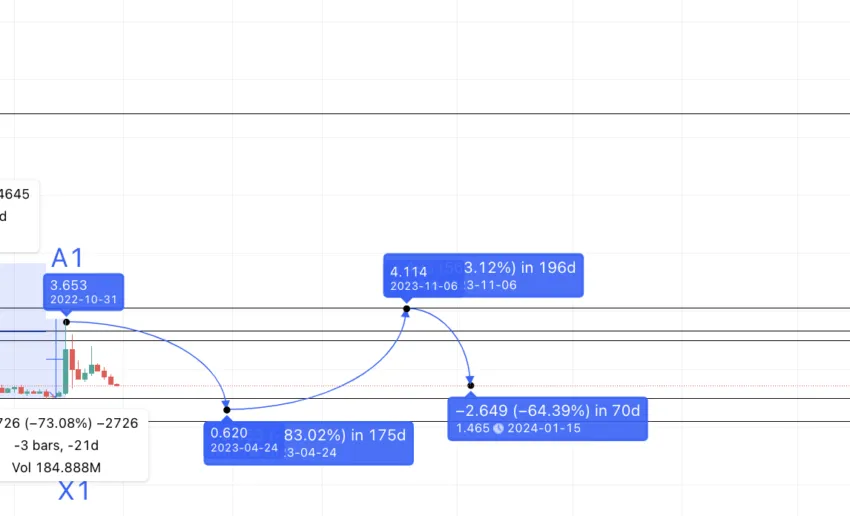

BAND price change between highs Pattern 2: TradingView

BAND price change between highs Pattern 2: TradingView

Pattern 2: (data set 2)

A1 to X1 = 21 days and -73.08% change; X1 to B1 = 196 days and 462.54% change; B1 to Y1 = 63 days and -46.89% change; Y1 to C1 = 84 days and 252.05% change; C1 to Z1 = 133 days and =61.06% change; Z1 to D1 = 70 days and 513.13% change

Now, if we take the average of the respective points across the patterns, we can first find the new low, X2, after A1. (assuming it’s a new pattern and A1 and A2 as the same points).

So, X2 comes at an average distance of 98 days (175 days max) from A1 and at a low of 83.4%. The forecast line puts that at $0.620. We can mark this point as X2.

Now, the next high could be at B1. While the max distance can be 196 days, using the information from data set 1 and data set 2, we cannot expect an 8407% or 462.54% gain in a bear market.

Therefore, we can project the price to the nearest resistance line or $4.10, which still puts B2 higher than A1 (A2).

Band Protocol (BAND) price prediction 2023

Outlook: Moderately bullish

The previous forecast puts the Band Protocol price prediction for 2023 high at $4.10. The low can surface anytime between 60 to 70 days, using the average of the B to Y and B1 to Y1 data. The average percentage drop, in that case, comes to 64.1%.

Band Protocol price prediction 2023: TradingView

Band Protocol price prediction 2023: TradingView

The forecast line from the high of 2023 puts the low at $1.465, but in 2024. Hence, the minimum price of BAND in 2023 stays at $0.620. This might surface soon as a near-term bearish trend looks imminent.

Band Protocol (BAND) price prediction 2025

Outlook: Bullish

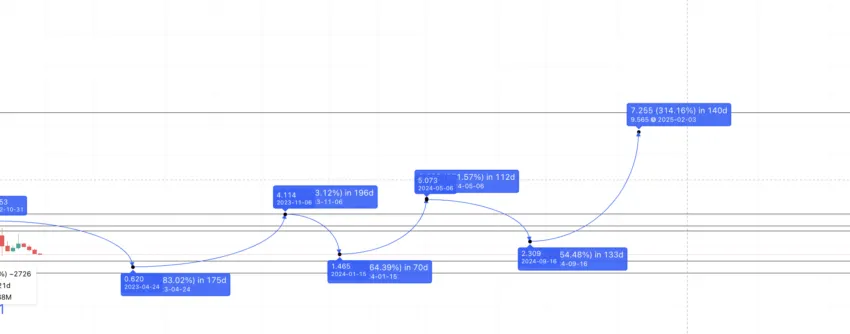

The low in 2024 might surface at $1.465. And if we follow the pattern, this point comes immediately after B2 and is termed Y2. Now, the next high, as per the old pattern, should be at C2.

Data from data set 1 and data set 2 places the Y to C movement in 112 days (max) and at a minimum of 252.05% peak. Plotting the same from 2024 low puts the same at $5.150. The next low uses the average of C to Z from the tables above.

Band Protocol price prediction 2025: TradingView

Band Protocol price prediction 2025: TradingView

This comes in a maximum timeframe of 133 days, with an average drop of 54.21%. The forecast line puts the same at $2.309. We can mark this as Z2. And finally, the next high or the peak of this cycle comes at D. Also, the previous Z to D data sets reveal a maximum timeline of 70 days, which might vary, and a minimum percentage gain of 115.21%. However, now that BAND looks to be in an uptrend, we can use the average percentage increase.

That comes to 314.17%. The forecast line puts the same at $9.56.

Do note that we have placed this point in 2025. After the bear market, a 300% move might take a little more than 70 days.

Band Protocol (BAND) price prediction 2030

Outlook: Bullish

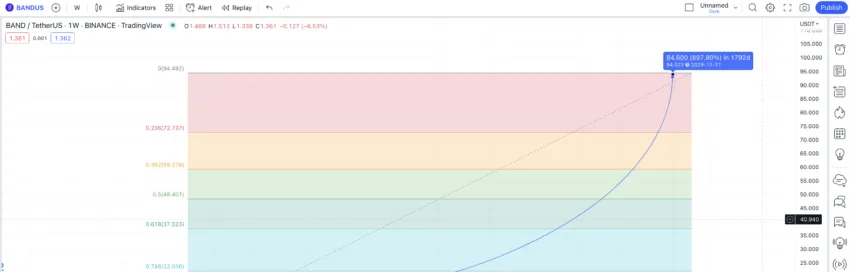

Now that we have the 2025 high, and the last low in 2024, we can connect the two and draw the Fib levels for better extrapolation.

BAND Protocol price prediction 2030: TradingView

BAND Protocol price prediction 2030: TradingView

The Fib extension points place the BAND price prediction for 2030 at $94.023. For these Fib levels to hold, BAND should cross the $37 mark by mid-2028. Also, the low in 2030 can be at $53.20, coinciding with the 61.8% of the Fib retracement when drawn from 2030 to 2025.

Band Protocol (BAND’s) long-term price prediction (up to 2035)

Outlook: Bullish

Now we have visibility on the Band Protocol price till 2030, here is a table that helps us trace the same till 2035:

| Year | Maximum price of BAND | Minimum price of BAND |

| 2023 | $4.10 | $0.620 |

| 2024 | $5.150 | $1.465 |

| 2025 | $9.56 | $3.06 |

| 2026 | $14.34 | $8.89 |

| 2027 | $21.51 | $13.33 |

| 2028 | $37.20 | $29.016 |

| 2029 | $63.24 | $39.20 |

| 2030 | $94.023 | $53.20 |

| 2031 | $141.03 | $87.43 |

| 2032 | $176.29 | $137.50 |

| 2033 | $220.26 | $171.80 |

| 2034 | $330.54 | $257.82 |

| 2035 | $429.71 | $335.17 |

Do note that the Band Protocol price prediction values might vary. This could depend on adoption, sentimental drivers, and the popularity of other real-world data providers like Chainlink. Therefore, the technical analysis might require updates, which we will bring to you as and when needed.

Is the Band Protocol price prediction accurate?

This Band Protocol price prediction uses detailed technical analysis into account but doesn’t rely on this. Instead, this price prediction model uses project fundamentals, on-chain data, and other factors like market cap, trading volume, and trading markets. Therefore, this Band Protocol price prediction piece is as detailed, accurate, and realistic as possible.