After rising to $22,000 on 8 July, Bitcoin [BTC] bulls have another reason to rejoice. The crypto king broke the $20,000 mark against all odds on 14 July.

The intraday low of Bitcoin on 14 July went to $19,613. However, the buyers stepped in with demand and BTC eventually crossed the important psychological level of $20,000. At press time, Bitcoin was at an exact price of $20,873- a 5.55% rise in the last 24 hours.

Bears in disbelief?

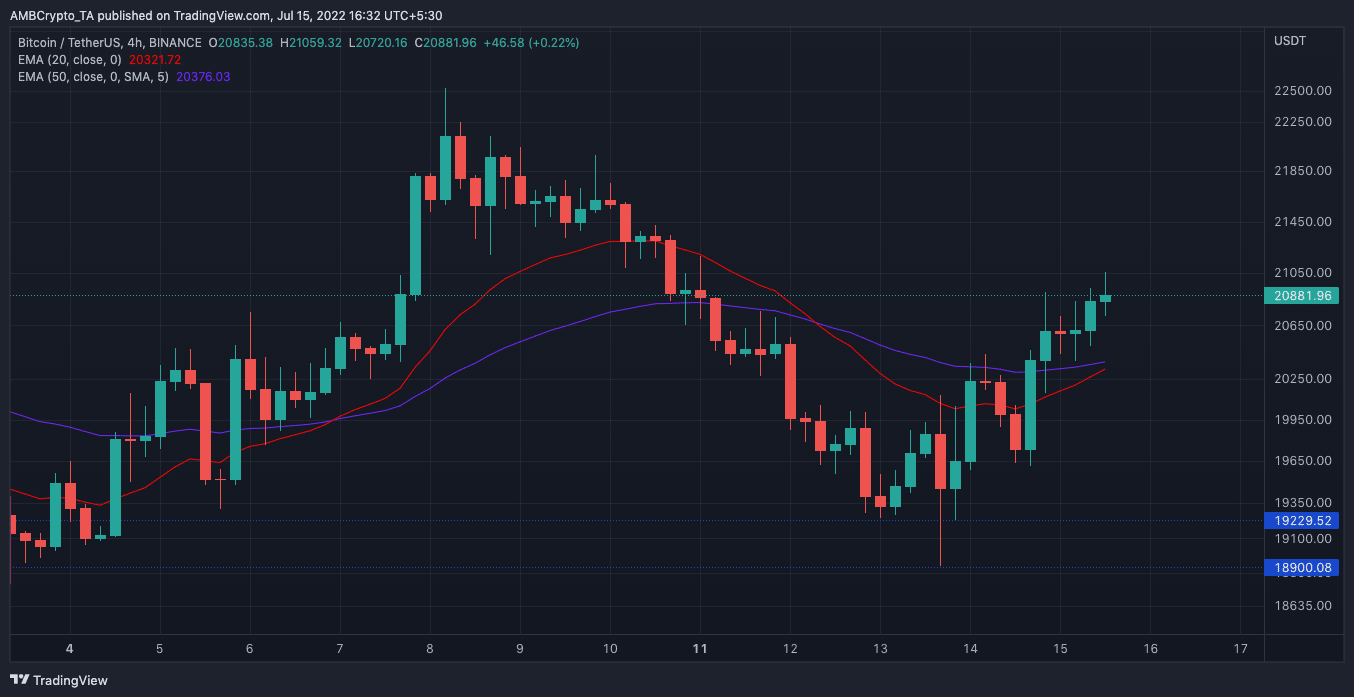

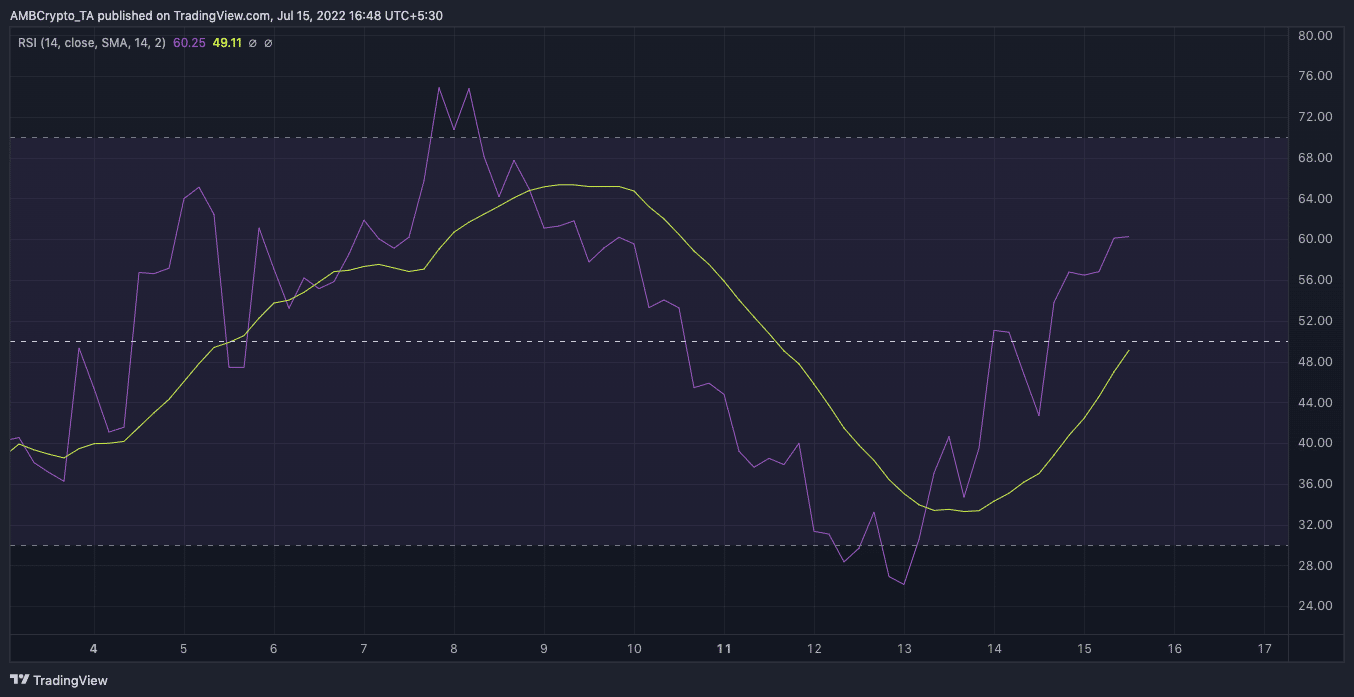

Despite the recent uptick, the indicators on the price chart were skewed towards the bearish side. Consider this- On 12 July, the 20-period EMA was below the 50-period EMA. A similar situation was observed on 13 and 14 July. This indicated that Bitcoin’s short-term move was more favorable for sellers.

Source: TradingView

While Bitcoin’s price has increased, the 20 and 50 EMA have not overlapped. Additionally, the chart, at press time indicated that the 20 EMA might soon overtake the 50 EMA. If that happens, it would be a good opportunity for short-term traders to make profits.

Source: TradingView

Given the unprecedented increase in the king coin’s price, the main question is – Will BTC continue its upward trajectory?

Maybe, maybe not

While that could be a difficult question to answer but on-chain metrics can definitely give some clarity.

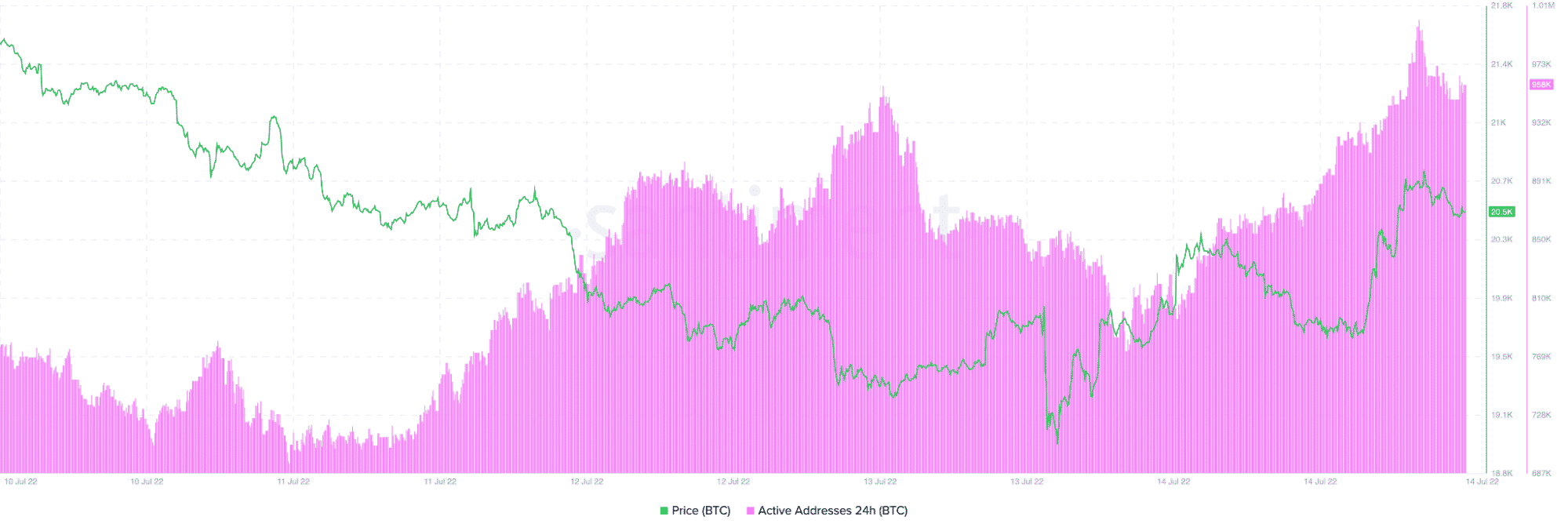

According to Santiment, BTC active addresses have increased over the last 24 hours. While it was around 860,000 on 14 July, the press time number stood close to a million. This goes to show that investors’ sentiment is reviving real quick.

Source: Santiment

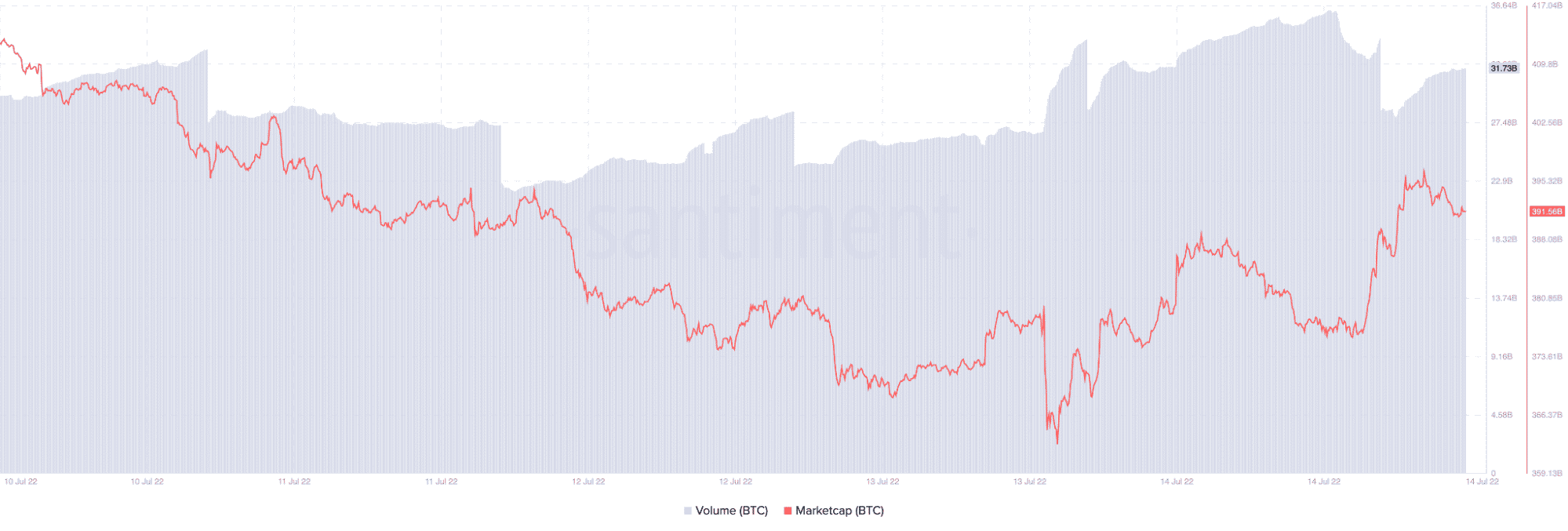

It is a similar situation with the volume, which moved from 28.13 billion to 31.64 billion. The uptick in the last 24 hours of 15 July could be a sigh of relief for Bitcoin maximalists. In fact, Bitcoin’s market cap also recovered from $376 billion to $391 billion at the time of writing.

Source: Santiment

Meanwhile, the current state of the crypto market may mean that Bitcoin has still not overthrown the extreme volatility plaguing it. However, the short-term price upticks almost guarantee bullish believers of relief. But, let’s not forget that it does not signify the end of the selling pressure.