Despite efforts to improve the health plan-buying process, choosing health insurance isn’t like buying a car. Deciding between car accessories can be fun. Picking a health insurance plan can feel like a chore, but it’s one of the most decisions you make each year.

You might feel confused about health insurance terms and the myriad options available to you. You may not even sure where to start. We’re here to help.

On this page, we’ll go through possible avenues for health insurance coverage depending on your situation. Not all of these solutions may work for your specific case. Instead, it’s a guide of what’s likely a choice for you.

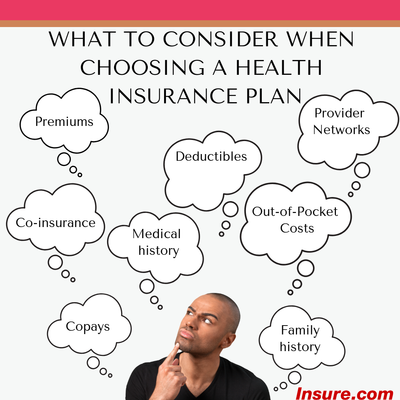

Now, before we get into options, let’s talk about what you should compare when choosing a health insurance plan:

- Your finances. How much money do you have for premiums and out-of-pocket costs? Are you eligible for health insurance tax credits?

- Family situation. Do you need a family health plan?

- Health care need. What are your and your dependents’ health care needs?

- Job status. Are you employed?

- Location. What individual plans are offered in your state?

- Your health plan preferences. Would you rather a restricted network of providers at a lower cost or more flexibility with higher premiums?

All of those factors play a part on what health insurance would work for you.

Open enrollment

Open enrollment is when most Americans sign up for or change health insurance. That period varies by how you get insurance.

Here’s when open enrollment is for different types of insurance:

- Employer-sponsored health insurance: Businesses don’t have a uniform open enrollment period. Instead, each company picks a time for employees to make benefit changes. Ask your benefits department when open enrollment is for you.

- Medicare: Medicare open enrollment runs from Oct. 15 to Dec. 7. Beneficiaries can sign up for or change a Medicare plan. There’s a second more limited open enrollment period from Jan. 1 to March 31.

- Individual insurance/Affordable Care Act (ACA) exchange plans: Open enrollment is from Nov. 1 to Dec. 15 for most Americans. There are a handful of states that have longer open enrollment for the individual market. We’ll get more into that later.

- Medicaid and Children’s Health Insurance Plans (CHIP): There is no open enrollment for Medicaid and CHIP. You can sign up at any time of the year if you’re eligible.

You can only make changes to your health insurance during open enrollment unless you have a qualifying event that kicks off a special enrollment period. This could be because of a job loss, reduced hours, a death, a divorce or a new child.

What health insurance is available for you?

Now, let’s go through 10 scenarios and likely health insurance options for you.

People with a job that offers health insurance

Having a job makes it much easier to get health insurance. Most Americans are covered through their job. Employer-sponsored coverage is usually cheaper than an individual plan. That said, there are other options even if you’re employed.

Here are five options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Medicaid

Individual market/Affordable Care Act exchanges

Short-term health plans

Someone with a spouse whose employer offers health insurance

Going with an employer-sponsored health plan is usually your best bet. Employers share the costs with employees. That results in lower premiums and out-of-pocket costs.

Don’t forget to explore your spouse’s employer’s insurance options.

Here are five options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Medicaid

Individual market/Affordable Care Act exchanges

Short-term health plans

Someone who’s unemployed

Not having a job is tough enough. It also means you lose an option of getting health insurance through an employer.

Your options were once more limited when you lost your job. In fact, COBRA might have been your only option. However, the ACA and recent regulation changes give you more choices if you’re unemployed.

Here are six options (click on any plan to find out more):

Health insurance through your spouse’s employer

COBRA

Medicaid

Individual market/Affordable Care Act exchanges

Short-term health plans

Children’s Health Insurance Program

Senior citizen

Turning 65 is a health insurance milestone. You become eligible for Medicare and can choose between original Medicare or Medicare Advantage.

You don’t have to sign up for Medicare at 65 years old, but it’s a wise choice. If you wait, you could get fined when you sign up. Not enrolling in Part B can mean a 10% premium late-enrollment penalty for each year you don’t sign up.

One option is to get Medicare Part A (hospitalizations), which is free for most Americans, and keep your employer plan if you’re still employed. Make sure you take into account the possible late-enrollment penalty if you don’t sign up for Part B when you become eligible for Medicare.

Here are four options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Original Medicare

Medicare Advantage

Young adults/20-somethings

The ACA requires insurers allow members to keep their children on health plans until the child turns 26. The good news is there are multiple options for young adults and 20-somethings other than your parents’ insurance.

If you find regular health insurance plans are too pricey, you can explore a short-term health plan. These plans have low premiums but don’t offer the same protections as a regular health insurance plan. So, beware of the limited coverage and out-of-pocket costs associated with those plans.

Here are five options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Individual market/Affordable Care Act exchanges

Catastrophic health plan

Short-term health plans

Someone who’s middle class

Your family’s household income can play a part in your health insurance options.

The IRS provides premium subsidies for households with incomes below 400% of the federal poverty line if you have an ACA marketplace plan. (See the federal poverty level guidelines chart to see if you’re eligible for premium subsidies if you have an ACA plan.)

Federal poverty level guidelines

| Persons in Household | Federal poverty level for continental U.S. | Premium subsidy threshold (400% of federal poverty level) |

|---|---|---|

| 1 | $12,700 | $50,800 |

| 2 | $17,240 | $68,960 |

| 3 | $21,720 | $86,880 |

| 4 | $26,200 | $104,800 |

| 5 | $30,680 | $122,720 |

| 6 | $35,160 | $140,640 |

| 7 | $39,640 | $158,560 |

| 8 | $44,120 | $176,480 |

Of course, you also may have the option of a plan through your job or your spouse’s job, which is likely a more affordable option than going with an individual or ACA plan even with tax credits.

Here are four options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Individual market/Affordable Care Act exchanges

Short-term health plans

Someone with a lower income

Americans with lower incomes have the potential for more help with their health insurance. The IRS offers premium tax credits and the ACA also kicks in funding to help offset out-of-pocket costs for lower-middle-class Americans with incomes less than 250% of the federal poverty level.

There’s also a public program option like Medicaid and the Children’s Health Insurance Program. States’ eligible income levels vary for Medicaid and CHIP. We’ll get more into that later.

Here are six options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Medicaid

Individual market/Affordable Care Act exchanges

Short-term health plans

Children’s Health Insurance Program

People with children

Getting your children covered is probably even more vital in your mind than getting insurance for yourself. Medicaid covers more than 45 million children and CHIP provides include for about 9 million.

Here are five options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Medicaid

Individual market/Affordable Care Act exchanges

Children’s Health Insurance Program

Someone with pre-existing conditions

Searching for affordable health insurance when you have a pre-existing condition, such as diabetes or heart disease, was once nearly impossible. Before the ACA, insurers could reject people with pre-existing conditions if they applied for an individual health plan. Alternatively, those insurers might charge high premiums because of the added risk.

The ACA ended that practice. Now, Americans with pre-existing conditions can’t get denied coverage and won’t pay a lot more for health insurance.

Here are four options (click on any plan to find out more):

Health insurance through your employer

Health insurance through your spouse’s employer

Medicaid

Individual market/Affordable Care Act exchanges

Small business owner or contractor

Being a small business owner or a contractor can limit your insurance options and you may face significant health coverage costs.

However, there are more options for small business owners and contractors now. The federal government changed regulations that expanded short-term plan and association health plan options. However, there are a handful of states that forbid those plans. Plus, there are others that restrict short-term plans.

These low-cost options come with fewer consumer and patient protections. So, you want to decide if sacrificing regular health insurance plan benefits are worth the lower costs.

Here are three options (click on any plan to find out more):

Individual market/Affordable Care Act exchanges

Short-term health plans

Association health plans

Your options for health insurance

Health insurance isn’t one-size-fits all. Your options vary depending on your job status, age, income, family and what you want from your insurance. In other words, would you rather pay more for premiums and less out-of-pocket? Alternatively, do you want low premiums with the potential for substantial out-of-pocket costs?

Here are 10 health insurance options and descriptions about each one.

Health insurance through your employer

Employer-sponsored health insurance remains how about half of Americans get their coverage. This coverage is also cheaper than many non-government options. That’s because your employer is chipping in to pay for health insurance.

Annual family premiums for employer-sponsored health insurance plans averaged $21,342 in 2020. Employees paid on average about $5,600 for that coverage. Businesses paid the rest, according to Kaiser Family Foundation.

Pros: Cheaper than the individual market.

Cons: Limited choices, employer must offer coverage.

Health insurance through your spouse’s employer

Most businesses allow employees to add their spouse and children to health plans, but it comes at a cost.

Some employers have removed the spouse tier for health insurance. In those cases, employees only have an individual or family plan option. That can result in higher premiums for a couple without children because they’re paying for family coverage.

When both you and your spouse have health insurance options, it’s a good idea to compare plans. You could actually save more than $1,000 each year depending on the health plan.

Where do you start? Compare the plans’ out-out-pocket costs, deductibles, copays and coinsurance. You might find your spouse’s plan makes more sense for your family. Just remember to check that your providers are part of that plan’s network.

Pros: Cheaper than the individual market.

Cons: Limited choices, employer must offer coverage.

COBRA

If you lose your job, you are likely eligible for COBRA coverage for 18 months.

You must sign up by 60 days after the qualifying event, such as getting laid off. COBRA extends your employer-sponsored plan though you’re no longer employed. COBRA is costly since the employer no longer pays for your coverage. You pay as much of 102% of the costs of the plan.

The average annual family premiums for an employer-sponsored health insurance plan cost more than $21,000 in 2020. Employees contributed about $5,600 on average. So, if you have a COBRA plan in this scenario, you’d wind up paying more than $20,000 in premiums. That’s pricey but allows you to maintain your coverage temporarily.

Pros: Allows you to keep your previous employer’s plan.

Cons: Costly and only available for 18 months after employment.

Original Medicare

Medicare Parts A & B are often called Original Medicare. It’s the program that has covered seniors since the 1960s.

Part A covers hospitalizations; Part B deals with physicians and outpatient care. Nearly all seniors can sign up for Part A without any premiums when they turn 65.

Annual Part B premiums average slightly more than $1,700 in 2020, but that could be higher depending on your income.

Pros: Accepted by most physicians and hospitals, Part A doesn’t charge premiums for most people, Part B can be a better alternative than employer plans or individual insurance.

Cons: You may have trouble finding a physician that accepts Medicare, you’ll need to get a Part D prescription plan and Part B coverage can be more expensive than Medicare Advantage.

Medicare Advantage

Medicare Advantage is a plan that’s offered by a private insurance company. It’s an alternative to original Medicare.

Many Medicare Advantage plans have prescription drug benefits. The plans also have supplemental benefits, such as home health care, transportation to appointments and population health initiatives. Some plans even pay for Uber visits to doctors and grocery shopping.

The average annual Medicare Advantage premium for 2021 is $252, though nearly half of enrollees have a plan with no premiums.

Pros: Less expensive than employer-sponsored plans.

Cons: You might have trouble finding a Medicare Advantage plan that accepts doctors in your area if you live a rural region.

Medicaid

Once viewed as a safety-net health insurance program that covered the poorest people, Medicaid has grown into an even more substantial way Americans get health insurance.

Medicaid, which is a federal/state program, covers nearly 70 million Americans. The ACA allowed states to expand Medicaid. What this did was let people up to 138% of the federal poverty level get coverage.

Thirty-eight states expanded Medicaid. Other states are also showing interest in the possibility, which is the primary reason why 15 million more Americans have health insurance since the ACA.

The costs of a Medicaid plan varies depending on your state and income. That said, Medicaid costs are much cheaper than most plans.

Pros: Low-cost plans that provide all the coverage found in regular health insurance.

Cons: Not all doctors accept Medicaid.

Individual market/Affordable Care exchange plans

The individual market could be an expensive option for uninsured Americans before the ACA. The health law made the market more affordable — though it’s usually still more costly than employer-sponsored plans.

The average annual individual premium is about $5,500 for family coverage. That’s quite higher than other health insurance and the premiums could be much higher depending on your state and plan.

However, the ACA helps people pay for their insurance. The federal government provides subsidies to decrease health costs for people at 400% of the federal poverty limit or below with an ACA plan.

Those provisions can save you hundreds of dollars each month if you qualify for subsidies or tax cuts.

Check out the Health Insurance Advisor to help you find an individual plan.

Pros: Cheaper alternative to COBRA.

Cons: More expensive than other plans.

Catastrophic health plan

Catastrophic health insurance is available to people under 30 and those who face specific hardships, including homelessness. These plans offer comprehensive benefits found in any other health plan, but at much less upfront costs. The average catastrophic health plan annual premium is about $200. That’s much more affordable than other plans.

However, it also has a $8,100 deductible. The deductible is what you pay for health care services before your health plan chips in money. Once you reach the deductible in a catastrophic plan, the health plan picks up the rest of costs for health care services, such as doctor appointments.

Pros: Low premiums and comprehensive benefits

Cons: High deductible and only for people under 30 and those with specific hardships are eligible

Short-term health plans

Short-term health plans are a low-cost alternative to regular health insurance.

The federal government lets people have short-term plans for a year and renew twice. So, in effect, you could have a short-term plan for three years.

Short-term plans don’t have to provide much coverage. For instance, you may have trouble finding one that offers prescription drug benefits or maternity care. The result is lower-cost plans that can offer little coverage with hefty out-of-pocket costs. So, you may pay low premiums but will have to pay more for health care services.

Most Americans are eligible for short-term coverage though a handful of states forbid the plans. Other states restrict how long you can have a short-term plan.

Pros: Low premiums.

Cons: Fewer consumer and patient protections and potentially high out-of-pocket costs.

Association health plans

Association health plans allow small businesses and sole proprietors to band together to buy health insurance.

AHPs no longer must provide the 10 essential health benefits. Also, the federal government lessened restrictions on companies banding together.

These plans offer low-cost solutions but may offer limited coverage. Some states don’t allow these plans.

Pros: Low-cost alternative to individual insurance.

Cons: Fewer protections, you must meet AHP requirements.

Children’s Health Insurance Program

The Children’s Health Insurance Program (CHIP) is a state/federal program initiative that provides coverage for children whose families meet income requirements. Income requirements vary by state.

More than 9 million children are covered by CHIP, which is sometimes rolled into with a state’s Medicaid program.

Pros: Low-cost coverage and peace of mind that your children are covered.

Cons: Fewer physicians accept CHIP than employer-sponsored insurance.

| Type of coverage | Average annual employee premiums | Plan characteristics | Pros | Cons |

|---|---|---|---|---|

| Employer-sponsored | $1,243/individual $5,588/family | Health insurance through your job | Cheaper than individual insurance while getting full benefits | Employer must provide coverage, less flexibility in choosing a plan |

| Spouse’s employer-sponsored | $1,243/individual $5,588/family | Health insurance through your spouse’s job | Cheaper than individual insurance while getting full benefits | Spouse’s employer must provide coverage, less flexibility in choosing a plan |

| COBRA | Up to 102% of cost of coverage | Available 18 months from end of employment | Allows you to keep employer’s insurance temporarily | Expensive since employer no longer helps pay for coverage |

| Original Medicare | Part A usually free; Part B $1,700 | Covers hospitalization and outpatient care like physicians | Lower cost than other types | Some doctors may not accept plans, you need a Part D plan for prescriptions |

| Medicare Advantage | $252 | Offered by private insurer and can include prescription coverage | Lower cost than Part B | May have trouble finding a doctor who accepts Medicare Advantage |

| Medicaid | Varies by income | Federal/state program for lower income Americans | Low-cost plans with all benefits of health insurance | May have trouble finding doctor to take Medicaid |

| Individual/ACA | $5,472 for family coverage | Plans are often costly but many Americans can get tax credits and subsidies to help pay for care | More options to choose than employer coverage and federal government chips in money to help pay for coverage for lower-income Americans | Costly |

| Catastrophic | $195 | Low-premium plans offered through the ACA marketplace for young people and people facing hardships | Low premiums coupled with comprehensive benefits | High deductibles and only available to people under 30 and those with specific hardships |

| Short-term | NA | Low-cost and lower coverage than regular health insurance | Inexpensive | Plans can offer little coverage and result in large out-of-pocket costs |

| Association health plans | NA | Allows small businesses and proprietors to band together and buy insurance | Cheaper than other plans and new regulations make it easier to band together | Plans can provide limited coverage |

| Children’s Health Insurance Program | Varies by income | Often part of Medicaid, CHIP offers coverage to children up to the age of 19 | Low-cost alternative to other coverage | May have trouble finding doctor that accepts CHIP |

Source: Data from Kaiser Family Foundation and the Centers for Medicare and Medicaid Services.

How to choose a health plan

Once you figure out your options, you may find that you have multiple alternatives. For instance, your employer may offer different types of plans, including a preferred provider organization (PPO) plan and a high-deductible health plan (HDHP). Or you might have multiple Medicare Advantage options in your state.

When choosing between health plans, look at the costs associated with the plans. That includes:

- Out-of-pocket maximums

- Deductibles

- Copays

- Co-insurance

Think about how often you needed to use health care services over the past year and what you expect for the next year. You can’t predict exactly how much you’ll require, but you may be able to figure out approximately what you need. For instance, you might be starting a family or you may need to finally get help with your back or knee. Figure out what you might need and that can help guide through which plan to choose.

Then, make sure your physicians are part of the plan’s network of providers. If not, you may not be able to see the provider or will have to pay more for those office visits.

Also, think about what you want from your plan. Do you want to see any doctor and don’t mind paying higher premiums, a PPO might be a good choice. If you want to pay low premiums and don’t mind paying more for actual services, then an HDHP could be a wise decision. If you don’t care about getting a referral to see a specialist and don’t find a restricted network of providers, a health maintenance organization (HMO) plan could be right for you.

Before making your decision, check out the Best Health Insurance Companies page on Insure to read reviews of health insurance companies.

No matter which type of health insurance plan for you, make sure you go through the process to find the right health plan for you.