Your wedding day is one like no other — it’s your turn for a fairytale-come-true and you want it to be perfect. Wedding insurance is a way to get protection for your special day.

Most people who we recently surveyed didn’t realize wedding insurance existed. We asked 500 people about their weddings and wedding insurance and found that 52% said they didn’t know wedding insurance is an option.

“These days, many venues actually require wedding insurance when couples book the place. Nevertheless, because weddings are a costly investment, it’s always a good idea to make sure that no matter what happens, you’re covered for any eventuality,” said David Berke, founder and CEO at eWed Insurance.

Weddings can be a major investment, which is why you may want wedding insurance. More than one-third said they paid at least $10,000 for their weddings.

How much did your wedding cost?

| Up to $1,000 | 15% |

| $1,001 to $5,000 | 21% |

| $5,001 to $10,000 | 29% |

| $10,001 to $20,000 | 20% |

| $20,001 to $30,000 | 10% |

| $30,001 or more | 6% |

More than half of respondents said they paid more than they originally budgeted.

How much more did you spend over your original budget?

| Spent up to $5,000 more | 36% |

| Spent between $5,001 to $10,000 more | 19% |

| Spent over $10,000 more | 3% |

| Didn’t spend more than originally budgeted | 41% |

Despite those figures, one-quarter of respondents said they wished they actually invested more in their wedding:

- A lot less — 15%

- Less — 17%

- A lot more — 18%

- More — 7%

- No regrets, I would spend around the same amount — 43%

More than half of women (54%) said they had no regrets, but only about one-third of men (35%) shared that sentiment. Twenty-two percent of men said they would have spent a lot more on their wedding if they could do it over. That’s compared to just 12% of women.

Respondents in the west (23%) and northeast (21%) said they would have spent much more on their wedding. However, 26% in the west also said they wished they spent less. Only 34% of people in the northeast said they have no regrets and would do everything the same. That’s compared to 51% in the midwest.

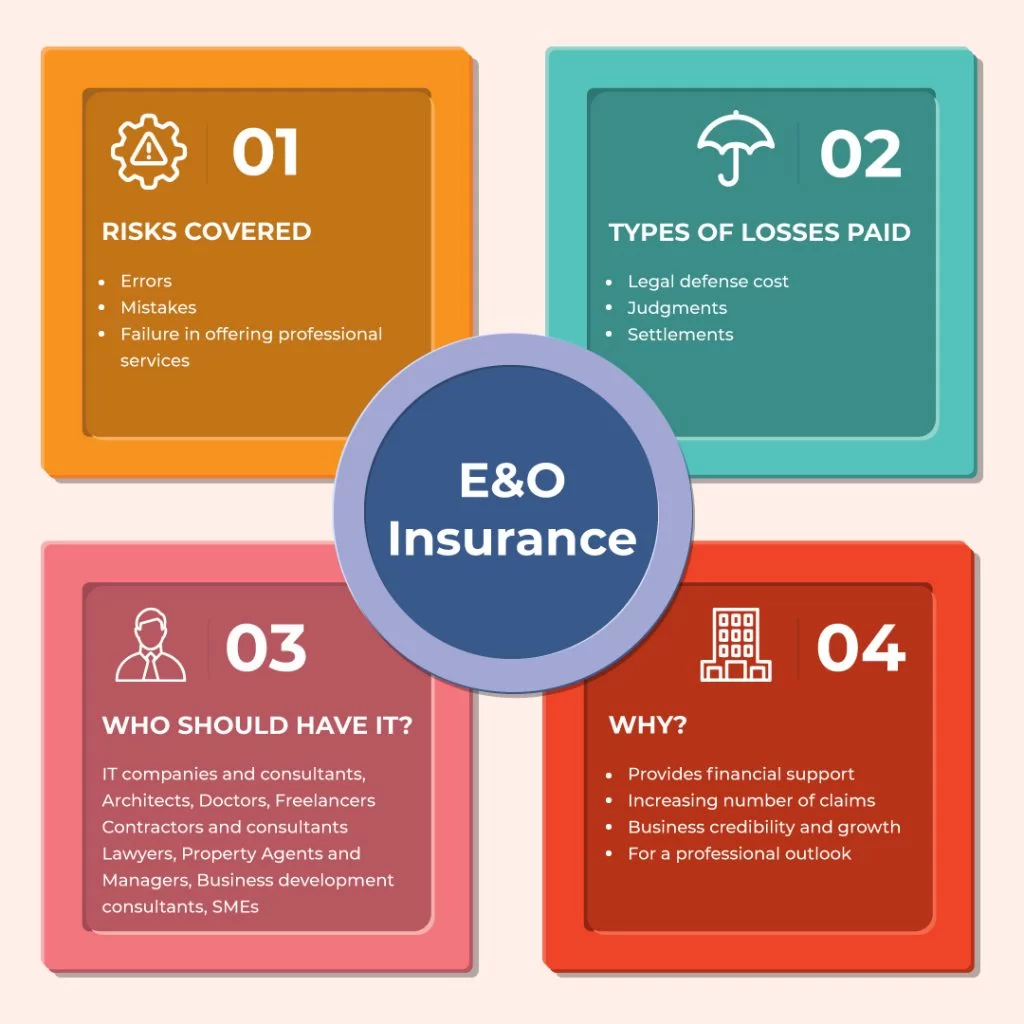

How does wedding insurance work?

Wedding insurance falls under special event coverage and usually comes in one-day, two-day and weekend length policies. There are two general types of policies:

- Liability

- Cancellation

Todd Shasha, managing director of personal insurance product management at Travelers, said wedding insurance is the perfect way to protect a significant investment.

“No matter the size, location and scale of your nuptials, a wedding is a significant investment as couples and their families plan full weekends complete with a rehearsal dinner, the wedding event itself and perhaps a celebratory send-off brunch. A wedding insurance policy helps to protect that investment from common and costly mishaps that can occur before, during and after the celebration,” he said.

Wedding insurance varies by coverage levels and deductibles. You can also add riders to the policy, such as liquor liability protection.

Mary Power, owner of event planning business White Mountain Celebrations Weddings Etc., in New Hampshire, said most clients purchase wedding insurance. However, none needed to file a claim.

“I tell my clients to get a one-day policy or a weekend policy,” she said. “Most venues ask for policies. Claims… can be

[filed]

for anything.”

One item that isn’t covered by any wedding insurance is the planner.

“I am an LLC and carry my own insurance,” but that doesn’t protect against cancellations, she said.

What is wedding cancellation insurance?

Cancellation covers a canceled event due to illness of family, extreme weather situations or other unforeseen incidents.

According to Shasha, as long as your reason is covered, wedding insurance can be a real benefit. He added that Travelers claim data show that vendor/venue issues and severe weather are the most common and expensive causes for wedding insurance claims.

It doesn’t cover cold feet, though. A change of heart isn’t protected and neither is a simple rainstorm. The weather would need to be extreme enough to prevent a safe ceremony or safe travels to and from the ceremony. Cancellation policies also don’t cover a vendor change once you make the deposit.

“Wedding insurance policies will help protect you in the event you have to postpone your event or cancel it entirely for those reasons and can also protect from other exposures, such as lost deposits, unplanned venue closings, military deployments or medical emergencies,” Shasha said.

Ivy Summer, certified wedding planner at Voulez Events, said it’s vital for couples to review the contract’s language and ask if the coverage protects against acts of God.

“We call this the Force Majeure clause. It refers to anything that significantly impedes on vendors’ ability to fulfill on their contracts. It’s important to make sure the language insures you against anything that’s outside of anyone’s control,” Summer said.

What is wedding liability insurance?

Liability coverage handles venue damages or injuries and illnesses to people at the wedding site. Some companies also offer liquor liability coverage, which covers you if a drunk guest gets into an accident after the wedding.

Shasha said there are many options under the liability policies.

“Optional liability and liquor liability coverage can be added to a wedding insurance policy to protect your contractually assumed exposures, such as bodily injury, property damage and personal injuries to third parties at the venues where your wedding ceremony, reception and rehearsal dinner will be held. Some venues require proof of liability insurance before the event takes place, so it’s a good idea to get in touch with your venue ahead of time to make sure you have the right coverage,” said Shasha.

Kerri McDonald from WedSure has seen many claims over the years, including hurricanes, fires, deaths in the family and closed venues.

“All sorts of things happen. A lot of people get injured at weddings as well and sue the venue and the bride and groom. Those are very large claims that can go into hundreds of thousands of dollars,” she said.

Remember, while everyone hopes for the perfect, problem-free wedding day, that’s not always the case. The survey found that:

- 37% said an important friend or relative couldn’t attend due to illness or injury.

- 16% said a vendor failed to show up.

- 11% said a vendor went out of business.

- 9% said a severe storm forced a rescheduling.

- 5% said a severe storm prevented many guests from attending.

When should you buy wedding insurance?

Ty Stewart, CEO and president at Simple Life Insure, suggested getting wedding insurance early.

“Apply for wedding insurance early in your wedding-planning process, ideally before you book any major vendors. This ensures you can be fully transparent with these vendors you have such protection and can negotiate deposits and contracts in good faith,” Stewart said.

Though you can purchase a policy two years in advance, some liability insurance can be purchased as late as the day before. It’s best to check with your agent — and venue — to find out your options and requirements.

Wedding insurance costs vary based on coverage levels, deductibles and riders. Our survey found most wedding insurance policies cost less than $700.

How much did your wedding policy cost?

| Less than $150 | 10% |

| $150 to $300 | 24% |

| $301 to $500 | 22% |

| $501 to $700 | 27% |

| $701 to $1,000 | 13% |

| More than $1,000 | 4% |

Berke said cost depends on how much coverage. For instance, for weddings between $7,500 and $100,000, eWed Insurance coverage costs about $448 for postponement/cancellation and $119 for liability. The company also offers a micro weddings package for $75.

Summer has actually seen fewer couples interested in wedding insurance since COVID-19.

“Although there’s been an uptick in claims during the pandemic, there’s been a decline in people purchasing policies since the pandemic started because according to some couples, they feel the chance of anything else happening is too low to matter. Additionally, vendors don’t normally require their clients to get wedding insurance,” Summer said.

How has the pandemic affected wedding insurance? Berke said COVID-19 brought to the forefront the need to be prepared.

“Most couples would rather not imagine something going wrong at their own weddings, but the reality is anything can happen and nothing can give you that peace of mind that no matter what, you will be fine if you are covered. While for a majority, it was too late to be covered because once it became a pandemic, it was no longer an unforeseen event. For the most part, there have certainly been more inquiries and now more are becoming aware of how wedding insurance is an indispensable part of wedding celebrations,” Berke said.

What are alternatives to wedding insurance?

You may not need a separate wedding insurance policy. Other types of protection may help instead.

Here are four ways other insurance may cover you:

- Your homeowners or renters insurance might cover stolen gifts.

- If you’re hosting the wedding at your house or one of your friend’s or relative’s houses, homeowners insurance might provide liability coverage. You may need to purchase an umbrella or rider with a higher claim threshold, but that’s usually easily attained.

- Your wedding venue may already have enough liability coverage to protect you. Restaurants and established venues often carry their own policy. You will want to ask what their coverage is and make sure there are no gaps, but usually if they’re in this business, they are covered fairly well.

- Event insurance can help you with large weddings. “For particularly large weddings involving hundreds of attendees, lots of logistics, and potential travel, I would recommend considering event insurance, which is a slightly different policy type altogether. Event insurance will offer broader coverage still relevant to a wedding ceremony, like deposit reimbursements, transportation liability coverage and liquor liability waivers. In some cases, it may be even cheaper than wedding insurance,” Stewart said.

You’ll want to talk to your agent beforehand to make sure you’re covered.

Companies that offer wedding insurance

Many companies write wedding insurance policies. Let’s take a look at three options.

Travelers insurance offers an all-encompassing policy called the Wedding Protector Plan. It has no deductibles and covers:

- Postponement or cancellation due to family illness, extreme weather or some other unexpected reason.

- No-show photographers or videographers, or photos and videos not delivered as promised.

- Lost deposits, such as those paid to bakers, caterers, bridal boutiques and wedding venues, that go out of business.

- Lost or stolen wedding gifts (excluding cash and gift cards).

- Lost or damaged dresses or attire and special jewelry, including wedding rings.

- Coverage for additional and unexpected expenses, such as replacing a damaged wedding cake, spoiled food and other glitches in catering and entertainment.

WedSafe offers liability and cancellation insurance. The liability policies have limits available up to $5 million. These policies include:

- Protects you in the event of injuries or property damage.

- Offers host liquor liability to protect against alcohol-related accidents.

- Allows for wedding ceremony, reception and rehearsal dinner venues to be named as “additional insured” for one price.

- Can be purchased up to the actual day of your wedding.

- This coverage is primary for both you and your venue; if you have a covered claim, your WedSafe policy will pay first before other insurance.

- There is no deductible for general liability coverage (bodily injury); however, there is a $1,000 deductible for third-party property damage claims.

WedSafe cancellation insurance offers protection for those times that you can’t predict, including:

- Severe weather

- Sudden illness

- Lost/non-refundable deposits

- Vendor bankruptcy

- Damage to wedding attire such as bridal gown, wedding rings

- Damaged wedding photos/videos

- Stolen gifts

McDonald said WedSure’s policies are a la carte.

“All of our coverages are optional and the pricing, which starts at $95, is determined by one of the nine coverages selected and the limit the insured wishes to select,” she said.

Their cancellation coverage starts at $125 and goes up depending on which coverages you choose to add to your policy. It covers:

- Severe weather

- Last-minute illness

- Honeymoon

Cancellation policies from WedSure cover “any non-refundable expenses when you must cancel or postpone your event due to reasons beyond your control.”

WedSure’s liability policies cover damage to venues, guest injuries and any incidents caused by drunk guests getting into a car crash. Policies start at $125 and cover up to $5 million, depending on the coverage.

Markel Insurance offers both liability and cancellation insurance. Liability coverage costs range from $75-$235 and liability limits start at $500,000. Coverage includes:

- Bodily injury and property damage liability — up to $2 million in coverage available.

- Host liquor liability insurance available.

- Venues can be named as “additional insured” on the certificate of insurance.

- Coverage can be purchased up to one day before the event.

- Event cancellation add-on — for $50, $5,000 of event cancellation coverage can be added to the event liability policy.

- Policy can cover ceremony, reception, rehearsal dinner (within 48 hours of event) and set-up and removal (within 24 hours of the event).

Its cancellation insurance will reimburse policyholders for non-refundable deposits and expenses if the wedding has to be canceled due to unforeseen circumstances, including:

- Vendor bankruptcy

- Extreme weather

- Military deployment

- Damage to wedding attire and jewelry

- Lost/stolen gifts

- Photographs

- Lost deposits from no-show vendors

Coverage can be purchased up to 14 days before your event and starts as low as $130. The cost is based on the overall wedding budget.

If you’re thinking about a wedding insurance policy, Shasha suggested talking with an insurance agent who can talk you through exposures, coverage limits and the many factors that would influence the level of policy that’s right for you and your family.

“Each wedding is a completely unique experience — and an insurance agent can help find the right type and level of coverage to make sure you are protected,” Shasha said.

Setting up financial goals after your wedding

Weddings can be pricey and leave you in a financial hole. Those money issues can affect your savings and limit vital purchases like life insurance.

We found that nearly all respondents made financial goals when they got married. Only 8% said they didn’t set goals.

The most common goals were to save for vacation and build up a savings or emergency fund (41% for each). Saving for retirement and saving to buy a home or condo was tied at 35% and paying off credit card debt was the goal of 32%. Saving for future children was next at 24% and then paying off college debt was at 18%.

How did people progress in their financial goals? It’s been tough.

- It’s been challenging, but we’ve made some progress. — 30%

- We made decent progress and are feeling optimistic about the plan. — 19%

- It’s been slow-going, but we have made a fair amount of progress. — 16%

- It’s a slog, we have done very little to make progress. — 15%

- It’s hopeless, we have made no progress and the future seems bleak. — 10%

- We have done stellar and made huge progress. — 8%

Getting married can cost tens of thousands of dollars, but it also lets you pool resources — and even get more insurance discounts.

We found that:

- 36% combined auto policies to get discounts and make it easier.

- 30% combined health plans.

- 21% combined renters or home insurance.

Less than half bought life insurance — 20% bought life insurance for both spouses; 17% bought life insurance for one person and the other already had it and 10% bought life insurance for one and felt the other didn’t need it.