Bitcoin has been stuck in consolidation since the crash of 11 May, which was responsible for the price drop from $39k to $29k.

However, what the question remains is that is the king coin set for further drawdown, and if so, when can it end?

Bitcoin set to repeat history?

The Relative Strength Index of the king coin has been a great indicator when it comes to shifts in trends in the past which is why its current state is raising concerns.

After being stuck in the bearish zone for 53 days now, Bitcoin has consistently experienced price drops. And even as of the time of this report, the situation hasn’t improved, and neither is it exhibiting signals of any improvement currently.

Bitcoin price action | Source: TradingView – AMBCrypto

But this isn’t the first time the king coin has been stuck in the bearish zone for such a long while. Back in November to January period, Bitcoin experienced a similar situation when it was stuck in the area for a good 80 days before escaping it with an 11.4% rally.

In this period, Bitcoin slipped by 41.09% on the charts and was left to trade at $37.3k.

This time after falling under the neutral mark in April, Bitcoin seems to be repeating that pattern as it has already been 53 days, and BTC has lost 35.79% of its value since.

Should the bearishness continue, Bitcoin could slip to $27k and consolidate around the same level until the end of June.

The possibility might seem far-fetched, but then again, no one was expecting a double crash this month either.

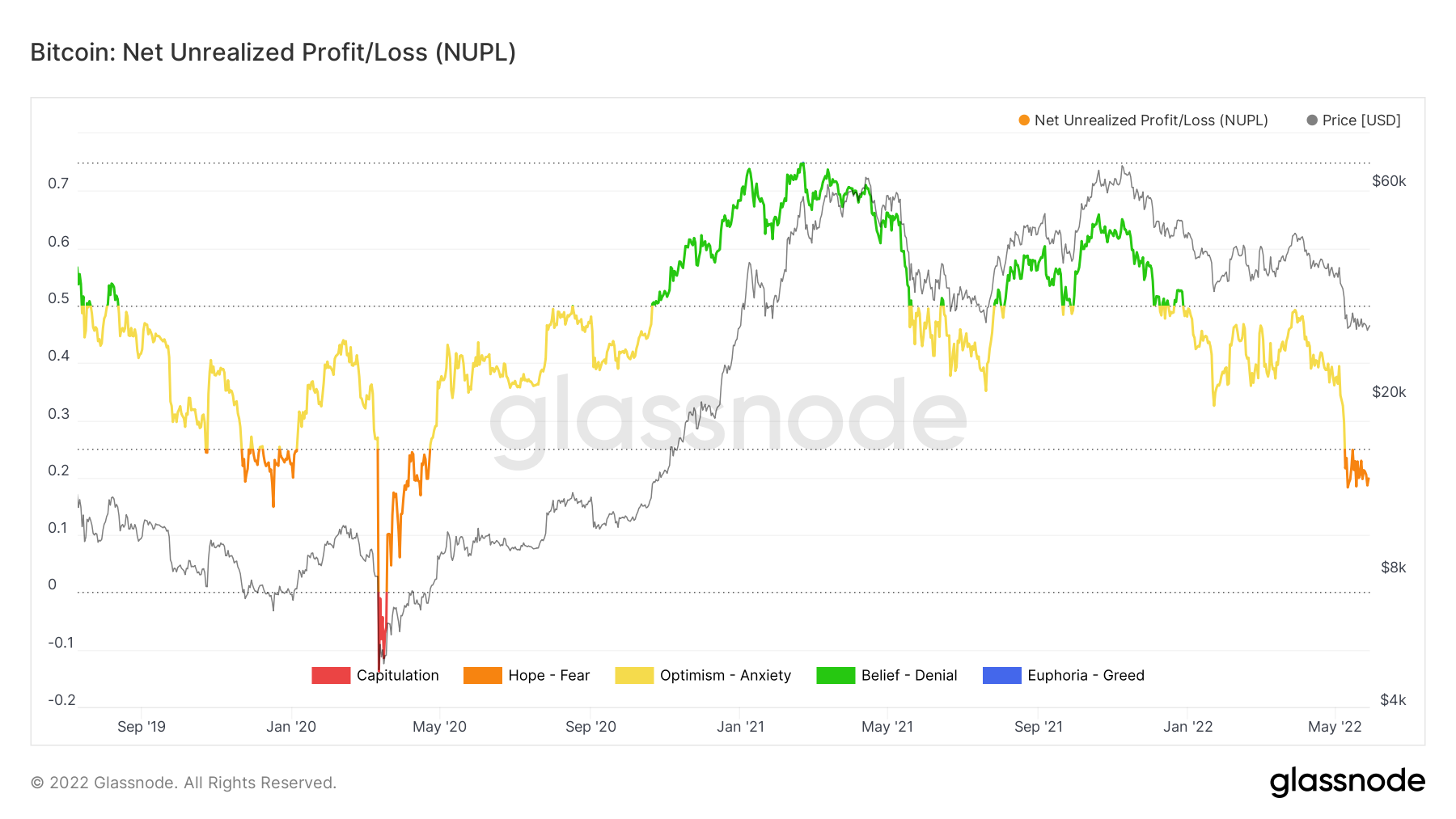

Besides, investors already appear to be prepared for consolidation as their optimism has now turned into fear. Although the hope of recovery remains alive, it certainly does not supersede the fear in the crypto market that has been persisting for the entirety of May.

Bitcoin NUPL | Source: Glassnode – AMBCrypto

This fear was responsible for the sale of 101,250 BTC, worth $3 Billion, post-crash, and the subsequent selling of 43,453 BTC worth $1.27 Billion.

Bitcoin balance on exchanges | Source: Glassnode – AMBCrypto

Going forward, the selling might slow down, but investors will only begin buying back after Bitcoin closes above $30k.