When you buy a stock that is undervalued, you are essentially investing in the company at a discount. This is because the stock is trading at a price lower than its perceived intrinsic value.

In this guide, we take an in-depth look at the 11 most undervalued stocks.

Most Undervalued Stocks to Watch in 2022

The 11 most undervalued stocks can be found in the list below:

- IMPT – Overall Most Undervalued Stock Alternative Investment Rewarding Carbon Credit Burns

- Battle Infinity – Popular Undervalued Investment

- Lucky Block – Undervalued Crypto That’s a Better Alternative to Stocks

- Coinbase

- Philip Morris

- Diamondback Energy

- Meta Platforms

- Innovative Industrial

- Southwest Airlines

- SoFi Technologies

- Grab

- Disney

We explain why the above stocks are deemed to be trading at a price below their perceived intrinsic value in the following sections.

A Closer Look at the Popular Undervalued Stocks

There are many reasons why a stock might be deemed to be undervalued. Although subjective, in many cases a stock will trade at an undervalued share price because of an overreaction from the broader markets.

This might be something as simple as a company falling short of its forecasted revenues in its most recent earnings report.

Or, a stock might be undervalued because the firm is still operating in a new and unproven industry – or it simply hasn’t had enough time to dominate its respective sector.

Either way, in the sections below, we take a closer look at the popular new stocks.

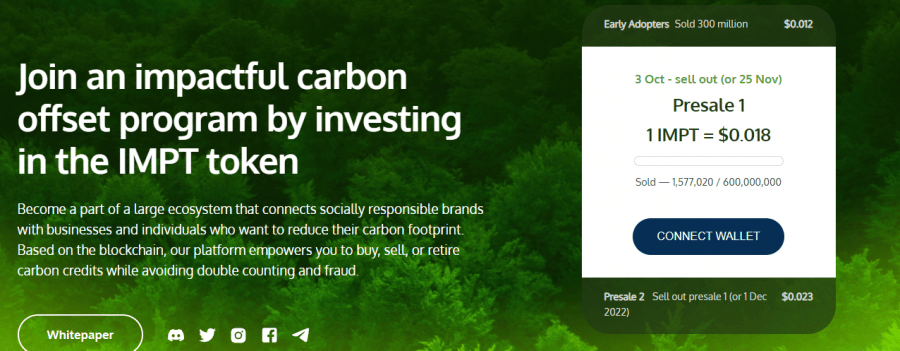

1. IMPT – Overall Most Undervalued Stock Alternative Investment Rewarding Carbon Credit Burns

Investors wishing to align themselves with publicly traded companies and popular retailers concerned about the environment can do so with IMPT. It’s a blockchain project that has partnered with numerous companies to enable individuals to support organizations striving to reduce their carbon footprint.

IMPT enables investors to choose from hundreds of projects that want to leave a good mark on the environment. The first step to making a difference is for investors to buy the IMPT token. Investors also earn tokens with every purchase at retailers IMPT has established a partnership with. Businesses that care about the environment can receive points by integrating the IMPT platform into their business.

The IMPT whitepaper states that tokens can be converted into carbon credits. Investors can buy, sell or retire carbon credits. If not retired to compensate for the token holder’s carbon footprint, the carbon credits are minted into NFTs, which can be held as investments.

Besides investing in environmental causes, investors and businesses can track their own carbon footprint with IMPT’s social platform. Positive contributors to the environment get rewarded with points. Higher points are awarded to users retiring their carbon credits.

IMPT tokens are one of the greenest cryptocurrencies currently in a presale that have raised over $1 million in a few days. Investors can buy IMPT tokens for $0.018 each.

All the information about the project is available on the IMPT Telegram channel.

2. Battle Infinity – Popular Undervalued Investment

Battle Infinity doesn’t fall under the same traditional stock umbrella as the rest of the assets on our list, but it’s definitely the most undervalued. The developers combined gaming with the Metaverse, and the result was a temper-proof ecosystem using the virtual world to integrate with gaming elements.

The center of Battle Infinity is players building teams to compete in the Battle Arena, but they can also access five other platforms. Some of the platforms included are Battle Market, Battle Swap and Battle Stake. Battle Swap serves as a decentralized exchange, enabling players to buy the platform’s native token, IBAT, and convert rewards to another currency.

IBAT is used for all platforms and enables players to explore while playing this play-to-earn game in the Metaverse. This BEP-20 token was designed on the Binance Smart Chain and can be used in the Battle Stake to compete against other players to earn a higher annual percentage yield. Other uses for the coin are advertising billboards within the Battle Infinity program, and the platform uses it for transaction fees, added to the staking pool.

By playing Battle Infinity, players collect IBAT and contribute to the ecosystem by making it more efficient. Rather than an NFT presale, this is a way to invest early in the native token of an NFT-based metaverse game.

3. Lucky Block – Undervalued Crypto That’s a Better Alternative to Stocks

When it comes to the most undervalued asset on the market, our number one pick right now is Lucky Block. Although Lucky Block is a cryptocurrency rather than an equity, it does offer a pathway to outsized gains since the token is currently trading at a discount. In addition, the fact that Lucky Block is a digital currency provides a simple way to boost your portfolio’s diversification.

When it comes to the most undervalued asset on the market, our number one pick right now is Lucky Block. Although Lucky Block is a cryptocurrency rather than an equity, it does offer a pathway to outsized gains since the token is currently trading at a discount. In addition, the fact that Lucky Block is a digital currency provides a simple way to boost your portfolio’s diversification.

Lucky Block is an innovative crypto-NFT platform that supports NFT-based competitions. To participate, users must buy NFTs and can then stand a chance to win prizes. The rewards range from products like luxury cars to watches to PS5 consoles.

LBLOCK was listed on PancakeSwap in January 2022 and immediately surged by over 3,000%, hitting an all-time high of $0.009617. However, this high was short-lived, and the token proceeded to lose around 70% of its value in the following weeks. Although this may seem negative, it actually makes LBLOCK relatively undervalued compared to similar tokens.

As members of Lucky Block’s Telegram group will know, numerous exciting upgrades are scheduled for the near future that look set to boost LBLOCK’s value. These include the long-awaited release of Lucky Block’s iOS and desktop apps, which will enable LBLOCK holders to begin receiving dividend payments. Lucky Block’s developers are also working on a payment gateway that will allow investors to purchase LBLOCK using FIAT currency.

4. Coinbase

If you’re in the market for the most undervalued stock of 2022, another option is Coinbase.

In a nutshell, Coinbase is a US-based crypto exchange that serves tens of millions of customers from around the world. The platform was first founded in 2012 and it was listed on the NASDAQ exchange in April 2021. Coinbase – which opted for a direct listing, attracted a significant amount of interest from growth stock investors in the lead up to its much-anticipated IPO.

However, while the shares opened for trading at $342, Coinbase stock has since moved in the wrong direction. In fact, as of writing, the shares are trading at just over $150. This means that since its IPO, Coinbase stock has more than halved in value. With that being said, we would argue that this stock market decline is unjustified.

After all, Coinbase – after Binance, is the world’s second-largest crypto exchange. The firm makes money irrespective of how the wider crypto markets are performing, because, just like conventional stockbrokers, Coinbase generates revenue from commission fees. As such, Coinbase can be profitable regardless of whether the crypto industry is bullish or bearish.

In addition to its traditional exchange and brokerage services, Coinbase is also launching an NFT marketplace, crypto-backed debit card, and more.

In terms of valuation, it is somewhat unprecedented that Coinbase is still trading with a P/E ratio of just over 10 times. Moreover, the firm is carrying a market capitalization of under $35 billion as of writing.

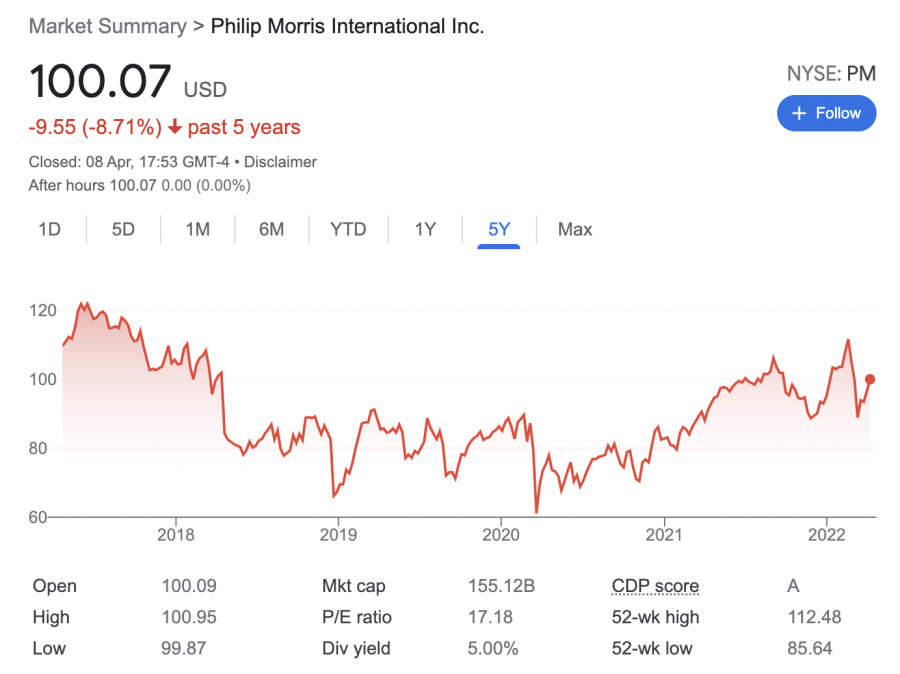

5. Philip Morris

Although the number of active smokers continues to decline globally, tobacco stocks still represent a solid sector to invest in. And at the forefront of this is Phillip Morris, the world’s largest tobacco firm after the state-owned China Tobacco. Philip Morris is behind some of the most recognized tobacco brands in this market – including Marlboro and L&M.

Crucially, stable stocks like Philip Morris can be held in your portfolio long-term, irrespective of how the broader economy is performing. After all, tobacco is a product demanded by consumers during all economic cycles. Moreover, to counter falling demand on a per capita basis, Philip Morris does what all leading tobacco firms do – it simply increases its prices.

Moreover, Philip Morris operates a high cash transient business model. As of writing, the company offers a running yield of 5%.

Another important metric to note about Philip Morris is that the firm dominates the emerging markets with its Marlboro brand. Unlike western regions such as the US and Europe, countries in the emerging markets do not regulate smoking in the same way. Furthermore, management at Philip Morris is also dedicating increased resources to IQOS (Heat Not Burn) products.

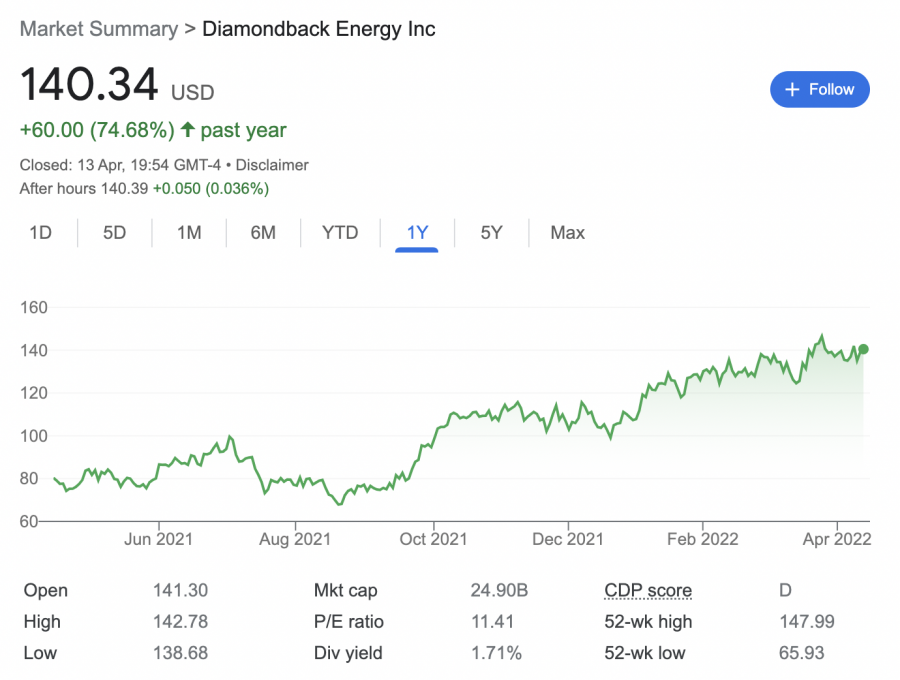

6. Diamondback Energy

In comparison to other companies in this sector, Diamondback Energy is a relatively small oil and gas stock – at least in terms of its market capitalization. As of writing, the firm is still trading with a valuation of under $30 billion. And as such, Diamondback Energy is arguably one of the most undervalued oil stocks to add to your portfolio today.

In terms of performance, Diamondback Energy has benefited tremendously from record-high oil prices. Over the prior 12 months alone the stocks are up 74%. both ExxonMobil and Shell are up 51% over the same period.

As of writing, a running yield of over 1.7% is on offer. Year on year, Diamondback Energy’s quarterly revenues grew by 162% while net income was up 235%.

The firm also increased its cash and equivalents by more than 500%. On the other hand, Diamondback Energy is an independent oil producer that is more sensitive to changing oil prices than many of its peers.

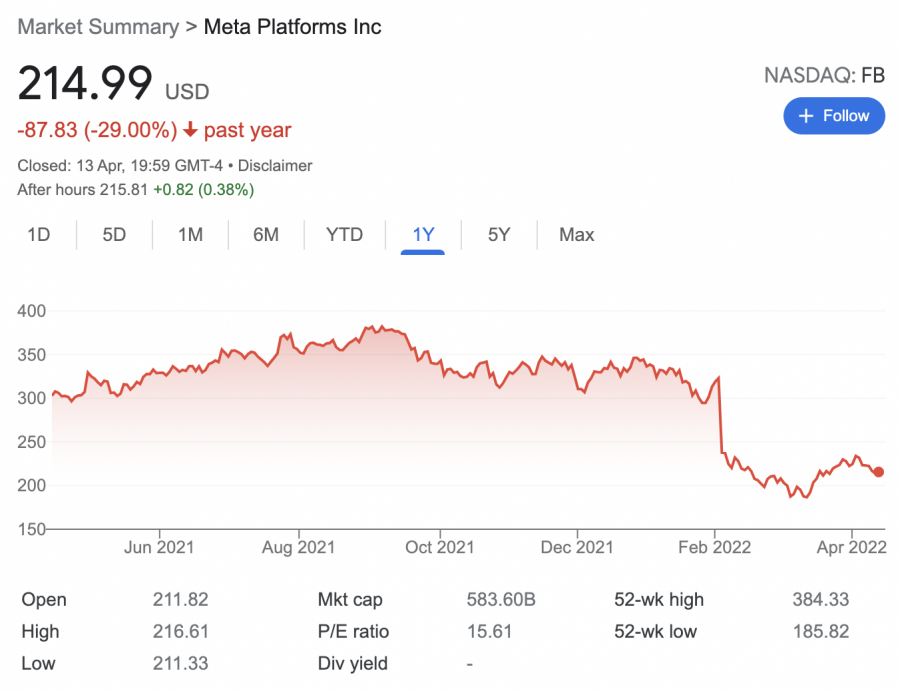

7. Meta Platforms

Meta Platforms – formally known as Facebook, is the world’s largest social media conglomerate. In addition to Facebook, Meta Platforms is also behind Instagram, Messenger, WhatsApp, Oculus, and dozens of other subsidiaries. And as a result, Meta Platforms are used by billions of consumers from around the world.

However, Meta Platforms – which rebranded to highlight its intentions to target the metaverse in the coming years, has had a rough time on the stock markets recently. Over the prior year, for instance, the shares are down 30%. Over a 5-year period, Meta Platforms stock is up just 50%. In comparison, fellow social media platform Twitter is up over 200% during the same period.

With that said, the share value decline of Meta Platforms is a classic example of an overreaction from the broader markets. Crucially, in its most recent earnings report, the firm noted that for the first time since going public – the number of monthly active users on its Facebook platform declined.

When this was announced, over $230 billion was wiped from Meta Platform’s market capitalization in a single day of trading. Based on prices as of writing, we would argue that Meta Platforms is one of the most undervalued stocks today. Although the firm does not pay a dividend, Meta Platforms is trading with a cheap P/E ratio of just over 15 times.

In recent news Meta Platforms is beginning to test tools that will allow creators to create digital experiences in its metaverse Horizon Worlds.

8. Innovative Industrial

It could be argued that cannabis stocks as a whole are hugely undervalued, as companies operating in this sector have struggled in recent years. With that said, if you’re in the market for the overall most undervalued marijuana stocks – it could be worth focusing exclusively on Innovative Industrial.

In a nutshell, Innovative Industrial is a REIT that gives you access to the wider cannabis industry in a more diversified manner. This is because the firm offers core real estate facilities – such as greenhouses and storage locations for state-licensed operators in the legal cannabis industry. Over the past five years of trading, Innovative Industrial has grown in value by nearly 1,000%.

Over a 12-month period, the shares have remained flat. Nonetheless, with a market capitalization of just $5 billion, Innovative Industrial is potentially undervalued – at least in the long run. After all, as more and more states in the US decide to legalize recreational cannabis sales, this will only benefit established market players like Innovative Industrial.

As a REIT, the firm is required to distribute dividends every month. And, as of writing, a running dividend yield of over 3.8% is being offered. Finally, the stock has a P/E ratio of over 40 times.

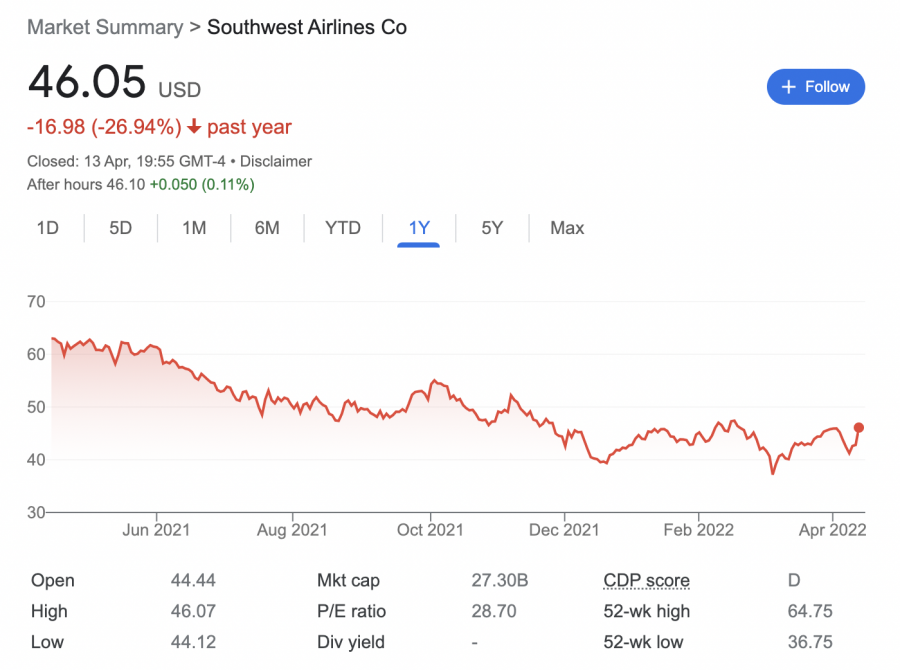

9. Southwest Airlines

Since the pandemic came to fruition, companies operating in the aviation industry have been hit extremely hard. Not only have airline stocks had to contend with ongoing travel restrictions and hugely reduced passenger numbers, but now record-high oil prices. And therefore, it will come as no surprise that many airline stocks are still trading below pre-pandemic levels.

Although this industry is fraught with risk, we would argue that the likes of Southwest Airlines are undervalued and thus – could represent a bargain buy for your portfolio today. While there are many aviation stocks trading on the cheap, Southwest Airlines stands out for us, not least because of its reasonable solid balance sheet.

Not only in terms of survival during times of increased travel restrictions, but to ensure that it continues to increase its domestic and international route expansion program.

When it comes to its stock price action, Southwest Airlines surpassed its pre-covid valuation in April 2021. However, the stocks have since slumped. As such, over the prior 12 months, Southwest Airlines stock is down over 25%.

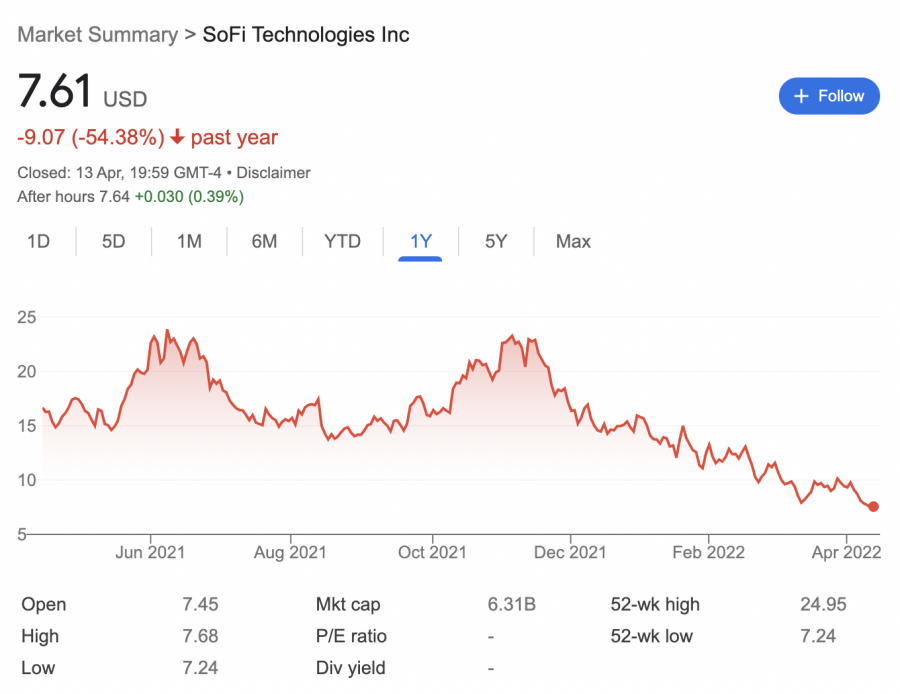

10. SoFi Technologies

SoFi Technologies is behind the popular SoFi website and mobile app – which consolidates a full suite of financial and investment services via a single hub. In addition to stocks, ETFs, and robo-advisory services, SoFi also offers checking accounts, loans, student finance, and much more.

Crucially, at current prices, SoFi Technologies is arguably one of the most undervalued stocks in the ever-growing FinTech, which, until recently, enjoyed rapid growth. A broader market sell-off of tech-related growth stocks has resulted in up-and-coming firms like SoFi Technologies, dropping in value by a large amount.

In fact, in the prior 12 months alone, SoFi Technologies stock is down more than 50%. This means that the firm is now trading at a lower price than its 2020 IPO, which opened at roughly $10 per share.

In terms of the fundamentals, 2021 was a solid year for the firm – with SoFi Technologies attracting an additional 87% in customer numbers. This takes the firm’s customer base to 3.5 million, which, in the grander scheme of things, is still minute. Therefore, there is plenty of upside potential with this undervalued stock.

SoFi Technologies is trading with a market capitalization of under $7 billion. And, perhaps most importantly, it was recently announced that SoFi has had its banking charter application approved by US regulators.

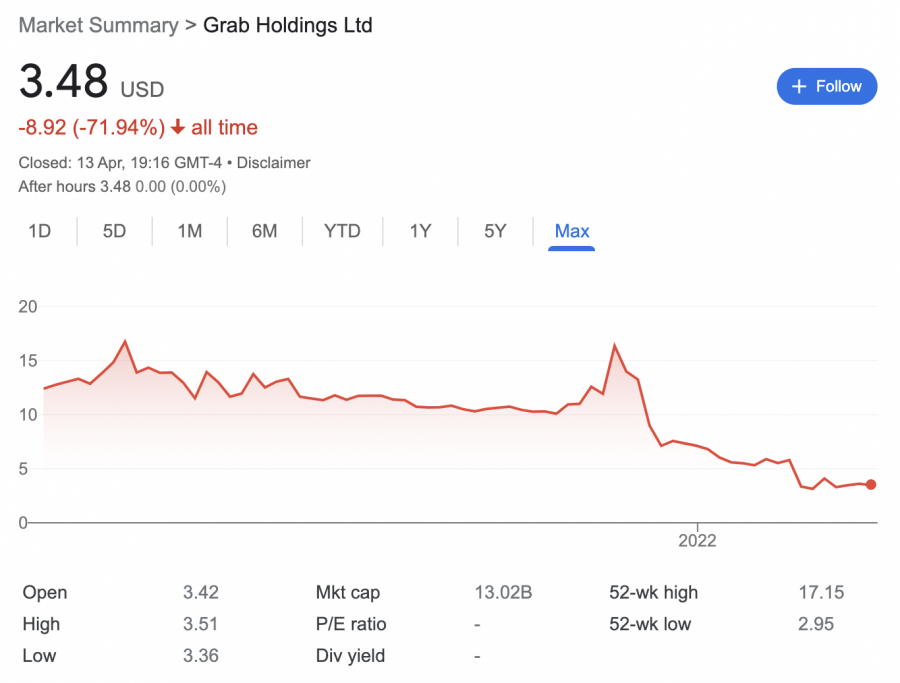

11. Grab

Grab is a Singapore-based super app provider, which is particularly dominant in Thailand, Vietnam, Indonesia, Malaysia, and the Philippines.

In addition to ride-hailing services, Grab offers everything from food delivery and groceries to micro-loans. Due to the exponential rate at which the firm continues to grow in the emerging economies, Grab was one of the most anticipated IPOs of 2020. However, things haven’t quite gone to plan since its NASDAQ listing.

Based on prices as of writing, Grab is trading at a price over 70% lower than its IPO. One of the main reasons for this rapid sell-off is due to Grab’s overly aggressive business model – in which it allocates significant resources to customer incentives.

This has since increased to an annual spend of over $1 billion. However, it should be noted that Grab is still very much a growth stock and thus – expenditure of this nature is not overly uncommon. Moreover, although the firm is still very much a loss-making company, this is to be expected. Ultimately, at current prices, Grab stocks are simply too cheap to turn down.

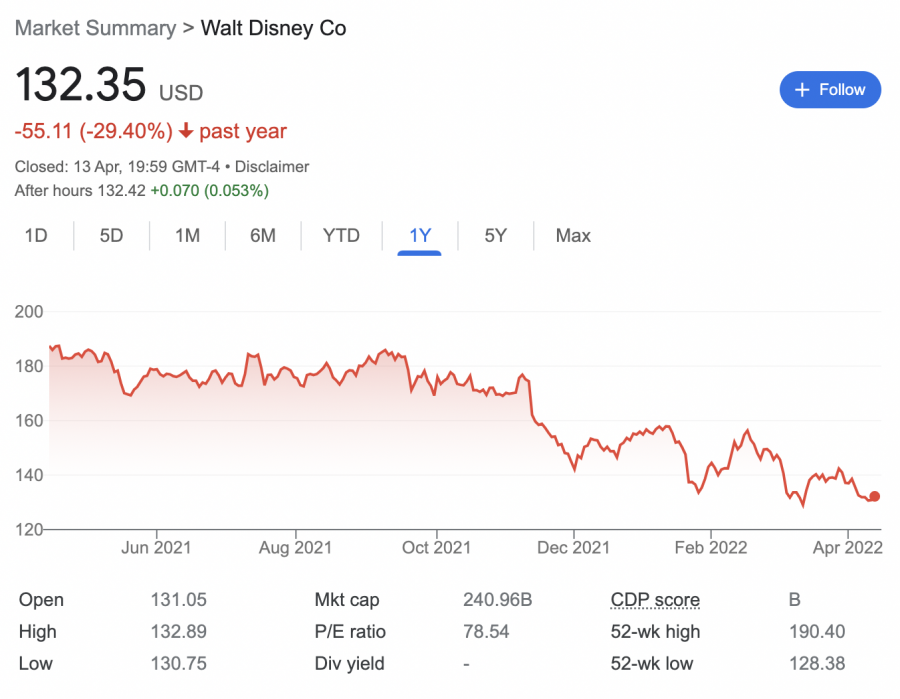

12. Disney

Make no mistake about it – Disney is a high-grade stock that can be relied on for long-term value seekers irrespective of how the economy is performing. Sure, on the one hand, many of Disney’s core services – such as its theme parks, cruise ships, and movie sets, were heavily disrupted in the midst of the pandemic.

However, the firm’s relatively new streaming service – Disney +, continues to perform well. Moreover, now that global economies are finally returning to some sort of normality, Disney stocks appear to be an unmissable bargain at current prices. Although the stocks hit all-time highs of over $190 in early 2021, the shares have since entered a market correction.

As of writing, this blue-chip stock can be purchased for less than $135 per share. And as such, if and when Disney returns to its prior high, this offers a medium-term upside of over 40%. Moreover, although Disney suspended its previously consistent dividend program in 2020 as per the impact of the pandemic, this is sure to return in the very near future.

After all, its decision to temporarily suspend dividends has no correlation to its balance sheet – which is solid.

What are Undervalued Stocks?

The term undervalued stock refers to a public company that is trading at a share price that is perceived to be less than its true value. In other words, the term is subjective, not least because investors determine and view company valuations in different ways.

In many ways, stocks are undervalued because of an overreaction from the markets. For example, we briefly mentioned earlier that when Meta Platforms announced in its most recent earnings report that the number of monthly active users on Facebook had declined in the quarter for the first time, the firm lost over 25% of its share value in just one day of trading.

This resulted in a decline of over $230 billion from its market valuation. However, many would argue that the fact that Facebook slightly underperformed for the quarter does not warrant such a significant stock decline. As a result, this is a perfect example of how to find undervalued stocks on the back of an unnecessary market reaction after the release of an earnings report.

Where to Buy Undervalued Stocks

Once you know which equities you wish to add to your portfolio, you can then process to buy your chosen undervalued stocks at an online broker.

The sections below review a popular broker that lets users invest in undervalued stocks.

eToro

All of the 10 companies from our list of the most undervalued stocks discussed today are available to purchase on the eToro platform in a safe and low-cost manner. First and foremost, the 3,000+ stocks listed on eToro can be bought and sold without paying any trading commission.

All of the 10 companies from our list of the most undervalued stocks discussed today are available to purchase on the eToro platform in a safe and low-cost manner. First and foremost, the 3,000+ stocks listed on eToro can be bought and sold without paying any trading commission.

Moreover, spreads are very competitive and US-based clients can deposit and withdraw funds without incurring any transaction fees. This is not only the case with ACH and bank wires, but debit/credit cards and e-wallets like Paypal too. See our full guide on how to buy stocks with credit cards.

The minimum deposit is just $10 for US clients, so you can invest in undervalued stocks on a budget. For example, you could buy Rivian stock or you could buy Medifast stock via fractional trading and only invest $10.

When your account is set up – which takes less than five minutes from start to finish, you can then buy your chosen stocks in fractional quantities. At eToro, you can invest any amount from just $10 upwards. If you buy undervalued stocks that pay dividends, your account will be credited accordingly. This will enable you to reinvest the dividends into other stocks.

If you wish to diversify your portfolio outside of the US markets, eToro also offers access to more than a dozen foreign exchanges. Unlike other brokers in the US, you won’t pay any fees to buy international stocks. You can also invest in ETFs on a commission-free basis and even buy cryptocurrency assets from just $10 at a fee of 1% above the bid-ask price.

eToro is also renowned for offering the copy trading features. This tool allows you to choose an investor that alligns with your goals and copy their trades automatically. You only need to outlay $200 to utilize this passive investment feature. Pre-made smart portfolios are also offered across a vast selection of strategies.

eToro also offers a mobile app for both iOS and Android smartphones and it gives you access to all of the same features as offered on the main eToro website. There are no fees to download the eToro app, either.

Safety and security will be of no concern at eToro, not least because the broker is approved in the US. It also holds licenses with the FCA (UK), ASIC (Australia), and CySEC (Cyprus). Finally, if you’re completely new to online trading, eToro offers a free virtual portfolio that tracks the real-world stock markets. This comes pre-loaded with $100k in risk-free paper money.

Conclusion

In buying undervalued stocks for your portfolio, you can purchase your chosen shares and try to diversify your investments. This guide has discussed the 10 most undervalued stocks , albeit, it’s important that you also conduct your own research.

Investors wanting to receive rewards while supporting environmentally-conscious companies should check out IMPT. It has provided a platform for investors to earn IMPT tokens for shopping with numerous big brands it has partnered with. Investors can also track their carbon footprint and receive points for positive contributions to the environment. Higher points are earned for burning carbon credits.

IMPT is currently in a presale that has raised over $1 million, and investors can buy the tokens at $0.018 before the price increases to $0.023 in the second stage.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor