Insurance companies determine how much you pay for car insurance using a number of factors, with a vehicle’s make and model being among the most heavily weighed. Not surprisingly, more expensive cars usually have higher average premiums.

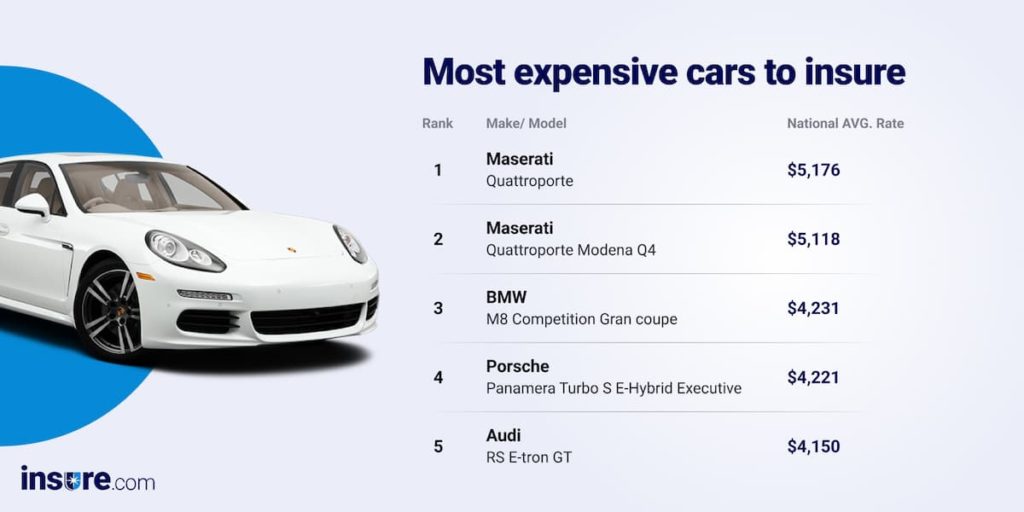

The most expensive automobiles to insure in 2023, according to Insure.com’s latest research, include the Maserati Quattroporte, Maserati Quattroporte Modena Q4 and the BMW M8 Competition Gran coupe. Meanwhile, the Subaru Forester 2.5I Wilderness, Hyundai Venue SE and Honda CR-V LX were the cheapest cars to insure.

Each year, Insure.com compares car insurance rates in every state for approximately 3,000 different vehicle models to find the cheapest and most expensive vehicles to insure.

We collected insurance quotes from seven major insurance carriers and averaged the premiums to give you an accurate picture of what you can expect to fork over for car insurance based on particular makes and models.

Read on to learn more about the cars with highest insurance rates, the most expensive SUV to insure, the cheapest vehicles to insure in 2023 and more.

Cheapest cars to insure

Let there be no doubt: SUVs and CUVs continue to be the categories that dominate our list of the least expensive vehicles to insure. As you can see from the rankings below, many of the cars that the editors assessed for this story fall into the SUV/CUV bin. The loss frequency of these models tends to be much lower due to the driver risk characteristics of the most frequent drivers and owners of these vehicles.

Subaru Forester 2.5I Wilderness

The all-new 2022 Subaru Forester Wilderness boasts all-terrain accessibility, increased ground clearance, standard symmetrical all-wheel drive, an amended drivetrain maximized for climbing, rugged exterior cladding, blacked-out exterior trim and matte black alloy wheels with all-terrain tires.

Because of this vehicle’s safety ratings and the lower price of parts associated with this model, this is overall less expensive to insure than virtually any other automobile. Expect to pay around $1,353 annually for full coverage on this car.

“The cost to insure a Forester for a full-coverage, low-risk driver is very reasonable,” says Lauren McKenzie, insurance broker/agent with A Plus Insurance in Sierra Vista, Arizona. “You are looking at about $150 a month or cheaper, depending on discounts that drivers may qualify for.”

Hyundai Venue SE

Available in three different trim levels, the Hyundai Venue SE offers 31 miles to the gallon fuel efficiency, a 121-hp 1.6L DPI 4-cylinder engine, forward collision-avoidance assist with pedestrian detection, lane keeping assist, driver attention warning and other bells and whistles.

You’ll likely pay around $1,360 for 12 months of full coverage on this vehicle.

“Hyundais have become popular vehicles due to their functionality and cheaper price points. You can get a brand-new Hyundai Venue for a good price and, in return, the insurance prices are inexpensive, as well,” McKenzie says.

Honda CR-V LX

The Honda CR-V LX is the top trim line for this popular model. The CR-V offers a 190-horsepower turbocharged four-cylinder engine and a continuously variable automatic transmission. You can expect around 28 mpg in the city and 34 mpg on the highway in front-wheel-drive versions (a little less in all-wheel-drive models). Included driver assistance features are forward collision warning, forward automatic emergency braking, road departure mitigation, adaptive cruise control, lane departure warning and lane-keep assist.

It costs approximately $1,366 (on average) to insure a Honda CR-V LX in 2023.

“Hondas, Mazdas and Toyotas all range about the same cost for full-coverage insurance based on similar price points and safety ratings for each vehicle,” McKenzie says. “The location in which you live will also determine how much you will pay for CR-V insurance.”

Mazda CX-30 S

The Mazda CX-30 S includes a 2.5-liter four-cylinder engine with an optional turbocharged 2.5-liter engine, standard all-wheel drive and a fuel economy of around 24 mpg in the city and 31 mpg on the highway (non-turbo models). Count on adaptive cruise control, lane-keep assist with lane-departure warning and automated emergency braking, too.

Insuring this vehicle in 2023 will set you back $1,379 a year, on average.

Toyota C-HR XLE

The Toyota C-HR XLE is the basic trim level for this subcompact crossover. You’ll likely get 27 mpg city and 31 mpg highway from the 2.0-liter four-cylinder engine that generates 144 horsepower and 139 pound-feet of torque. This vehicle has a predicted reliability score of 80 out of 100 from J.D. Power. Safety features built in include lane trace assist, lane keep assist, lane departure warning, forward collision warning, forward automatic emergency braking, pedestrian detection, rearview camera, adaptive cruise control and blind-spot monitoring.

At $1,384 annually to insure, the C-HR XLE is among the most affordable automobiles to insure this year.

The least expensive cars to insure in 2023

| Rank | Make | Model | National Average Rate |

|---|---|---|---|

| 1 | Subaru | Forester 2.5I Wilderness | $1,353 |

| 2 | Hyundai | Venue SE | $1,360 |

| 3 | Honda | CR-V LX | $1,366 |

| 4 | Mazda | CX-30 S | $1,379 |

| 5 | Toyota | C-HR XLE | $1,384 |

| 6 | Toyota | C-HR NightShade | $1,387 |

| 7 | Mazda | CX-30 S Premium | $1,388 |

| 8 | Honda | CR-V EX | $1,391 |

| 9 | Kia | Seltos LX | $1,391 |

| 10 | Honda | HR-V EX | $1,398 |

| 11 | Hyundai | Venue SEL | $1,402 |

| 12 | Ford | Transit Connect XL | $1,405 |

| 13 | Volkswagen | Tiguan S | $1,406 |

| 14 | Mazda | CX-5 S Select | $1,407 |

| 15 | Subaru | Outback 2.5I | $1,407 |

| 16 | Honda | HR-V Sport | $1,408 |

| 17 | Subaru | Forester 2.5I Sport | $1,412 |

| 18 | Toyota | C-HR Limited | $1,412 |

| 19 | Chrysler | Voyager LX | $1,413 |

| 20 | Jeep | Wrangler Willys Sport | $1,415 |

What makes a car more expensive to insure?

Mark Friedlander, director of corporate communications for the Insurance Information Institute in St. Johns, Florida, says the make and model of your new vehicle is a significant factor in determining the cost of your auto insurance policy.

“Insurers consider the cost of repairs for a new vehicle and its general safety record as well when pricing the risk,” he says. “Individual rating factors also play a key role in determining your premium. In general, a cheaper new vehicle means your insurance will cost less than if you purchase a more expensive car.”

A car can also get more expensive to insure based on the type of coverage you have, your driving history and your location. While not all companies use the same criteria, here is a rundown of a few common factors that make a car more expensive to insure:

- The make and model of the car: Car insurance companies prefer to cover vehicles that are deemed safe because they are less likely to result in costly claims. As a result, a car with good safety ratings may save you money. Whereas cars that are newer, more powerful, smaller and costly are more expensive to insure.

- Your age: Young drivers are less experienced and more likely to have an accident, resulting in higher car insurance premiums. After the age of 25, driver’s insurance rates begin to fall. Senior drivers are not only more likely to get into a car accident than younger people, but they’re also far more likely to suffer damage in an accident.

- Driving record: Your driving history impacts your car insurance costs. Drivers with recent accidents or infractions on their records pay greater auto insurance premiums than those with clean records. The difference in rates is because these drivers are statistically more likely to be involved in another accident.

- Credit-based insurance score: Car insurance companies frequently assess your credit history while setting your premiums. A credit-based insurance score shows how a consumer manages their money.

“Statistically, people with a poor insurance score are more likely to file a claim. This allows carriers to better match insurance premiums with the risk that an individual insured might pose, helping prevent better risks from subsidizing bad risks,” Friedlander says.

Also read: The best car insurance companies of 2023

QuickTake

The most expensive cars to insure

Prefer sportier and more upscale rides? You’re going to pay higher premiums for that comfort, speed and luxury. The most expensive vehicles to insure are also among the costliest to purchase, with many models coming from overseas and sporting big engines and snazzy finishes. What is more, most of these are high-performance automobiles with small distribution.

Three of the priciest cars to insure this year are the Maserati Quattroporte, Porsche Panamera Turbo S E-Hybrid Executive and Audi RS E-tron GT, for example. The difference in average full-coverage insurance premiums for the Maserati ($5,176 annually) versus our cheapest vehicle to insure – the Forester 2.5I Wilderness ($1,353) – is $3,823.

Maserati Quattroporte

Want to turn heads and elicit “oohs” and “aahs”? Buy a Maserati Quattroporte, which has a 3.0 L V6 engine or 3.8 L V8 that delivers 345 to 580 horsepower but only 16 mpg city and 25 mpg highway fuel efficiency. You’ll accelerate from 0 to 60 mph in only four seconds, but you’ll also pay a lot more for insurance: $5,176 a year on average.

“This vehicle could cost from $96,000 to $143,000, depending on customizations,” says McKenzie. “Since this vehicle has a high price tag, the cost to replace parts or replace the entire vehicle in the event of an accident would be a huge payout for this luxury car.”

Maserati Quattroporte Modena Q4

If you want a Maserati Quattroporte Modena Q4, you can pick from three trim levels: GT, Modena and Trofeo, offering 345, 424 and 572 horsepower, respectively. Each model includes all-wheel drive, adaptive cruise control, heated front and rear seats, ventilated front seats, heated steering wheel, surround-view camera, blind-spot detection, forward collision warning, autonomous emergency braking and much more.

A whopping $5,118 is the expected annual premium you’ll pay to drive this vehicle.

“The price tag on this vehicle can start at $126,000 and go up based on packages and customizations,” McKenzie says. “The cost to insure this car will be high because of the price of parts and the costs to replace it if you suffer a total loss.”

BMW M8 Competition Gran coupe

According to BMW, the Competition Gran Coupe’s 4.4-liter V-8 engine offers 617 horsepower and includes track-ready cooling systems, a twin scroll bi-turbo and a uniquely designed dual oil pan that maintains oil pressure during intense maneuvers. The standard Active M differential automatically reacts to driving conditions for more traction in real time. Also, the intelligent M xDrive lets you adapt power distribution with distinct 4WD, 4WD Sport and 2WD modes.

Set aside $4,231 to keep this sporty head-turner insured in 2023, on average.

“The base price starts at $144,000 for a 2023 model and can go up to $170,000-plus with customizations. Because the price of this automobile is so high and parts are so expensive, the average cost for insurance goes way up,” McKenzie says.

Porsche Panamera Turbo S E-Hybrid Executive

This turbo hatchback hybrid provides 48 mpg city and 19 mpg highway fuel efficiency, twin turbo gas/electric V-8 engine that runs on plug-in electric and gas, brake assist, electronic stability control, night vision, traction control, lane departure warning, lane keeping assist and a myriad of other safety and luxury features.

You’ll probably pay $4,221 to insure a Porsche Panamera Turbo S E-Hybrid Executive this year.

“Most insurance companies will not even insure a high-risk vehicle like a Porsche or Audi, so you may need to shop for luxury vehicle insurance to find proper coverage on this model,” McKenzie says.

Audi RS E-tron GT

You’ll get 637 horsepower and 612 pound-feet of torque in an Audi RS E-tron GT, getting you from 0 to 60 mpg in as little as 3.1 seconds. The range is around 232 miles on the battery only, which can recharge in as quick as 10 hours. The fuel efficiency is impressive: 79 mpg city and 82 mpg highway.

But insurance coverage is going to set you back about $4,150 annually for this make and model.

The costliest cars to insure in 2023

| Rank | Make | Model | National Average Rate |

|---|---|---|---|

| 1 | Maserati | Quattroporte | $5,176 |

| 2 | Maserati | Quattroporte Modena Q4 | $5,118 |

| 3 | BMW | M8 Competiton Gran coupe | $4,231 |

| 4 | Porsche | Panamera Turbo S E-Hybrid Executive | $4,221 |

| 5 | Audi | RS E-tron GT | $4,150 |

| 6 | Porsche | Panamera Turbo | $4,129 |

| 7 | Tesla | Model S Plaid | $4,115 |

| 8 | BMW | M8 Competition XDrive | $4,054 |

| 9 | Porsche | Taycan Turbo S | $4,028 |

| 10 | Audi | R8 5.2L V10 Quattro Performance | $3,967 |

| 11 | Audi | RS6 Avant Quattro | $3,922 |

| 12 | BMW | M760i xDrive | $3,911 |

| 13 | BMW | M850i XDrive Gran Coupe | $3,854 |

| 14 | Maserati | Ghibli Trofeo | $3,840 |

| 15 | Alfa-Romeo | Giulia Quadrifoglio | $3,695 |

| 16 | Acura | NSX Type S | $3,626 |

| 17 | Dodge | Charger SRT Hellcat Redeye | $3,533 |

| 18 | Dodge | Charger SRT Hellcat | $3,528 |

| 19 | Porsche | 911 Carrera Targa 4 GTS | $3,527 |

| 20 | Tesla | Model S Long Range | $3,503 |

Ways to save the most money on car insurance

When shopping for a new vehicle, it’s essential to do your homework. Your due diligence can lead to the most affordable premiums.

“Try to get insurance quotes on different types of vehicles and from a mix of national and regional carriers to see the differences in the cost of insurance before you finalize your purchase,” Friedlander says. “When you have decided on which car to buy, ask your agent what types of discounts you may qualify for.”

The most common ways to save money on auto insurance include:

- Bundling by purchasing auto and home insurance or two or more vehicles with the same company

- Signing up for telematics

- Increasing your deductible

- Setting up automatic electronic payments of your premium

- Maintaining a good credit rating

- Keeping a safe and clean driving record

- Opting for factory-installed safety features like airbags, antilock brake systems, anti-theft systems, electronic stability control, forward-collision warnings and lane-departure warnings.

“Overall, the best way to save the most money on full-coverage car insurance is to make sure the vehicle you are purchasing is within your budget and then factor in the cost of insurance,” McKenzie says.

Factors that impact car insurance rates

Auto insurance underwriters typically consider more than a dozen individual rating factors to determine your premium.

“The most common rating factors include motor vehicle record, auto claim history, age, gender, ZIP code, credit-based insurance score, how much you use your vehicle or annual miles driven, make and model of your car and the coverages and deductibles you choose,” Friedlander says.

If you have other drivers listed on your policy, many of the same factors will apply.

What is in your car can help with discounts. Safety features like airbags, lane departure, back-up cameras and automatic restraint systems are all factored into an insurance premium and typically get you a discount on your liability insurance. But the fancier your car’s technology, the more expensive it will be to repair or replace if damaged in an accident.

How to use our rankings of the cheapest cars to insure

We’re here to help you make sure the cost of car insurance is within your budget.

The Insure.com comparison tool makes comparing insurance rates simple. You compare the cost of insurance on up to 10 different vehicles, so you can narrow down your choices before you make a final decision on a car. If you’re looking for an older car, we have a used car rate tool as well.

Both of our tools show the national average as well as state average annual rate. That makes it easy to go onto the next step and shop for a great car insurance policy at a price you can afford.

And remember, the vehicle is just one of the many rating factors that insurers look at. Our rates are an average based on a driver with good credit and a clean record; if your credit is only so-so or you have a ticket or two, then your rates may be a bit higher. Our average rates are a jumping-off place to continue to get accurate quotes based on your specific situation.

Buying a new vehicle is something to be excited about! But make sure you consider all factors of buying a new car, including insurance rates, before taking the plunge.

Methodology

Insure.com commissioned Quadrant Information Services to calculate average auto insurance rates for 2022 models. Averages are calculated using data from seven large carriers, such as Allstate, AmTrust, Farmers, GEICO, Nationwide, Progressive and State Farm, in 10 ZIP codes per state. Not all models were available, especially exotic cars. Nearly 3,000 models are included in the 2022 study.

The least expensive rankings were based on the best-performing standard set of features for each car model. The most expensive rankings were determined by the worst-performing standard set of features for each car model. Averages are based on full coverage for a single 40-year-old male who commutes 12 miles to work each day, with policy limits of 100/300/50 ($100,000 for injury liability for one person, $300,000 for all injuries and $50,000 for property damage in an accident) and a $500 deductible on collision and comprehensive coverage. This hypothetical driver has a clean record and good credit. The rate includes uninsured motorist coverage.