Location is a key risk factor that auto insurance companies view when calculating premiums.However, it’s not the only rating factor looked at, other main factors include the type of vehicle, limits and coverage you choose for your policy and, of course, the all-important driving record. Where you live can help lower your rates, if you have lots of competition among insurance providers and fewer claims in your area, or raise your rates, due to urban areas with higher collision and claims or weather like hail and hurricanes that result in more claims as well.

Insure.com reviewed rate data compiled from six large carriers in 10 ZIP codes per state. Our driver profile for the annual state-by-state study of car insurance premiums is a 40-year-old man with good credit and a clean driving record. Rates for the same full coverage policy were averaged for America’s 20 best-selling new vehicles to determine which states rates were the cheapest – and most expensive in the nation.

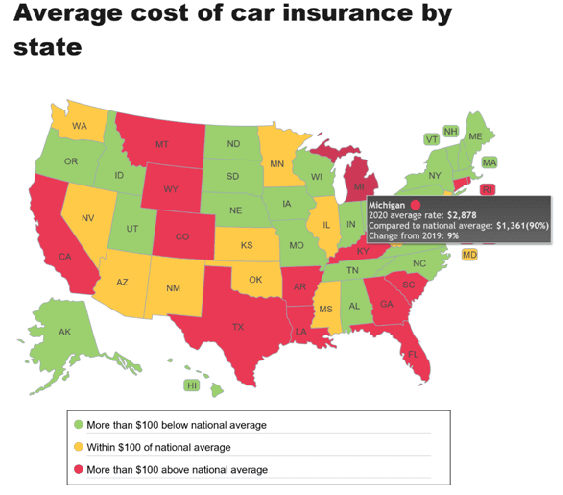

The 2020 study found a nationwide annual average premium of $1,517, up 4% from 2019. State average premiums range from $2,878 in the most expensive state to $912 in the cheapest state. The difference between the highest and lowest is $1,966, the most expensive state’s car insurance costs nearly 215% more than the cheapest.

Continue on to learn which states have the highest and lowest annual average car insurance rates for 2020.

No. 5 most expensive: California

Average rate: $1,968

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $1,818

Average rate for the top-selling SUV in the country first quarter of 2020Toyota RAV4: $1,942

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $2,093

California captured fifth place on the expensive list for car insurance, one place higher than last year. California is up 6% from last year’s rates and is 30% more expensive than the 2020 national car insurance average ($1,517).

Californians love to drive and there are 39.5 million residents in the state. The sunny state is home to 10 of largest cities in the nation and while many roadways may be beautiful in the mountains or by the ocean, they can get crowded.

A densely populated urban area breeds traffic and congestion, which leads to a higher rate of car collisions and, thus, auto accident claims. The more claims paid out, the higher the risk the insurance company takes on to insure drivers, which results in high car insurance rates.

The best way to combat high rates is to shop around with at least three different companies and during the process ask about discounts you’re eligible to receive. A driving record clean of traffic infraction and claims for the last three years will also help you obtain the best rates possible.

No. 4 most expensive: Texas

Average rate: $2,050

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $2,758

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $1,714

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,837

Texas ranked as the fourth most expensive state for car insurance in 2020, up from 10th place last year. The average annual premium in the Lone Star State came is up 13% over last year and is 35% higher than the 2020 national average.

There is a variety of reasons why Texas rates are on the high side. High speed limits, high density cities and a high number of auto accidents all contribute to the cost of auto insurance for Texans. Texas may have some smaller towns but is also home to three of the top 10 largest cities in the country with Dallas, Houston and San Antonio.

Data from the Insurance Institute for Highway Safety (IIHS) data shows Texas had the most fatal auto accidents (3,305) in 2018. California came in second with 3,259 fatal car crashes. Insurance companies consider crash and claim rates when setting a premium and if you live in a state with a high accident rate, you will pay higher premiums regardless of whether you’ve ever been in an accident or made a claim.

Even with reasons for car insurance rates to be high, Texas drivers should shop around to get the best premiums possible. Insurance companies rate risk factors differently, so shopping with multiple companies is the way to find the best rates for your specific situation.

No. 3 most expensive: Florida

Average rate: $2,239

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $2,138

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $2,264

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $2,446

The Sunshine state seized the third spot on the list of most expensive states for car insurance for the third year in a row. The state annual average premium is up 1% over 2019 and is 48% higher than the 2020national average.

There are a variety of factors that contribute to Floridians paying higher car insurance premiums. One main one for the expensive rates is the state’s no-fault insurance, personal injury protection (PIP), which motorists are mandated to carry Florida. Florida continually battles PIP fraud with questionable claims raising rates for all by approximately $250 a year.

Another reason for high rates is drivers operating vehicles without having insurance. Over a quarter of the drivers are uninsured — 26.7% according to the IRC –which is the highest in the country. Uninsured drivers push up the costs of auto insurance for insured drivers as there are not as many drivers to spread the risk around, so those who are responsible with policies have to absorb that cost.

How do you get reasonable rates in Florida for car insurance? Work on keeping a clean driving record (no tickets), good credit and a clean claims history (no accidents) and comparison shop with three or more car insurance companies at least once a year.

QuickTake

No. 2 most expensive: Louisiana

Average rate: $2,389

Average rate for the top-selling vehicle in the country first quarter of 2020F-150: $2,218

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $2,467

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $2,589

Louisiana again is found to be the 2nd most expensive state in the nation for car insurance rates. It’s the fourth straight year ranking second and all but one year of our study it has been in the top five. Louisiana has in fact topped the most expensive state list four times in the last ten years.

Louisiana’s annual auto insurance premium is 57% higher than the 2020 national car insurance average and 4% more than its 2019 rates.

Some reasons for high rates in Louisiana include poor roads, frequent natural disasters, and a low overall credit score for motorists in the state. In addition, Louisiana residents are considered to be some of the most litigious in the nation. Louisiana has a direct-action law that allows residents to sue insurers directly. Lawsuits of this kind drive up the cost of insurance for everyone in the Pelican State. Until lawmakers figure out a way to rope this apparently broken system, auto insurance rates will likely continue to stay among the highest in the nation.

Not only does it have a high percentage of uninsured drivers, 13%, but 40% of those that are insured only carry state minimum coverage levels. Higher liability limits don’t cost that much extra, and not only will get you better coverage but it may translate into you receiving reduced rates in the future as car insurance providers prefer drivers who continually carry higher limits.

To get the best rates drivers in Louisiana should work on building up good credit, keeping claims to a minimum (none is best) and a clean driving record.

No. 1 most expensive: Michigan

Average rate: $2,878

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $2,245

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $3,086

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $3.373

For seven years straight Michigan has taken the top spot for the most expensive state for car insurance.

The Wolverine’s average annual premium is 9% percent higher than last year’s rate. Michigan’s this year premiums area whopping 90% higher than the 2020 car insurance national average of $1,517.

The reason for the very pricey auto rates in Michigan remains the same – its no-fault system. The state’s one-of-a-kind no-fault auto insurance system requires drivers to carry PIP coverage that pays medical expense resulting from injuries sustained in an auto accident. There are over 15 other no-fault states, but only Michigan offers unlimited medical benefits. That is much more than the $10,000 that Floridians are required to purchase.

Michigan may be knocked out of first place next year if car insurance rates go way down as the Michigan state lawmakers hope after making sweeping changes to car insurance laws. The changes start taking effect on July 1, 2020 and allow car drivers to choose PIP coverages with lower limits and have a new medical fee schedule to rein in medical expenses that are paid out.

Also, Michigan car insurance reform made it so insurers can no longer rate based on a list of factors including: gender, marital status, home ownership, education level and occupation, postal zone and credit score.

An eye will be on Michigan to see if rates lower and if the number of uninsured drivers falls. Currently the state is in fourth place for number of uninsured drivers with over 20% driving without car insurance. With a lower number of insured motorists to pay premiums and share the risk pool, car insurance premiums spike upwards. The hope is the changes to car insurance will make it so rates will decrease and more people can afford car insurance.

The best way to get the best deal for car insurance in Michigan is to shop with a variety of companies. If you find low rates with a lesser known company, check out reviews and their A.M. Best financial strength rating before purchasing your policy.

No. 5 least expensive: Idaho

Average rate: $1,062

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $1,011

Average rate for the top-selling SUV in the country first quarter of 2020 RAV4: $1,059

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,126

Idaho grabbed the fifth spot for the least expensive states for auto insurance premiums. The annual average premium is 30% less than the 2020 national average of $1,517, but up 2% over its 2019 rates.

Idaho is much cheaper than its neighboring states to the east. Wyoming premiums average $1,684 and Montana $1,693, so both about 59% higher for car insurance than Idaho. Crossing the state line to the southwest to Nevada rates rise to $1,570, an increase of about 48%.

Like other states in the top five of least expensive states, Idaho is a mostly rural state with a competitive auto insurance marketplace. That means congestion and urban traffic doesn’t drive up car insurance rates and residents have a variety of car insurance companies to comparison shop with to find the best rates. More affordable rates allow more people to keep insurance on their vehicle, thus, only 8% of drivers are uninsured – a far cry less than the 20% plus that are uninsured in expensive states of Michigan, Florida and Louisiana.

No. 4 least expensive: Wisconsin

Average rate: $1,049

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $971

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $1,039

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,141

Wisconsin has made it in the top five of cheapest states for car insurance five times since 2010. It fell from 2nd cheapest to 4th cheapest this year, but still is a good showing for the Badger state. The average premium in Wisconsin is 31% less than the 2020 car insurance national average but 9% more than its 2019 rates.

The Badger State falls in the middle in population density; however, much of the state is rural, which helps keep car insurance rates low.

Drivers in Wisconsin are lucky to have a competitive car insurance marketplace that keeps premiums cheap for motorists. Hundreds of insurance companies to shop and chose from allows motorists to benefit and find low-cost car insurance rates for their needs.

No. 3 Least Expensive: Ohio

Average rate: $1,034

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $947

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $1,040

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,096

Ohio took third place for the least expensive states in the U.S. for car insurance, up seven spots from 10th place in 2019. Ohio has been in the top 10 cheapest list eight times since 2010, so Ohioans have been able to find cheap car insurance rates for many years.

The average annual premium in Ohio is 32% less than the 2020 national car insurance average. And, the yearly premium is 14% less than its 2019 rates, so rates are going down instead of up.

The Buckeye state isn’t disaster-prone, which certainly helps keep car insurance rates low for Ohioans.

Drivers here are lucky to have a competitive car insurance marketplace that keeps premiums cheap for motorists. It also helps that Ohio’s insurance department is a strong advocate for its citizens and consumers. The state has a variety of services and offers both national and regional car insurance providers, so it’s easy for motorists to shop and compare premiums to find the best buy.

No. 2 least expensive: New Hamsphire

Average rate: $985

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $943

Average rate for the top-selling SUV in the country first quarter of 2020Toyota RAV4: $978

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,066

New Hampshire has made it in the top 10 cheapest states for car insurance eight times since 2010, but this is its first time grabbing 2nd place. The average premium in New Hampshire is 35% less than the 2020 car insurance national average and 10%less than its 2019 average rates.

The Granite State is unique in that it does not require car owners to buy insurance in order to register a vehicle, like most states do. Instead state law requires residents to show sufficient funds – financial responsibility – if in an auto accident. Of course, the easiest way to show financial responsibility is to carry an auto insurance policy. Most drivers abide by this law with only 9.9% driving around uninsured.

New Hampshire’s population density falls right in the middle, ranking 21st in the nation. However, it must be enough to keep accidents and claims lower, allowing drivers to obtain lower auto insurance rates. Also, it helps to have a healthy car insurance market so drivers have insurers competing for their business.

No. 1 least expensive: Maine

Average rate: $912

Average rate for the top-selling vehicle in the country first quarter of 2020 F-150: $881

Average rate for the top-selling SUV in the country first quarter of 2020 Toyota RAV4: $922

Average rate for the top-selling sedan in the country first quarter of 2020 Toyota Camry: $1,009

Maine claimed the number one spot once again this year.Every year but one, Maine has landed in the top three of least expensive states and has claimed the cheapest title eight times since the study began in 2010.

Motorists in Maine are lucky to see annual premiums that are 40% below the 2020 national car insurance average. Though still inexpensive, its rates are up 7% compare to its average rate last year. Maine’s annual rate of $912 is 215% lower than Michigan, the most expensive state, whose premium is $2,878.

A rural state with few large cities helps Maine top the “cheap” list of states for car insurance. It ranks 38th in population density. Its rural setting allows drivers to stay away from traffic, or accidents. Fewer accidents lead to fewer claims and lower auto insurance rates.

In addition to a low-density rate, Maine has a very low rate of uninsured drivers. According to the IRC report, Maine has an uninsured driver rate of 4.5%, which is the lowest in the nation.

Maine may get a lot of snow but escapes some of the severe weather that haunts much of the U.S., such as tornadoes, floods and hailstorms, which can cause extensive damage resulting in a lot of claims. More claims results in higher auto insurance rates, so mild weather also contributes to the lower premiums motorists see in the Pine Tree State.

Comparison shop for the best rates in your state

A number of risk factors determine car insurance rates. These rating items vary from state to state, but location is a main one looked at by auto insurance companies. Other factors affecting your premium include state litigation laws and crime and crash rates in your area. Beyond these items, which you don’t have any influence over, there are items that you can control, such as your driving record, credit history and the vehicle you insure and drive plus the coverages and limits you choose. By making sensible choices, driving responsibly and keeping claims to a minimum, you can help keep your car insurance rates low.

Insure.com’s annual state-by-state comparison of car insurance rates features an interactive map providing you with average state rates at a glance. This tool, combined with our average rates by vehicle tool, gives you an idea of what you should be paying annually for car insurance for new vehicles. We also offer a used car tool, to see the average car insurance costs of over 4,000 model vehicles.Keep in mind that your annual premiums will vary due to your specific situation and set of risk factors, so be sure to comparison shop to find the best car insurance rates possible for your unique situation.