More than 41 million Americans provide care for an aging or ill loved one. This equates to the equivalent of $470 billion in unpaid care.

Being a family caregiver helps to fill a significant void for an elderly or sick relative who may not be able to afford skilled or long-term care on their own.

How we prepare for aging and long-term care can make all the difference in easing some of the daily responsibilities that family caregivers face. In 2016, an AARP study found that family caregivers spent an average of nearly $7,000 a year of their own money. In 2019 dollars, that would be more than $7,400.

If you have an aging relative, it is important for everyone involved to make sure your loved one have adequate insurance coverage.

Here’s how insurance can help and what your family can do now to get prepared.

- Planning for health insurance

- Planning for long-term care insurance

- Planning for life insurance

- Planning for home insurance

- Planning for auto insurance

- The importance of getting prepared

Planning for health insurance

People may rely on a combination of Medicare and health insurance offered by a former employer through a pension plan. However, the vast majority of people age 65 and older will solely depend on the federal health insurance program.

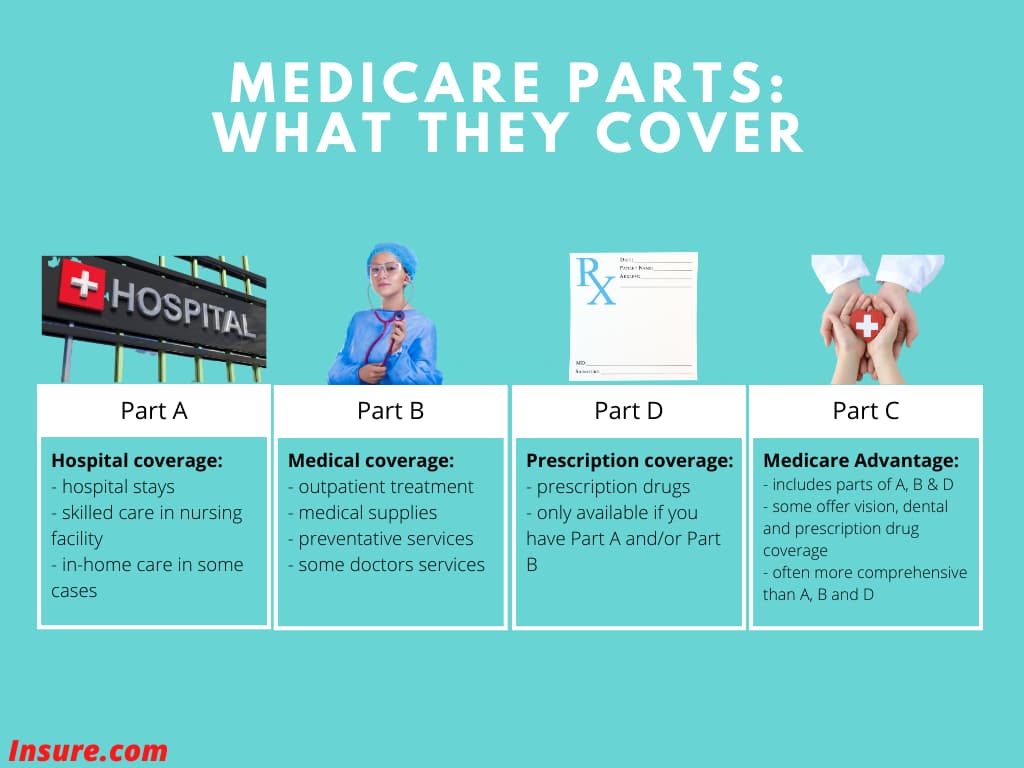

The first step is to decide whether to go with a combination of Medicare Parts A, B and D or get Part C.

Here is what each part covers:

- Part A: Part A is hospital coverage. It handles hospital stays, skilled care in a nursing facility and, in some cases, in-home care.

- Part B: Part B is the medical insurance portion. It provides coverage for outpatient treatment, medical supplies, preventive services and certain doctor’s services.

- Part D: Part D is optional prescription drug coverage. You can only get Part D if you have Part A and / or B.

- Part C: Part C is also called Medicare Advantage. Private insurers provide these plans. Medicare Advantage combines coverage you’d find in Parts A, B and D. Medicare Advantage plans are often more comprehensive than Original Medicare. Some Medicare Advantage plans offer prescription drug coverage, supplemental benefits like vision and dental and may allow beneficiaries to be directly admitted to a skilled care facility. Medicare’s Plan Finder can help you find and compare Medicare Advantage plans.

Medicare Misconceptions

Liz Barlowe, a certified aging life care manager and president-elect of the Aging Life Care Association, says several misconceptions about Medicare exist. Here are some of the most common.

In-home care is included in Medicare

People often think that Medicare covers continuous in-home care.

“We get a lot of people who think Medicare is going to cover in-home care, like a private caregiver to come in and be constantly available for their loved one or themselves,” Barlowe says.

In reality, Medicare only covers these services on a part-time or periodic basis if a beneficiary has Part A, Part B or both. Eligible health services include part-time skilled nursing care, physical and occupational therapy and home health aides, but Medicare doesn’t pay for these services 24 hours a day, seven days a week.

However, Medicaid, the government health insurance program for low-income Americans and those with disabilities, may pay for long-term care in a skilled nursing facility if the person is eligible for Medicaid, Barlowe says.

Medicare Advantage and Medicare supplemental cover the same things

Another misunderstanding Barlowe encounters in her work is that people may not understand the difference between a Medicare Advantage plan and a Medicare supplemental plan.

First, it’s important to know that Medicare plans don’t cover everything. Your loved one may have to pay a deductible, copay and prescription costs out of pocket. That’s why some people opt for a Medicare supplement plan like Medigap insurance.

A Medigap policy pays for coinsurance, deductibles and copays not covered under Original Medicare. You can get a policy through a private insurer, but you must have Part A and B to get this coverage.

Another alternative is a Medicare Advantage plan that often has no or low copays and low out-of-pocket costs.

Medicare is accepted everywhere

Barlowe says family caregivers and their loved ones should know that providers often accept Original Medicare plans, but you may have more trouble finding one that takes Medicare Advantage. So, you want to make sure your provider is part of the plan network before signing up.

“If a person needs to go to a skilled nursing facility after surgery for any reason, it’s the same thing since Medicare Advantage plans contract with certain providers,” Barlowe says.

Here’s how Medicare and Medicaid plans compare:

| Type of plan | What is covered | Who’s eligible | When you can apply | Average monthly premium | Out-of-pocket / deductible |

|---|---|---|---|---|---|

| Medicare Part A | Hospitalization | People 65 and over and younger people with specific disabilities and people on SSDI | During open enrollment and when you turn 65 | Most people pay $0 | $1,484 annual deductible |

| Medicare Part B | Physicians / outpatient | People 65 and over and younger people with specific disabilities and people on SSDI | During open enrollment and when you turn 65 | $148.50* | $203 annual deductible and then pay 20% of Part B costs |

| Medicare Part C (Medicare Advantage) | All health care, including supplemental benefits | People 65 and over and younger people with specific disabilities and people on SSDI | During open enrollment and when you turn 65 | $21, but many plans have $0 premiums | Out-of-pocket max is $6,700 for in-network and $10,000 for out-of-network |

| Medicare Part D | Prescription drug coverage for people with Parts A and B plans | People with Parts A and / or B | During open enrollment and when you turn 65 | $30.50 | Can’t exceed $445 deductible. |

| Medigap | Supplemental coverage to help pay for out-of-pocket costs | People with Parts A and / or B | During open enrollment and when you turn 65 | Varies, can be less than $100 | Varies by plan |

| Medicaid | All health care | Based on income, which varies by state | Anytime | Depends on income and can be as low as $0 | Minimal if any |

*People who file individual taxes and earn more than $87,000 and those who file joint taxes and make $144,000 may pay higher premiums.

Medicare open enrollment

Medicare open enrollment runs from October. 15 to December. 7. During that time, you can help your loved one evaluate plan options and better understand Medicare. You can only make changes to Medicare plans during the rest of the year if the person has a qualifying life event, such as the death of a spouse.

Barlowe says a good place to start when deciding on a Medicare plan is to review the “Medicare & You” Handbook. She also says State Health Insurance Programs, or SHIP, are another valuable resource. SHIP has a national network of staff and volunteers who provide insurance counseling to seniors during open enrollment. SHIP has a locator tool on its site organized by state that you can use to find insurance counseling services in your area.

If you have questions about your loved one’s Medicare coverage, use SHIP, call 1-800-Medicare or contact their current Medicare plan provider directly to get more information. Doing this during open enrollment will enable you to help your loved one make the best coverage decision.

Find out more about Medicare and the differences between the types of Medicare and Medicaid.

Planning for long-term care insurance

While Medicare may cover things like hospital stays and doctor visits, it doesn’t pay for long-term care. This is why long-term care insurance is essential.

Currently, over 10 million Americans have a long-term care policy. These plans cover:

- Permanent care in a nursing home or assisted living facility

- Extended in-home care

- Adult daycare

- Hospice care

- Respite care to give caregivers a break

Unless your loved one has a substantial amount saved for retirement, it’s unlikely he or she will have the means to pay for this care. A private room in a nursing home can cost nearly $7,700 a month. The national average for assisted living is about $4,000 a month.

If your loved one does not plan to go into a nursing home or skilled care facility and you are unable to provide care due to other responsibilities or limitations, the other option may be to hire a caregiver. Although family caregivers are most often unpaid, there are professional caregivers who provide care services for hourly pay.

How much should a caregiver get paid? There is a strong correlation between caregiver pay and turnover so it is important to pay fairly. The pay your hired caregiver should receive depends on the location, the type of care they will provide, their level of experience and if they have any certifications like Certified Nurse Assistant (CNA). Here are some of the types of caregiving and their rates from 2019.

- Companion caregivers earn between $11.50 and $11.99 per hour

- Personal care attendants earn between $12 and $12.49 per hour

- CNA’s earn between $12.50 and $12.99 per hour

When is the best time to get long-term care insurance?

The best time to get long-term care insurance is when you’re young and healthy when policy premiums are lower. Premiums may be higher if you wait until your 50s or 60s, so you’ll need to work with them to determine what they can afford.

The American Association for Long-Term Care Insurance estimates that a 55-year-old woman will pay an average of $2,675 a year for long-term care insurance with a $164,000 policy benefit. Five years later, that same person would pay more than $3,000 for the same policy.

Another important consideration is the level of care you can provide. If your loved one doesn’t have complex medical needs or requires around-the-clock care, you may be able to help either by driving them to doctor’s appointments, running their errands or remodeling their home to age in place. However, if your loved one has more serious medical needs that require a full-time caregiver, long-term care will be necessary.

If your loved one is working and still healthy, he or she should check with his or her employer to see if long-term care insurance is part of its group insurance coverage. If not, you can work with an independent insurance agent to find a policy.

Should I get a standalone long-term care policy or add it as a rider to a life insurance policy?

You can get long-term care insurance as either a standalone policy or add it as a rider to a combination permanent life insurance policy. Jonathan Fritz, co-founder and CEO of NoExam.com, a digital agency focused on helping people find the right life insurance, says a standalone policy is probably the best option for most people.

“Riders attract consumers because they reduce costs on the front end. However, a rider can end up costing more in the long run because it can reduce the death benefit of the life insurance policy. This leads to the policyholder being underinsured at the time of death,” Fritz says. “While a standalone long-term care policy is more expensive, it provides a more defined plan for in-home or nursing care. The upside is that it offers options in the way of coverage amounts and term duration periods. These variables can be useful when comparing quotes from multiple long-term care providers.”

Fritz adds that a long-term care rider is actually not a long-term care policy. Instead, it’s a form of an accelerated death benefit that is part of a permanent life insurance policy.

“The benefit available depends solely on the amount of life insurance coverage in force. Life insurance companies allow the insured to withdraw against the policy based on a percentage of the death benefit. Since the percentages vary from one company to the next, it’s critical to know how much can be withdrawn to cover long-term care expenses if needed,” he says.

Benefit periods and elimination periods

Whether you opt for a standalone long-term care policy or a life insurance rider, elimination periods and benefit periods are two important things to consider when comparing plans. The benefit period outlines how long you’ll have coverage. This period can range from two years to forever, according to the Insurance Information Institute.

Policies also come with 30-, 60- or 90-day waiting periods before coverage kicks in. You’ll be responsible for any out-of-pocket costs in the interim. If you get ill and require long-term care during this period, that could be a challenge. That’s especially true since insurance won’t cover any illnesses that occurred during the waiting period.

Though longer waiting periods typically mean lower premiums, you’ll need to weigh all these factors along with the benefit period if you’re approved for a policy.

Planning for life insurance

.jpg) Life insurance is another consideration. For an aging parent or relative, it’s critical to make sure the beneficiaries on a policy are up to date.

Life insurance is another consideration. For an aging parent or relative, it’s critical to make sure the beneficiaries on a policy are up to date.

Talk to your loved one about what company holds the policy, the type of policy and the location of insurance documents. If a term life policy is set to expire, he or she may be able to convert the policy to whole life, Fritz says.

“Conversions allow for the insured to retain their initial health class rating, but the policy must be underwritten at their new age. For this reason, it’s imperative to consider converting a policy when an insured’s health has changed,” he says.

Fritz adds that you may not be able to convert a term life policy because whole life insurance is considerably more expensive than term life insurance.

“If this is the case, it is best to apply for a new term life insurance policy. It’s important to complete the underwriting process for the new policy prior to expiration of a current policy’s conversion privilege,” Fritz says. This will allow your loved one to review both options at the same time, compare costs and make the best policy decision.

Life insurance policies often have other riders that may help your loved one. In addition to long-term care riders, you can often add other coverage, such as disability income riders, accelerated death benefits, critical illness riders and accidental death benefits.

If your loved one isn’t able to convert the policy or get a new term policy, then final expense insurance may be the best option. Final expense insurance provides a cash payout to cover funeral expenses or other associated expenses after a loved one’s death.

These policies are designed for people who can’t get traditional life insurance, so they typically have lower death benefits. However, as a caregiver, every little bit could help ease the financial responsibilities that come with laying a loved one to rest.

Make sure you talk to your loved one and help them get this coverage in place as soon as possible.

Planning for home insurance

As your loved one ages, it’s important to reevaluate a homeowner’s insurance policy. There may be an existing policy that hasn’t been updated in years. Here are some things to consider.

Liability coverage

If you have home health aides or nurses coming into the home, it may make sense to increase the liability coverage. That will offer more protection. Just keep in mind this may increase your premium.

You also may have to update your home or your loved one’s home to age in place. That could mean adding railing, ramps, hand bars in the bathtub and non-slip flooring. Some of these renovations may increase the home’s value. Depending on the type of improvement, it may increase or decrease your insurance rates.

Before the remodel, call the insurance company and let them know. You might also need to increase the liability coverage since contractors will be doing work on the property. After you’ve completed the remodel, call the insurer and provide receipts and before-and-after photos of all the work. If the improvements increase the home’s value, it also may increase you or your loved one’s rate.

Vacant home insurance

If your loved one is away from his or her home for an extended period, vacant home insurance may be necessary. A home is declared vacant if it’s unoccupied for at least 60 days. An empty home has a higher risk of damage, theft or someone coming unto the property and getting injured.

If your loved one doesn’t plan to return to his or her home for 60 days or more, inform the insurance company and request an endorsement. Your loved one may be able to add an endorsement to the existing policy, or the insurance company may require an entirely new policy.

Vacant home insurance can be as much as three times more expensive than traditional insurance. If your loved one’s move is permanent — either to your home or to a long-term care facility — the home insurance likely will be canceled after a vacancy of 60 days or more.

At that point, you’ll need to work together to decide whether to sell the home or transfer ownership to a family member and re-insure it.

Planning for auto insurance

Auto insurance companies often deem seniors riskier to insure because of age-related changes to their vision and mobility. However, like Maryland and New Jersey, some states prevent insurance companies from charging seniors higher rates.

If you’re concerned about your loved one’s ability to continue driving, have a conversation with him or her. If cost is more of a concern than safety, you might consider adding the person to your policy. Just call your insurer and find out how this will affect your premium. If it’s too costly, adding yourself as an insured driver on the loved one’s policy is another option.

For example, if your mom or dad has given up a license but still has a car, you can be added as the primary driver on the insurance. If you have a good driving record and low risk rating, this may be a more affordable option than having mom or dad keep a policy. Still, they may qualify for a discount if they maintain a clean driving record or don’t drive that much throughout the year. Evaluate all your options and compare costs before making a decision.

Find out more about auto insurance for seniors.

The importance of getting prepared

.jpg) Being a caregiver can alternately feel like a blessing and an overwhelming responsibility. As your parents or a close relative get older, you want to do everything possible to ensure they can age with dignity and get the care they deserve.

Being a caregiver can alternately feel like a blessing and an overwhelming responsibility. As your parents or a close relative get older, you want to do everything possible to ensure they can age with dignity and get the care they deserve.

A big part of this is making sure they have the right insurance coverage in place. Most people find it uncomfortable to talk about aging and long-term care. However, it’s critical to put these feelings aside and to enlist the help of qualified professionals like an elder law or estate planning attorney and an aging life care specialist to ensure your family is prepared.

“Initiate conversations with parents on what their goals are for future medical care and engage an aging life care professional to help lead these conversations, as they have had experience in lots of different scenarios,” Barlowe says. “Consider long-term care insurance or know if they have a policy and life insurance policies.”

And once you have everything in place, perform an annual insurance review to ensure your loved one continues to have the insurance protection they need as they age. As a caregiver, making all these preparations may just add to your peace of mind.