On 15 December, leading oracle network Chainlink [LINK] announced its partnership with Coinbase Cloud to bring its NFT Floor Price Feeds to Ethereum mainnet.

Similar to its Data Feeds, Chainlink NFT Floor Price Feeds provides users with an estimate of the floor prices of NFT collections deemed risk-averse.

Read Chainlink’s [LINK] Price Prediction 2023-24

Identifying the lack of access to quality NFT price data as a clog in the wheel of development of the NFT ecosystem, the partnership would “provide Web3 developers with a secure, reliable, and accurate floor price feed for leading NFT collections, unlocking the ability for NFTs to become seamlessly integrated within DeFi protocols.”

The deployment of Chainlink NFT Floor Price Feeds came after the launch of the first version of Chainlink Staking on the Ethereum mainnet and the launch of Chainlink Automation on leading layer 2 scaling network Arbitrum.

LINK in trouble?

Recent partnerships, integrations, and deployments in the past few weeks have failed to culminate in the growth in the value of Chainlink’s native token LINK.

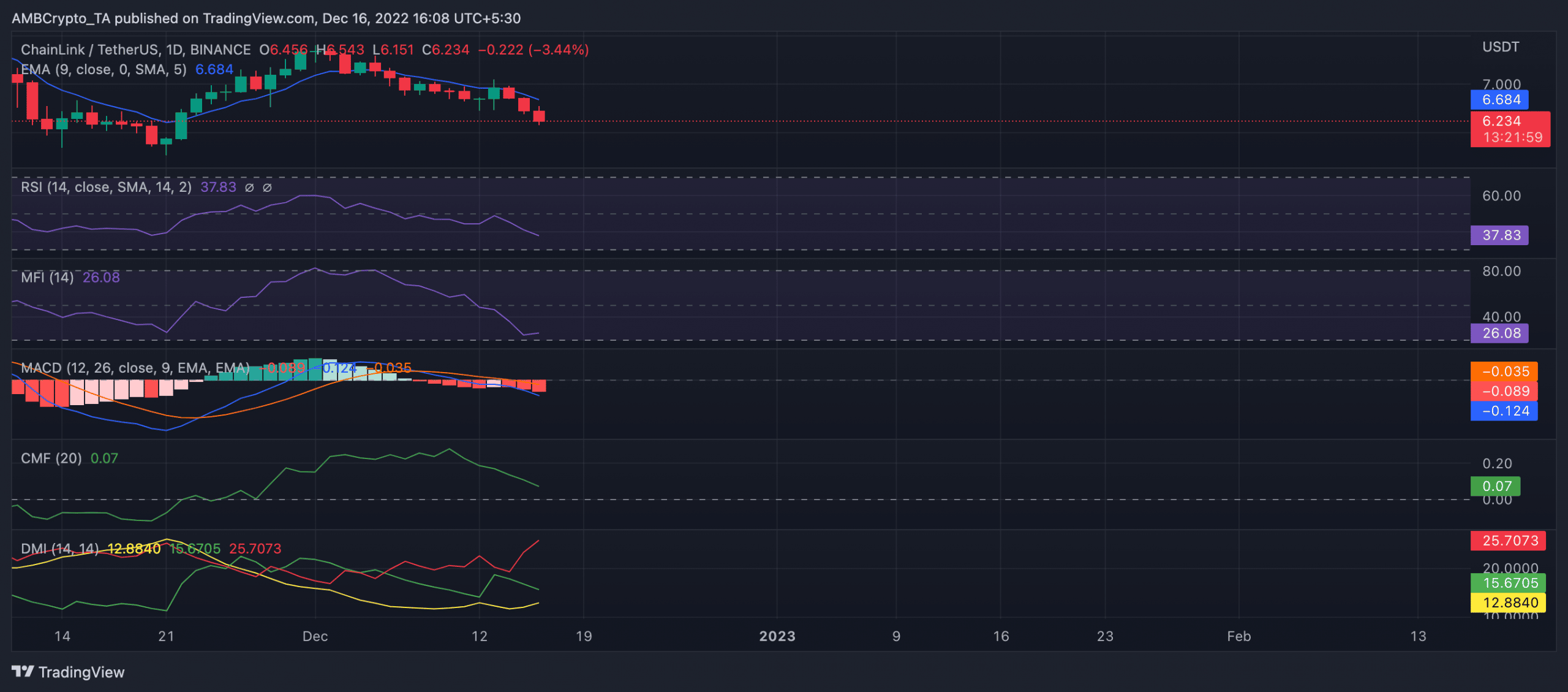

An assessment of LINK on a daily chart revealed that the alt commenced a new bear cycle on 8 November, two days after the launch of Chainlink Staking. The MACD line since intersected with the trend line in a downtrend to post red histogram bars.

Exchanging hands at $6.24 at press time, LINK’s price has since declined by almost 10%, data from CoinMarketCap revealed.

Likewise, LINK has seen a sharp rally in coin distribution since 8 November. Before the bear cycle commenced, the Relative Strength Index (RSI) and Money Flow Index (MFI) sat above their 50-neutral lines. However, with a drop in LINK accumulation in the past few days, they have since plummeted.

Indicating that LINK was oversold at press time, the MFI was 26.08. Not any better, the RSI was positioned in a downtrend at 37.83

Further, LINK’s Chaikin Money Flow (CMF) headed to a spot below the center line. While still positive at press time, a further decline in LINK accumulation would send the CMF indicator returning negative values.

Lastly, with waning buying pressure, sellers had control of the LINK market at press time. The position of its Directional Movement Index (DMI) confirmed this. The sellers’ strength (red) at 25.70 was pegged above the buyers’ (green) at 16.67.

Source: TradingView