After what can be considered a long and never-ending wait, Bitcoin [BTC] managed to find some green pastures on the charts finally. This sparked joy within the crypto-community as investors and enthusiasts were expecting a breakout soon. Apart from this, several other interesting developments acted in favor of the king coin.

Here’s AMBCrypto’s Price Prediction for Bitcoin [BTC] for 2023-24

A recent tweet from market intelligence platform Santiment revealed that whales have been accumulating more BTC of late, which wasn’t the case for a majority of 2022. According to the same, addresses holding 100 to 10k BTC collectively added 46,173 BTC to their wallets.

Interestingly, it was also revealed that while the whales increased their BTC holdings, a simultaneous decline was seen in Tether whale supply. This new development seemed to be good news for Bitcoin as it represented whales’ growing confidence in the coin.

After weeks of decline, the cryptocurrency managed to turn the tide in its favor, gaining by over 7% over the past week. At the time of writing, BTC was trading above the $20,000-level at $20,233.28 with a market capitalization of $387.9 billion.

Source: Coinstats

Interestingly, as per a tweet from Messari, that’s not all the positive news for Bitcoin. According to the market intelligence platform, BTC capacity held in public channels on the Lightning Network reached a new high of 4,618 BTC – Valued at $93 million.

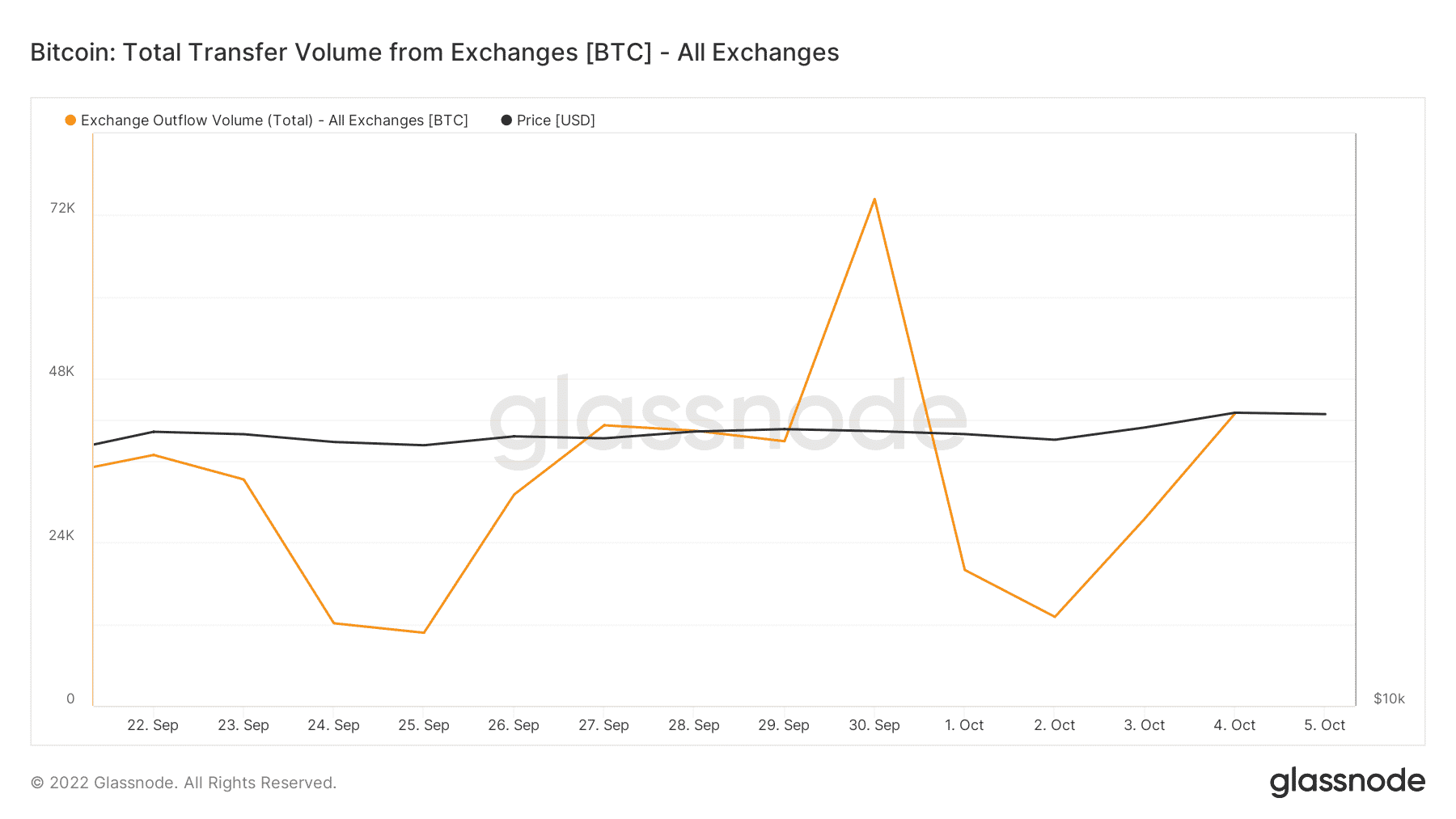

Not only this, but several other on-chain metrics also painted a positive picture for the crypto. Glassnode’s data revealed that BTC’s exchange outflows spiked over the last few days – A bullish signal.

Source: Glassnode

As Bitcoin’s price hiked on the charts, its total percentage of supply in profit also followed the same route and registered an uptick. On-chain data analytics platform CryptoQuant’s data revealed that Bitcoin’s exchange reserves continued to fall. This confirmed lower selling pressure.

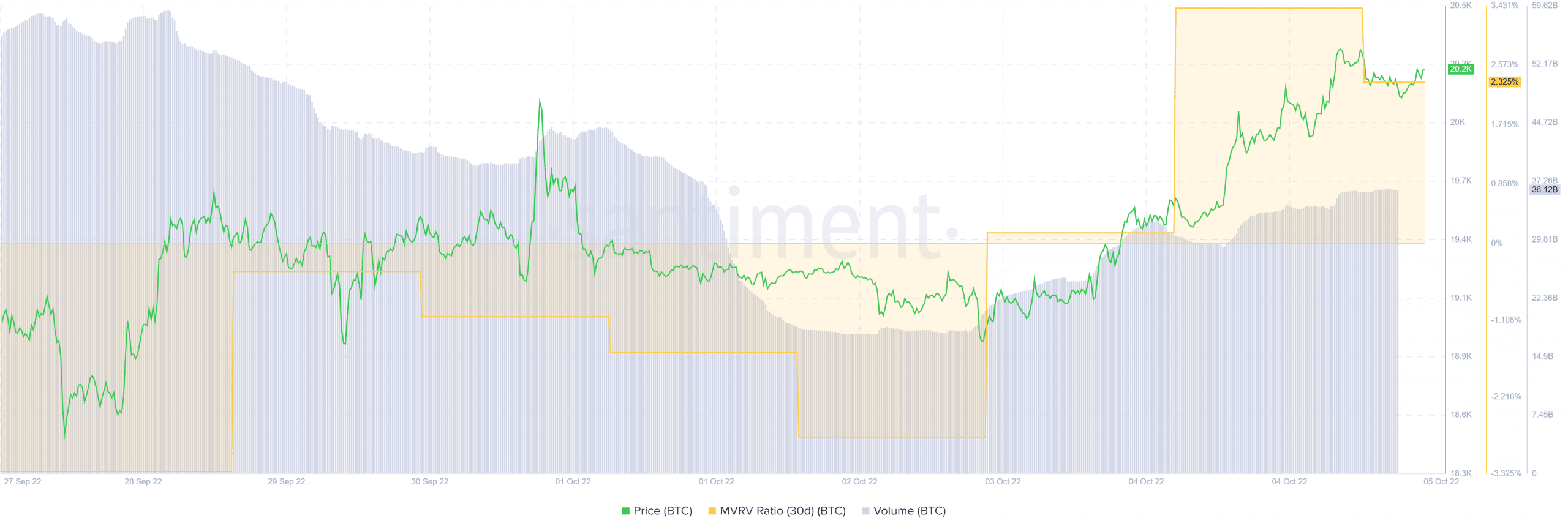

Moreover, BTC’s Market Value to Realized Value (MVRV) Ratio, along with volume, also went up recently. This indicated a sustained uptick in the days to come.

Source: Santiment

Attention traders!

All the aforementioned metrics indicated that BTC may have left darker days behind. Investors could expect BTC’s price to rise on the charts again. However, a few metrics did suggest otherwise.

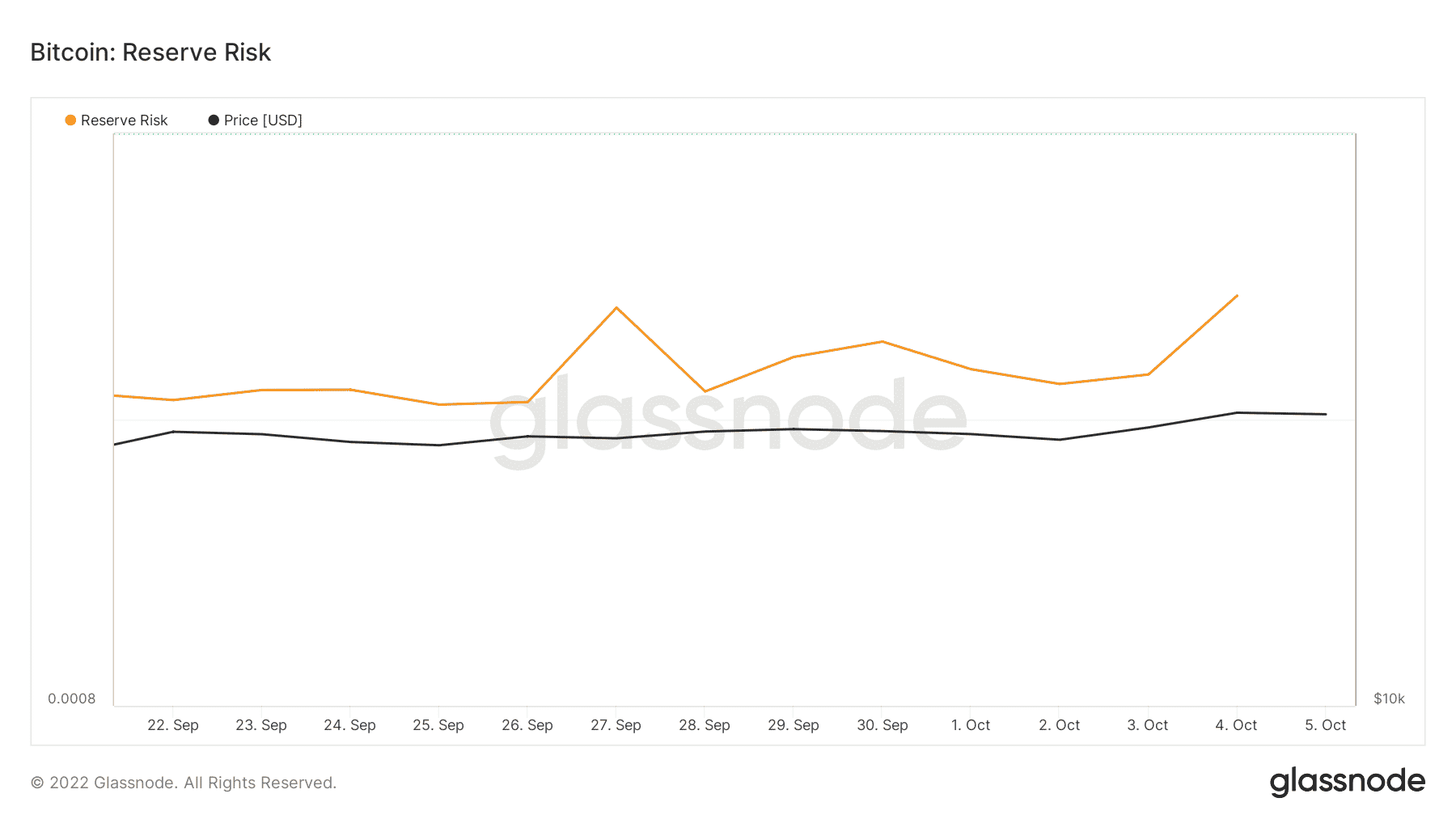

For instance, BTC’s net deposits on exchanges were high, compared to the seven-day average. This was a bear signal, one confirming higher selling pressure. Moreover, BTC’s reserve risk also went up, indicating that it was not the right time to invest whole-heartedly.

Source: Glassnode