- Bitcoin’s price was gravely impacted by the failure of FTX.

- On-chain metrics suggested a shift in HODLer’s behavior.

The sudden collapse of Sam Bankman-Fried’s crypto empire left the general cryptocurrency dealing with significant losses. The effects of the events between 6 -14 November 2022 could be compared to the collapse of Mt Gox in 2012.

Read Bitcoin’s [BTC] Price Prediction 2022-2023

For the first time in two years, leading coin Bitcoin’s [BTC] price fell below the $17,500 price mark. Per data from CoinGecko, the cascading impact of the FTX collapse caused the global cryptocurrency market cap to fall below $900 billion for the first time since January 2021.

While BTC HODLers have remained resilient in spite of the market downturn, FTX’s collapse tested their faith. This was because many long-term holders sought safety for their investments in the last week.

On-chain analytics company Glassnode, in a new report, considered a few metrics to assess whether “there has been a discernible loss of conviction” among BTC holders as the FTX debacle unraveled.

To call it in or not?

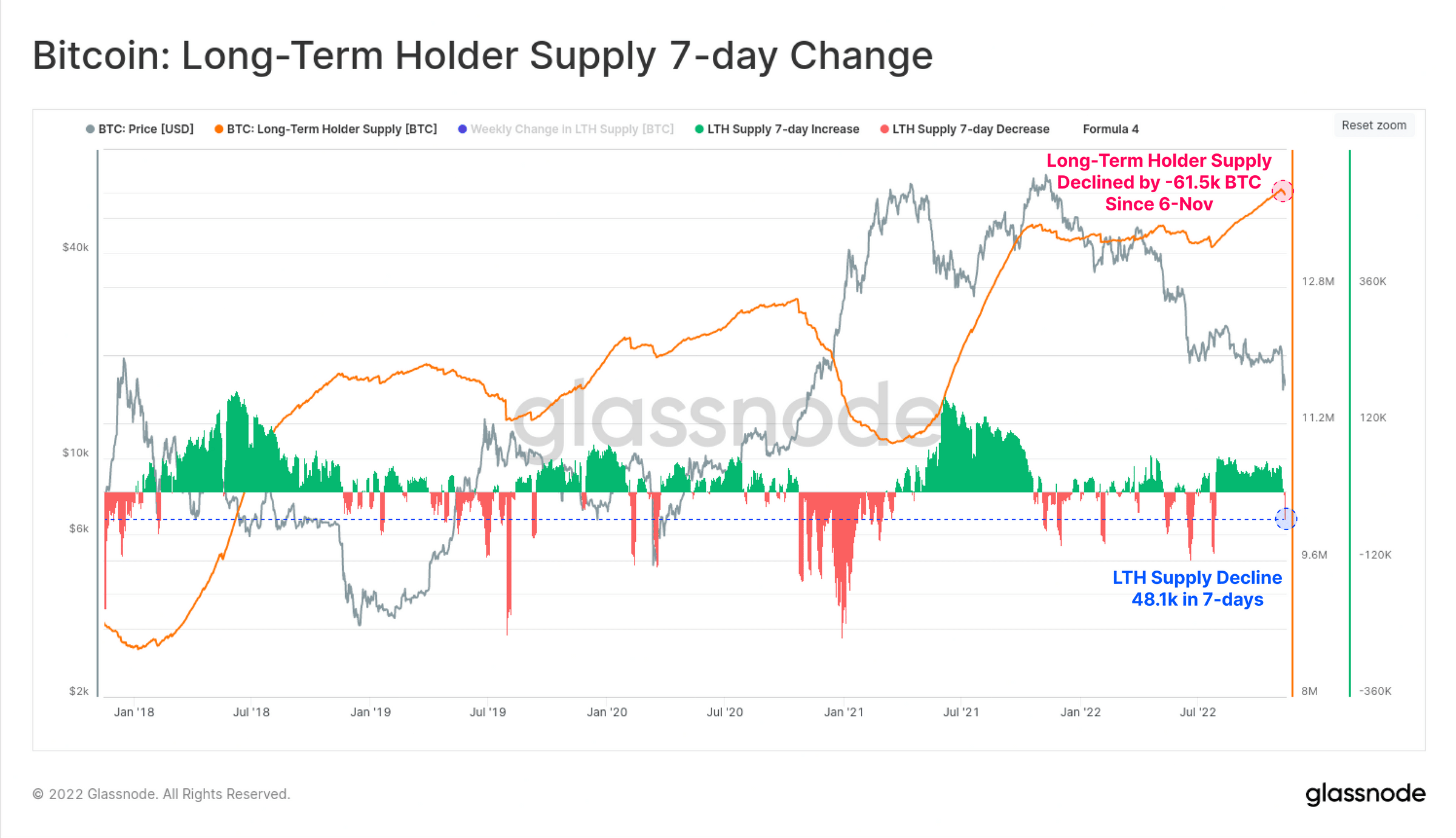

Glassnode considered BTC’s Long-Term Holder supply metric and found that the category of BTC that was least likely to be spent declined since 6 November. Glassnode found that in the last seven days, about 48,100 BTC was spent. While this was a notable decline, Glassnode opined that it was not enough “to infer widespread loss of conviction.” It, however, added a caveat that a continued decline in the metric “may suggest otherwise.”

Another metric that posted a decline in the last week was BTC’s Revived Supply. Per Glassnode, 97,450 BTC which were older than one year were spent “and potentially returned to liquid circulation” over the last week.

While this was an unusual move as it represented a +0.83 sigma move on a four-year basis, Glassnode noted that it was not “yet of historical magnitude.” It was, however, to be kept a watch on for as a consistent increment. This was because a rise in the number of BTC holders spending BTC older than one year would mean a loss of holder conviction.

Source: Glassnode

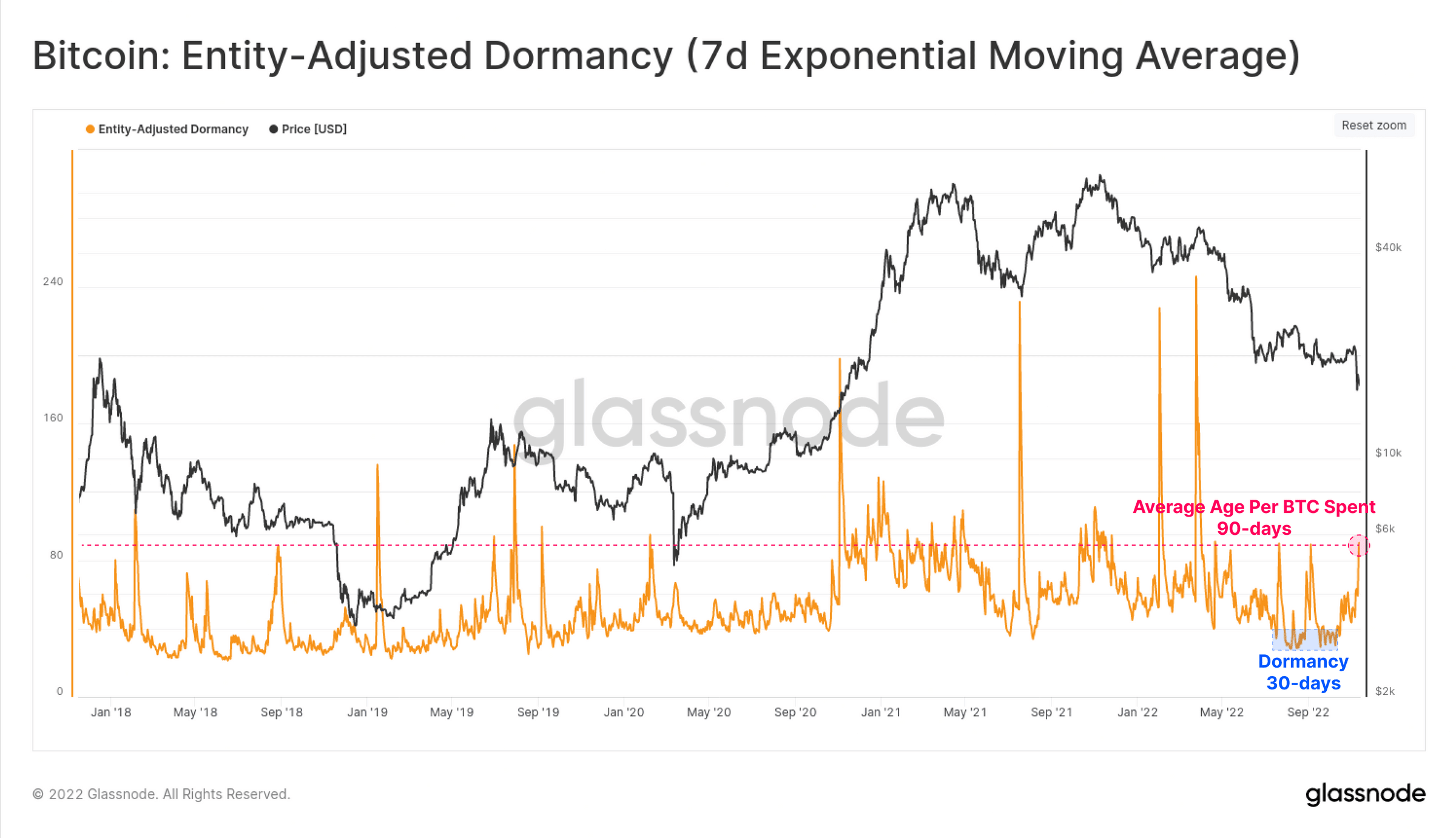

Furthermore, Glassnode found that the average age per BTC spent also climbed to over 90-days in the last week. Per the report, this index was triple than which was spent during September and October.

According to Glassnode,

“The uptick in older coins being spent is noteworthy and is in line with peaks seen during previous capitulation sell-off events and even the 2021 bull market profit-taking. A sustained uptrend or elevated level of Dormancy may indicate a more widespread panic has taken root amongst the HODLer cohort.”