ESG stands for Environment, Society, and Governance. ESG stocks are shares of companies that seek to do good for the world, whether that’s by fighting climate change, empowering more diverse workforces, setting standards for how companies are managed, or other positive initiatives.

In this guide, we’ll highlight 10 of the most popular ESG investing stocks for 2022 and take a closer look at the positive impacts these companies are creating.

10 Popular ESG Stocks to Watch in 2022

Let’s dive straight into our list of 10 popular ESG stocks that investors can check out in 2022:

- Best Buy – Runs the World’s Largest Electronics Recycling Program

- Xylem – Wastewater Treatment Solutions That Save Water and Energy

- Accenture – Helping Companies Transition to Net-zero Emissions

- Texas Instruments – 100% Corporate Equality Index Rating

- Nvidia – Tech Stock with Focus on Improving Diversity

- Levi Strauss – Apparel Company with Strong Human Rights Record

- Salesforce – Donates Millions to Charities Each Year

- First Solar – Building Solar Panels to Cut Carbon Emissions

- Clorox – Industry Leader in Corporate Governance

- Target – ESG-Focused Retailer with Numerous Initiatives

A Closer Look at ESG Stocks

Want to know more about what projects these popular ESG stocks are working on? We’ll take a look at the environmental, social, and governmental impacts each company is making and also look at how the stocks are performing right now. You can also explore some of the best ESG investing funds by reading our article on ESG Funds.

If you’re wondering what the difference between ESG investing and socially responsible investing is then our article on SRI has everything you need to know about this investing method.

1. Best Buy – Runs the World’s Largest Electronics Recycling Program

Best Buy has several ESG initiatives that set the company apart from its retail peers. First, it operates the largest electronics recycling program in the world, helping to divert millions of pounds of waste from landfills each year. The company’s Chino, California facility also achieved 100% waste diversion in 2020.

Best Buy is also having social and governmental impacts. The company has committed $10 million to build youth education centers to improve diversity in tech. In addition, women hold 5 out of 11 of Best Buy’s board seats.

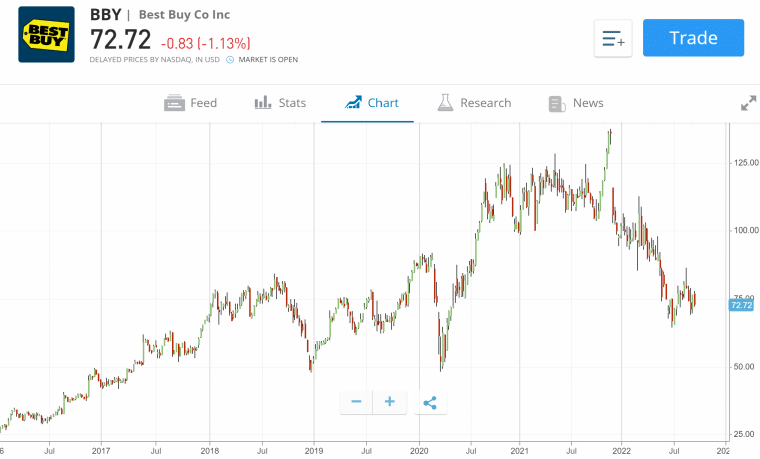

Best Buy stock is down 27% since the start of the year and now trades at a price-to-earnings (P/E) ratio of less than 10. This suggests that Best Buy could be an undervalued stock, especially since the company pays a dividend yield of 4.74%. The consensus among Wall Street analysts is that Best Buy could reach $80 per share within the next 12 months.

2. Xylem – Wastewater Treatment Solutions That Save Water and Energy

Xylem is one of a handful of publicly traded companies that’s focused first and foremost on sustainability. The company is developing a range of water treatment solutions that can make current water uses more efficient and unlock new sources of potable water. This is especially important in developing countries, where water scarcity is an increasingly severe issue.

Xylem has baked sustainability into its own business, too. The company plans to use only renewable energy at its facilities by 2025 and to save enough water for 55 million people per year.

Xylem stock is down 19% year-to-date, but it’s still trading at a P/E ratio of more than 40. The stock pays a dividend of 1.27%.

3. Accenture – Helping Companies Transition to Net-zero Emissions

Accenture is an Ireland-based consulting firm that helps companies around the world streamline their businesses and operate more effectively. Lately, a major part of Accenture’s work has been helping companies set sustainability goals and reduce their carbon footprint. Accenture has also taken a leading role in working with companies to make their workforces more diverse and their corporate policies more equitable.

Accenture has also tried to set an example using its own business. The company has set goals of achieving net-zero emissions and net-zero e-waste by 2025. The company is also working to reduce its actual carbon emissions by more than 10% by 2025.

Accenture stock is down 32% since the start of the year and trades at a P/E ratio of 27.8. Currently, the stock is sitting just above its 52-week low. Accenture pays a 1.40% dividend yield and Wall Street analysts have a median 12-month price target that is 26.4% above the current share price.

4. Texas Instruments – 100% Corporate Equality Index Rating

Texas Instruments is one of the only companies in the US to have received a 100% rating from the Corporate Equality Index for 6 years in a row. This index measures a company’s performance on metrics like gender pay equality, support for LGBTQ+ employees, and diversity in the workforce. Today, 20% of Texas Instruments’ employees come from underrepresented communities.

TI has also worked on improving its environmental footprint. The company reduced its greenhouse gas emissions by nearly 20% last year and recycled 90% of its waste. The company has set a goal to reduce its greenhouse gas emissions by 25% by 2025.

Texas Instruments stock is down 14.5% so far in 2022 and now trades at a P/E ratio of 17.8. The stock pays a dividend yield of 2.8%.

5. Nvidia – Tech Stock with Focus on Improving Diversity

Nvidia isn’t the most popular ESG stock for many investors, in part because the company’s graphics processing units are used to power energy-intensive Bitcoin mining. However, if investors are willing to overlook how Nvidia’s products can be used, the company itself has set strong ESG goals.

The company has tripled the number of Black employees in its workforce and continued to pay contractors during the COVID-19 pandemic, even when plants were shuttered. The company also takes ethics training seriously, offering anti-corruption classes for its entire global workforce. Nvidia has also worked to eliminate conflict materials from its raw materials supply chain.

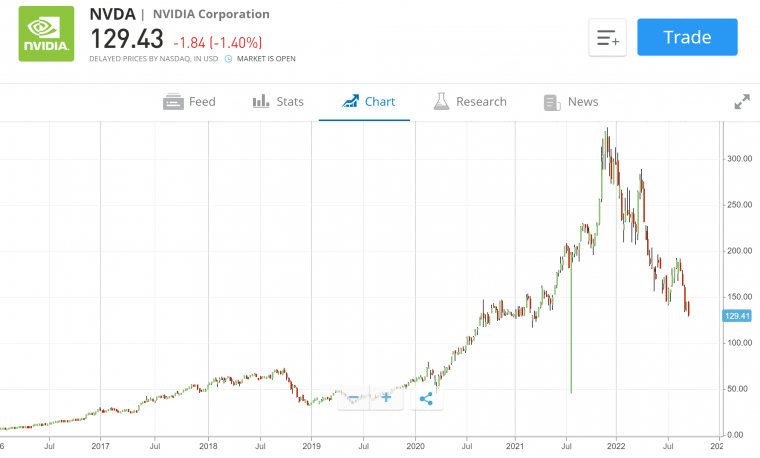

Nvidia stock has been hit hard by this year’s drop in tech stocks, falling 57% since the start of the year. However, Wall Street analysts suggest a 12-month price target that’s 59% higher than the current price. Nvidia stock trades at a P/E ratio of 42.1 and the stock pays a dividend of 0.1%.

6. Levi Strauss – Apparel Company with Strong Human Rights Record

Many apparel manufacturers don’t have great reputations when it comes to human rights or consumer safety. But Levi Strauss was one of the first companies to voluntarily remove PFAS chemicals – also known as ‘forever chemicals’ – from its materials. The company received the highest possible rating for an apparel maker from the Natural Resources Defense Council earlier this year.

In addition, Levi Strauss has been outspoken about human rights abuses in Xinjiang, China. The company recently left the Better Cotton Initiative after the organization refused to stop working with suppliers in Xinjiang.

Levi Strauss stock is down 30% since the beginning of the year and trades at a P/E ratio of just 11.8. Shareholders receive a dividend of 2.8%. Wall Street analysts have a consensus 12-month price target that is 40% above the current share price.

7. Salesforce – Donates Millions to Charities Each Year

Salesforce is another tech company with several ongoing ESG initiatives. The company uses 100% renewable energy and has achieved net-zero carbon emissions. In addition, it has spent more than $16 million to close the gender pay gap across its global operations.

Salesforce also donates 1% of the value of its stock to charities each year and employees are asked to spend 1% of their work hours volunteering. The company has donated more than $430 million to communities and given its software to more than 50,000 nonprofits and educational institutions.

Salesforce shares are down 39% since the start of 2022. This tech stock trades with a lofty P/E ratio of 290 and doesn’t pay a dividend. Wall Street analysts suggest a median price target that is 39% above the current stock price.

8. First Solar – Building Solar Panels to Cut Carbon Emissions

First Solar is one of the largest manufacturers of solar panels, which many experts see as essential to transitioning the power grid away from fossil fuels. In 2020, the company’s panels produced 6 GW of energy – enough to power roughly 600 million LED lights.

This leading renewable energy company has also built sustainability into its manufacturing processes, working to recycle more than 90% of its waste, cut water use by more than 10%, and lower its own greenhouse gas emissions by more than 30%. First Solar claims to have the smallest carbon footprint of any solar panel manufacturer.

First Solar is one of the only ESG investing stocks on this list that has seen its share price grow in 2022. The stock is up 51% since the beginning of the year and trades at a P/E ratio of 75.7. First Solar does not pay a dividend.

78% of retail investor accounts lose money when trading CFDs with this provider.

9. Clorox – Industry Leader in Corporate Governance

Clorox, the maker of household cleaners and medical products, has positioned itself as an industry leader in corporate governance. The company’s board consists of 42% of women and 4 members who come from underrepresented minorities. In addition, the compensation packages of top executives at the company are tied to achieving sustainability goals rather than only to the company’s share price.

Clorox also has more restrictive stock ownership rules for corporate insiders than most similarly sized companies. These help to ensure that the interests of the company’s leadership are aligned with the interests of shareholders.

Clorox stock is down 20% year-to-date, but the stock still trades at a P/E ratio of 37.5. Clorox pays a dividend yield of 3.7%, making it potentially worth considering as a dividend stock.

10. Target – ESG-Focused Retailer with Numerous Initiatives

Target, one of the largest retailers in the US, has several ESG initiatives to improve its environmental and social footprints. The company has promised to add 20% more underrepresented employees to its workforce by 2025 and has put structures in place to help those employees advance.

Target has also partnered with the nonprofit Water.org to ensure that supply chain workers in Southeast Asia have access to clean drinking water at home. The company also works hard to root out child labor in its supply chain and works with global nonprofits to ensure that its supply chains follow strong ethical practices.

Target stock is down 28% for the year, with much of that drop coming after a discouraging earnings report in May. The company’s stock trades at a P/E ratio of 18.9 and Target pays a dividend yield of 2.6%.

What are ESG Stocks?

ESG stocks, sometimes called ethical stocks, are stocks of companies that are working to make a positive impact on the environment, society, or corporate governance. There’s no exact bar that companies need to clear to be considered an ESG stock, so it’s up to individual investors to decide whether a stock counts as ESG to them.

Popular ESG stocks may belong to companies that have pledged to reduce their carbon emissions to zero, that are working on renewable energy technology, that are promoting underrepresented minorities, or that are supporting women and the LGBTQ+ community. These are just examples of ways that companies could be considered ESG stocks and many companies offer different approaches to achieving ESG principles.

ESG Explained

ESG stands for Environment, Society, and Governance. ESG stocks are stocks that are making positive impacts in one or multiple of these categories. Some stocks are considered ESG investing stocks because they have made huge strides in cutting carbon emissions. Others may be considered ESG stocks because they contribute to charity.

Importantly, there is no strict definition of what a company must do to be considered an ESG stock. Every investor must decide for themselves whether the initiatives a company has undertaken make them an ESG investing stock in their eyes. Some investors may be more focused on companies that reduce their carbon footprint, while others may prioritize companies that support diverse employees.

Many investment firms and stock research platforms offer ESG ratings for companies they track. However, these ratings are subjective and can vary widely between firms. For investors who want to dig deeper into ESG investing stocks’ achievements, many companies offer annual ESG or sustainability reports.

Why Do People Invest in ESG Stocks?

Investors are buying ESG stocks for multiple reasons.

For many investors, ESG stocks resonate with their own ethics. They want to invest in companies that are benefiting causes they care about, such as fighting climate change or supporting specific communities. Investing in ESG stocks or climate change stocks is seen as a way to put money behind these causes.

Some investors invest in ESG stocks because they believe that these stocks will fare better than their peers in the long run. Companies that have ESG initiatives can potentially save money by being more sustainable or attract more talented employees by demonstrating that they offer inclusive workplaces. ESG companies may also be more attractive to customers than peers that don’t have ESG initiatives in place.

Regulated Stock Brokers Offering ESG Stocks

Investors can start buying ESG stocks using most major brokerage platforms. Many S&P 500 companies are considered ESG stocks and these shares are widely available. Note that investors in search of ESG penny stocks will need to find a brokerage that offers trading on over-the-counter (OTC) stocks.

One brokerage to consider using to invest in ESG stocks is eToro. eToro offers commission-free trading on hundreds of stocks from the US, Europe, and markets around the world. The brokerage also has several ESG-themed ETFs available, which enable investors to build a portfolio of ESG stocks in a single trade.

One brokerage to consider using to invest in ESG stocks is eToro. eToro offers commission-free trading on hundreds of stocks from the US, Europe, and markets around the world. The brokerage also has several ESG-themed ETFs available, which enable investors to build a portfolio of ESG stocks in a single trade.

eToro offers its own charting and analysis platform that investors can use to decide which ESG stocks to buy. eToro’s charting software comes with dozens of built-in technical indicators and drawing tools. Fundamental analysis can help investors look more closely at ESG stocks’ business prospects.

Another reason many investors use eToro is because of its social trading and copy trading features. Investors can see what stocks fellow investors are buying and selling and start conversations with each other. They can also see what percentage of users on eToro own a particular ESG stock and whether sentiment around that stock is positive or negative.

eToro’s copy trading platform enables investors to mimic the investments of more experienced users and can be used to automate a portfolio. Investors must commit a minimum of $2,000 in order to copy a portfolio.

eToro requires a minimum deposit of $10 to open a new account. Investors can make a deposit by bank transfer, credit card, debit card, PayPal, and more. Customer support is available by phone or live chat 24/5.

Conclusion

ESG investing stocks enable investors to put their money into companies that are having a positive impact on the environment, society, or corporate governance. Some popular ESG stocks to watch include S&P 500 companies like Nvidia and Salesforce as well as upstarts like First Solar and Xylem.

Investors can use eToro or another stock broker to buy ESG stocks today. eToro offers 0% commission stock and ETF trading as well as social and copy trading.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor