When wildfire season rolls around, those living in high-risk areas like the West Coast might start thinking about worst-case scenarios: What happens if a fire rages through your neighborhood? How will you pay for fire damage to your property?

When cars suffer fire damage, the results aren’t pretty. From minor issues like scratched paint to major ones like structural damage and lingering smoke, fire damage to your car puts your health and safety at risk.

Having the right insurance coverage makes a huge difference in the aftermath of natural disasters like forest fires. And while you probably already have homeowners or renters insurance to protect your belongings from fires, your car needs its own special coverage.

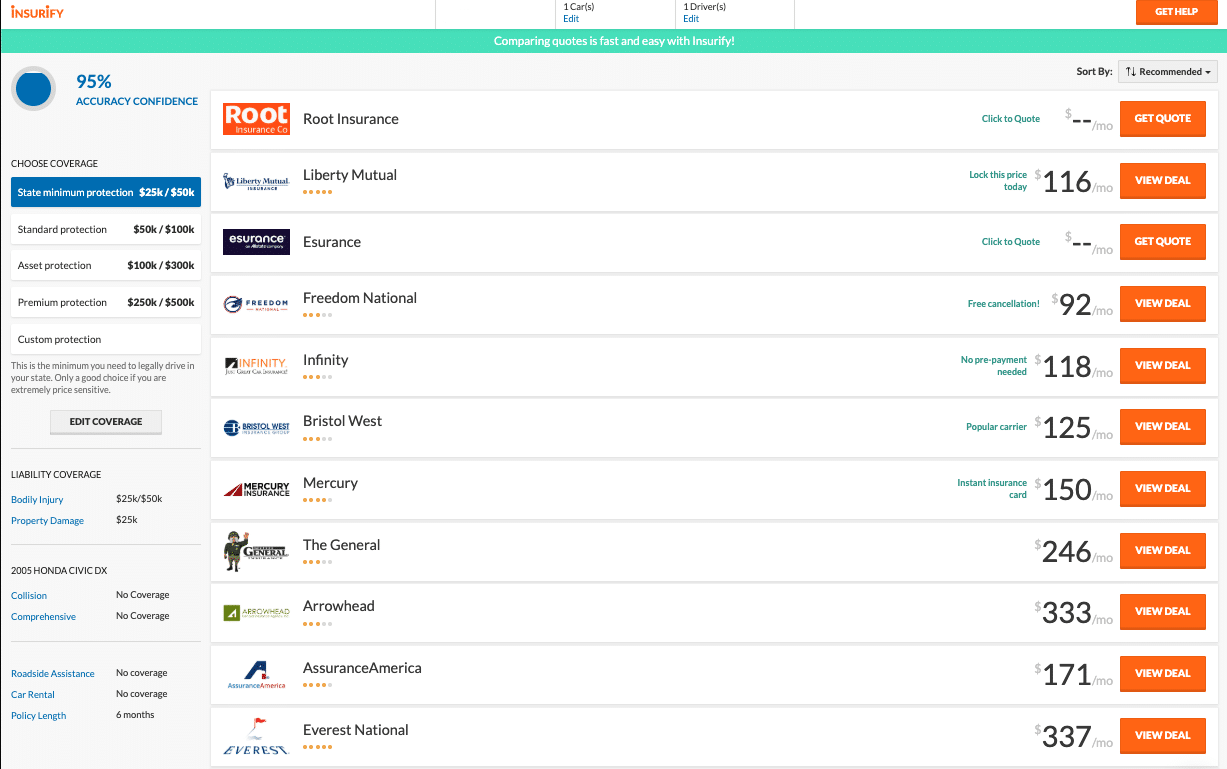

That’s where Insurify can help. With just a few minutes and a single profile, you can get personalized car insurance quotes that fit your budget and cover exactly what you need. Head on over to the Insurify website to give it a try today.

Table of contents

- Car Insurance and Fire Damage

- Does your car insurance cover fire damage?

- Will my insurance go up for filing a claim for fire damage?

- How to Prevent Fire Damage to Your Car

- Car Insurance and Fire Damage: FAQ’s

Car Insurance and Fire Damage

Forest fires can cause serious damage to your vehicle, whether or not your car was actually touched by flames. Prepare for the unexpected by knowing the signs and effects of fire damage on your vehicle.

Fire Damage to Your Car

If your car has actually caught flame from wildfires, it won’t take much investigation to figure it out. Long-lasting burns can cause irreparable damage to the structure of your vehicle. In some of these cases, your car will simply be declared totaled, or a “ total loss, ” meaning the cost of repairs would be more than the actual cash value of your vehicle. However, if the car can be salvaged, you’ll need the help of a trusted mechanic to fix it up.

Smoke Damage to Your Car

If you live in an area at risk for forest fires, there’s a good chance you need to check your car’s air filters, even if flames don’t reach your property.

The first thing to check after a fire is the air filter. Having a clean air filter in your vehicle plays an important role in your health since you’ll breathe in any debris and dust that the filter doesn’t catch. Once the smoke has cleared from your area, you can check the air filter by taking it out and giving it a shake. If you see anything come off of it, it’s time for a new one. Since air filters are relatively cheap, you may just consider replacing it to be safe. Parts and labor for a new air filter are typically less than $100, so you wouldn’t necessarily need to get your insurance involved if that’s the only damage.

However, if heavy smoke makes its way into your car, you may be in for some deep cleaning. If you’ve ever gotten in the car with someone who smokes, you’ll know firsthand just how the smell of smoke can linger on interior fabrics. Smoke from forest fires is no different, and a professional cleaning crew might be the only way to get the smell out of your car.

Ash Damage to Your Car

Falling ash can be surprisingly harmful to your paint job. This is because ash contains calcium and potassium, which can cause chemical damage when wet. This means ash left sitting on a dewy car overnight can start to do some harm to the body of your car.

Because of the grainy nature of ash, you won’t want to just brush it off. Instead, using a high powered hose or heading to the nearest car wash is your best bet to clear off the outside of your car. Fortunately, if you take care of it quickly, you likely won’t need professional intervention.

Does your car insurance cover fire damage?

C ar insurance covers fire damage if you have the right insurance coverage in place. This will also depend on where the fire originated.

There are two insurance coverages to keep in mind: collision coverage and comprehensive coverage. Collision coverage pays for repairs following an accident with another automobile or object where you are at fault. Comprehensive coverage helps pay for repairs following an “act of God,” damage to your car that’s outside of your control. Along with liability insurance, these three coverages are often referred to as “ full coverage” insurance.

Let’s take a look at how these insurance policies work with car fire damage.

Wildfires are usually considered a covered peril with a comprehensive insurance policy. This means that your insurance would help pay for repairs to your vehicle or reimburse you for your car’s actual cash value if it’s a total loss. As with other natural disasters, it’s important to have comprehensive coverage in place before a fire warning has been issued. Typically, you need to have your auto insurance policy in place for 30 days before you can use your coverage, so be sure to plan ahead.

But it’s not just natural causes that can lead to fire damage in your vehicle. Vandalism and certain garage fires may also be covered by your comprehensive insurance policy.

On the other hand, if your car catches fire following a car accident and you’re at fault, your collision insurance would pay for this damage instead.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesWill my insurance go up for filing a claim for fire damage?

Car insurance companies can raise rates based on the number of claims you file in a given policy period, but many states prohibit car insurance companies from raising rates for claims when you weren’t at fault. Fire claims following a natural disaster like a forest fire would fall under that category.

However, if your car has fire damage and you’re at fault (for example, if you didn’t maintain your vehicle or the damage was from a car accident), you’re more likely to see your insurance rates go up—unless your insurer offers a forgiveness program.

Your auto insurance policy is there for you to use it. If the cost of repairs is more than your deductible, it’s probably worth filing a claim, having an adjuster take a look at your car, and figuring out how to get insurance to cover your costs.

But if you find that your insurance claim leads to higher rates that you can’t afford or feel are unfair, don’t forget that you have other options available. You can shop for a new car insurance policy anytime you want to find a better deal.

The best way to get a competitive insurance rate is by comparing personalized quotes from several insurance companies. While doing this on your own can be time-consuming and tedious, Insurify can save you time and money by pulling multiple quotes based on your personal profile. If you’re ready to find the right comprehensive coverage for your budget, go ahead and give Insurify a try today.

How to Prevent Fire Damage to Your Car

If your car is parked in the vicinity of a wildfire but won’t be directly affected, a simple preventive measure is to park your car in a closed garage or cover it with a large tarp to prevent some damage from ash and fire. That being said, you can’t always avoid the effects of natural disasters like wildfires.

When there’s nothing that can be done to stop your car from being damaged by fire, the best thing you can do is have the right insurance coverage in place to protect you when it’s all over.

Finding the right insurance policy isn’t hard when you use a site like Insurify to compare personalized quotes. Whether you want a more affordable comprehensive insurance policy or need to add on this coverage for the first time, now is a great time to compare quotes with Insurify.

Car Insurance and Fire Damage: FAQ’s

How do you fix fire damage?

Fire damage to your vehicle will probably require a trip to the mechanic or a professional cleaner at the very least. For structural damage, scorched exteriors, paint damage from ash, smoky fabrics, and dirty air filters, it’s best to get a professional involved.

Does car insurance cover fire damage?

If your car has fire damage following a wildfire, comprehensive car insurance can help cover the cost of damage.

How is fire damage assessed on a car?

When you file an insurance claim for fire damage, your insurance company will likely send an adjuster to inspect your car and determine the cost of damages and whether or not it is a total loss.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesMethodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.